Develop an integer programming model to maximize the NPV in this situation. Use excel to solve this problem. Which of the three investments would be undertaken if NPV is maximized? [ Select ] Maximize 9000 X1+ 7000 X2 + 8000X3 Minimize 32000 X2 + 29000X3 V Minimize 25000 X1 + 32000 X2 + 29000X3 The Objective functior Maximize 9000 X1 + 7000 X2

Develop an integer programming model to maximize the NPV in this situation. Use excel to solve this problem. Which of the three investments would be undertaken if NPV is maximized? [ Select ] Maximize 9000 X1+ 7000 X2 + 8000X3 Minimize 32000 X2 + 29000X3 V Minimize 25000 X1 + 32000 X2 + 29000X3 The Objective functior Maximize 9000 X1 + 7000 X2

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 25P

Related questions

Question

100%

![Develop an integer programming model to maximize the NPV in this situation. Use

excel to solve this problem. Which of the three investments would be undertaken if

[ Select ]

Maximize 9000 X1 + 7000 X2 + 8000X3

Minimize 32000 X2 + 29000X3

NPV is maximized?

V Minimize 25000 X1 + 32000 X2 + 29000X3

Maximize 9000 X1 + 7000 X2

The Objective function

The Optimal solution:

X1= [Select]

X2= [ Select ]

X3= [ Select ]

Profit= $ [ Select ]](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fba0907a9-6c52-4bb2-92a1-adea0cb5c93c%2F5d542305-85cd-4c47-a35d-481e79cf2870%2F8ikgc_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Develop an integer programming model to maximize the NPV in this situation. Use

excel to solve this problem. Which of the three investments would be undertaken if

[ Select ]

Maximize 9000 X1 + 7000 X2 + 8000X3

Minimize 32000 X2 + 29000X3

NPV is maximized?

V Minimize 25000 X1 + 32000 X2 + 29000X3

Maximize 9000 X1 + 7000 X2

The Objective function

The Optimal solution:

X1= [Select]

X2= [ Select ]

X3= [ Select ]

Profit= $ [ Select ]

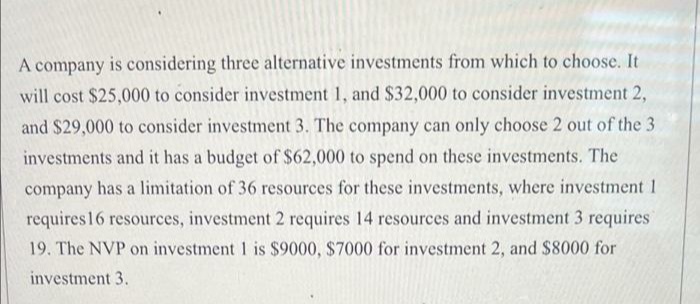

Transcribed Image Text:A company is considering three alternative investments from which to choose. It

will cost $25,000 to consider investment 1, and $32,000 to consider investment 2,

and $29,000 to consider investment 3. The company can only choose 2 out of the 3

investments and it has a budget of $62,000 to spend on these investments. The

company has a limitation of 36 resources for these investments, where investment 1

requires 16 resources, investment 2 requires 14 resources and investment 3 requires

19. The NVP on investment 1 is $9000, $7000 for investment 2, and $8000 for

investment 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning