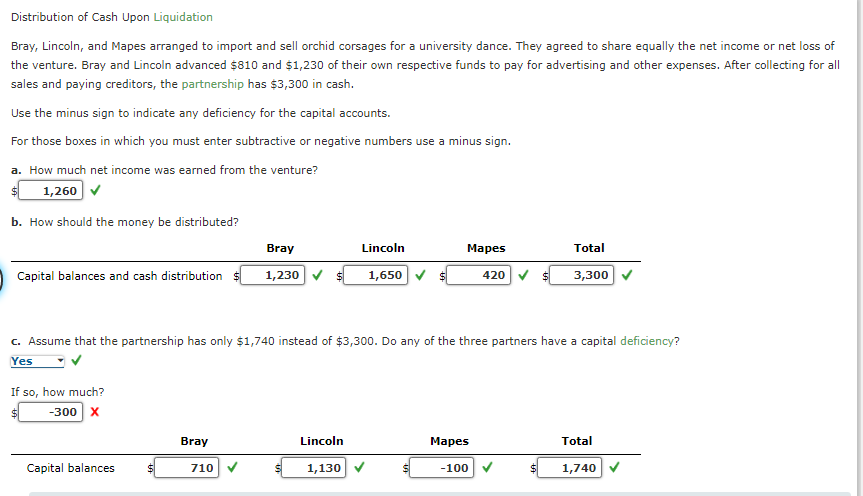

Distribution of Cash Upon Liquidation Bray, Lincoln, and Mapes arranged to import and sell orchid corsages for a university dance. They agreed to share equally the net income or net loss of the venture. Bray and Lincoln advanced $810 and $1,230 of their own respective funds to pay for advertising and other expenses. After collecting for all sales and paying creditors, the partnership has $3,300 in cash. Use the minus sign to indicate any deficiency for the capital accounts. For those boxes in which you must enter subtractive or negative numbers use a minus sign. a. How much net income was earned from the venture? 1,260 V b. How should the money be distributed? Bray Lincoln Марes Total Capital balances and cash distribution $ 1,230 v $ 1,650 v $ 420 v 3,300 c. Assume that the partnership has only $1,740 instead of $3,300. Do any of the three partners have a capital deficiency? Yes If so, how much? -300 x Bray Lincoln Марes Total Capital balances 710 1,130 -100 V 1,740

Distribution of Cash Upon Liquidation Bray, Lincoln, and Mapes arranged to import and sell orchid corsages for a university dance. They agreed to share equally the net income or net loss of the venture. Bray and Lincoln advanced $810 and $1,230 of their own respective funds to pay for advertising and other expenses. After collecting for all sales and paying creditors, the partnership has $3,300 in cash. Use the minus sign to indicate any deficiency for the capital accounts. For those boxes in which you must enter subtractive or negative numbers use a minus sign. a. How much net income was earned from the venture? 1,260 V b. How should the money be distributed? Bray Lincoln Марes Total Capital balances and cash distribution $ 1,230 v $ 1,650 v $ 420 v 3,300 c. Assume that the partnership has only $1,740 instead of $3,300. Do any of the three partners have a capital deficiency? Yes If so, how much? -300 x Bray Lincoln Марes Total Capital balances 710 1,130 -100 V 1,740

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 5CE

Related questions

Question

Transcribed Image Text:Distribution of Cash Upon Liquidation

Bray, Lincoln, and Mapes arranged to import and sell orchid corsages for a university dance. They agreed to share equally the net income or net loss of

the venture. Bray and Lincoln advanced $810 and $1,230 of their own respective funds to pay for advertising and other expenses. After collecting for all

sales and paying creditors, the partnership has $3,300 in cash.

Use the minus sign to indicate any deficiency for the capital accounts.

For those boxes in which you must enter subtractive or negative numbers use a minus sign.

a. How much net income was earned from the venture?

$1

1,260 V

b. How should the money be distributed?

Bray

Lincoln

Маpes

Total

Capital balances and cash distribution $

1,230

1,650 V $

420

3,300

c. Assume that the partnership has only $1,740 instead of $3,300. Do any of the three partners have a capital deficiency?

Yes

If so, how much?

$1

-300 x

Bray

Lincoln

Mapes

Total

Capital balances

710 V

1,130 V

-100 V

1,740

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,