(Cash, Non-cash and Net Assets Contributions) The partnership of Abueva and Alano was formed on June 1, 2014, when they agreed to invest equal amount of capital into the firm. The investment by Abueva consists of PS18,000 cash and an inventory of merchandise valued at P1,152,000. Alano agreed to contribute the assets of his business along with the transfer to the partnership of his business liabilities. Alano was credited for goodwill for the excess of the capital credit over the agreed value of his net assets. The assets and liabilities are shown on the next Balances on Alano's Records Agreed Value P 1,792,000 76,800 192,000 256,000 576,000 P 1,792,000 150,000 253,000 206,000 Accounts Receivable Allow. For Uncollectible Accounts Inventory Office Equipment (net) Accounts Payable 576,000 Instructions: 1. Give the entries to record the investments of Abueva and Alano in the new partnership. Prepare the beginning statement of financial position of the partnership, reflecting the above transfers to the firm. 2.

(Cash, Non-cash and Net Assets Contributions) The partnership of Abueva and Alano was formed on June 1, 2014, when they agreed to invest equal amount of capital into the firm. The investment by Abueva consists of PS18,000 cash and an inventory of merchandise valued at P1,152,000. Alano agreed to contribute the assets of his business along with the transfer to the partnership of his business liabilities. Alano was credited for goodwill for the excess of the capital credit over the agreed value of his net assets. The assets and liabilities are shown on the next Balances on Alano's Records Agreed Value P 1,792,000 76,800 192,000 256,000 576,000 P 1,792,000 150,000 253,000 206,000 Accounts Receivable Allow. For Uncollectible Accounts Inventory Office Equipment (net) Accounts Payable 576,000 Instructions: 1. Give the entries to record the investments of Abueva and Alano in the new partnership. Prepare the beginning statement of financial position of the partnership, reflecting the above transfers to the firm. 2.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 47P

Related questions

Question

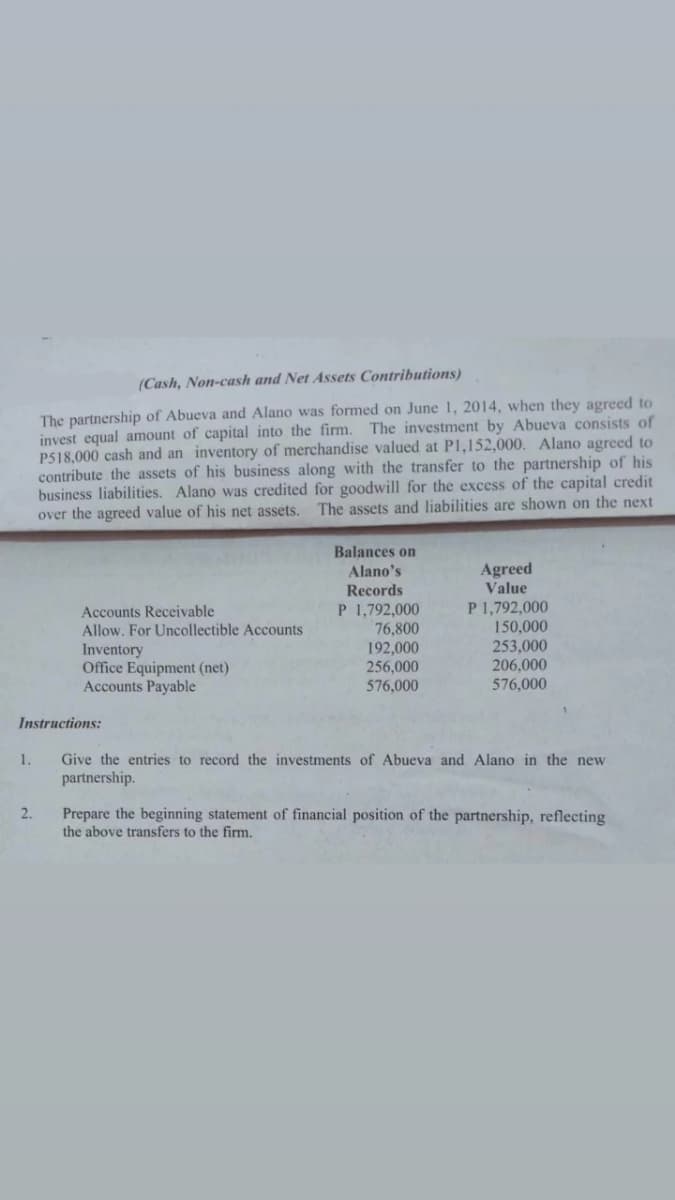

Transcribed Image Text:(Cash, Non-cash and Net Assets Contributions)

The partnership of Abueva and Alano was formed on June 1, 2014, when they agreed to

invest equal amount of capital into the firm. The investment by Abueva consists of

P518,000 cash and an inventory of merchandise valued at P1,152,000. Alano agreed to

contribute the assets of his business along with the transfer to the partnership of his

business liabilities. Alano was credited for goodwill for the excess of the capital credit

over the agreed value of his net assets.

The assets and liabilities are shown on the next

Balances on

Agreed

Value

Alano's

Records

P 1,792,000

76,800

192,000

256,000

P 1,792,000

150,000

253,000

206,000

576,000

Accounts Receivable

Allow. For Uncollectible Accounts

Inventory

Office Equipment (net)

Accounts Payable

576,000

Instructions:

1.

Give the entries to record the investments of Abueva and Alano in the new

partnership.

2.

Prepare the beginning statement of financial position of the partnership, reflecting

the above transfers to the firm.

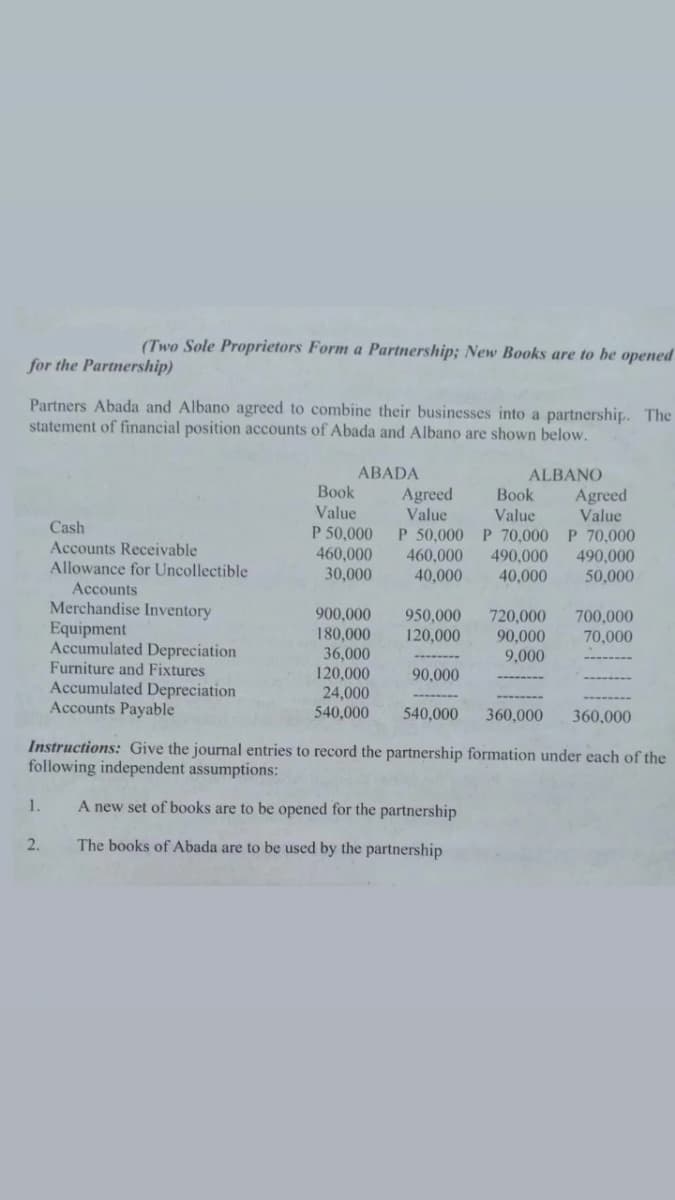

Transcribed Image Text:(Two Sole Proprietors Form a Partnership; New Books are to be opened

for the Partnership)

Partners Abada and Albano agreed to combine their businesses into a partnership. The

statement of financial position accounts of Abada and Albano are shown below.

ABADA

Вook

ALBANO

Book

Agreed

Value

P 50,000 P 70,000 P 70,000

460,000

Agreed

Value

Value

P 50,000

460,000

30,000

Value

Cash

Accounts Receivable

Allowance for Uncollectible

490,000

490,000

40,000

40,000

50,000

Accounts

Merchandise Inventory

Equipment

Accumulated Depreciation

Furniture and Fixtures

Accumulated Depreciation

Accounts Payable

900,000

180,000

36,000

120,000

950,000

120,000

720,000

90,000

9,000

700,000

70,000

90,000

24,000

540,000

540,000

360,000

360,000

Instructions: Give the journal entries to record the partnership formation under each of the

following independent assumptions:

1.

A new set of books are to be opened for the partnership

2.

The books of Abada are to be used by the partnership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College