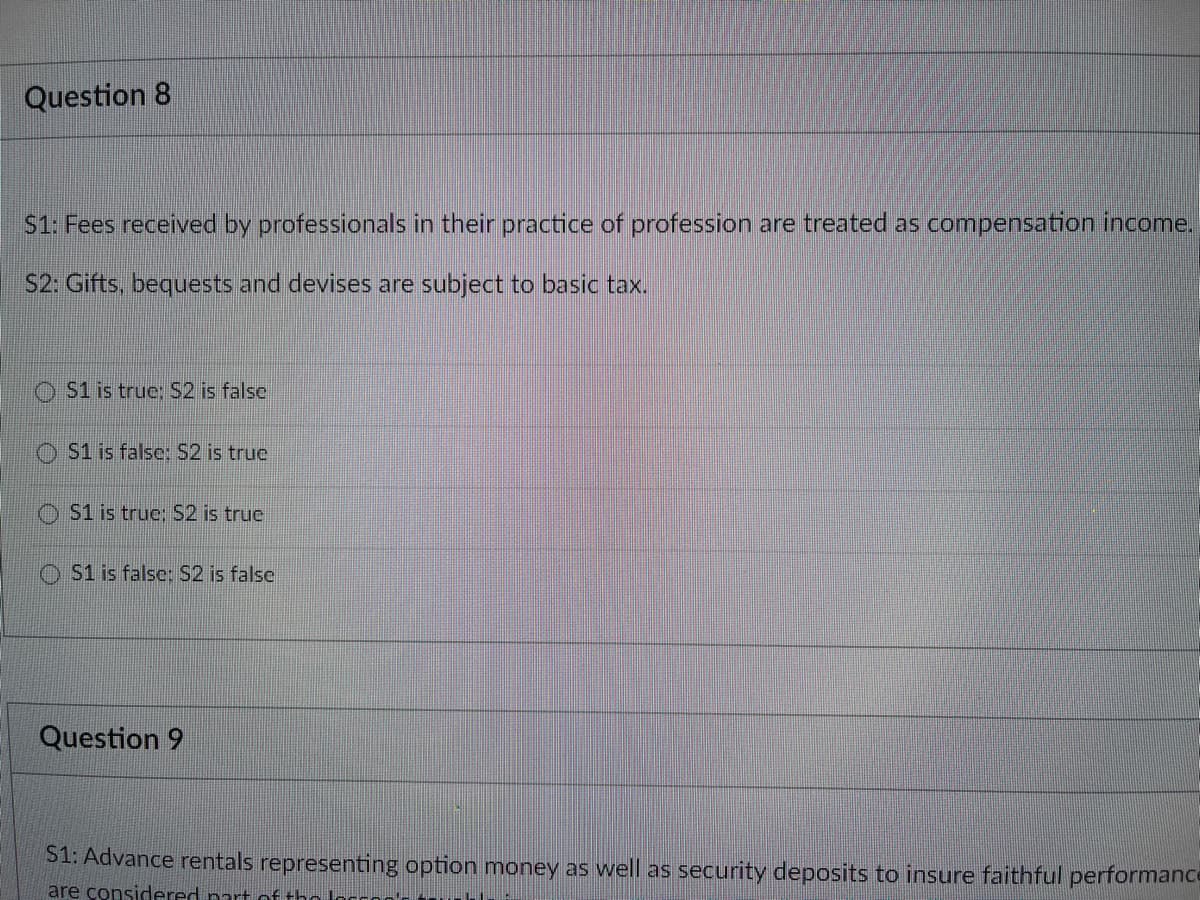

$1: Fees received by professionals in their practice of profession are treated as compensation income S2: Gifts, bequests and devises are subject to basic tax. S1 is true: S2 is false S1 is false: S2 is true

Q: FRT Company sells each unit for $ 60, variable costs for each unit $ 25, Fixed costs $ 200000 Wants…

A: Formula used: Units to sell for earning a target profit = ( Fixed cost + target Profit ) / Unit…

Q: Explain the difference between Tangible and Intangible Assets

A: Introduction: Assets: Any resource which is having monetary value called as Assets. Assets are to be…

Q: Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug…

A:

Q: ake-or-Buy, Traditional Analysis ehner Company is currently manufacturing Part ABS-43, producing…

A: Make cost is the cost to produce the product internally. Buy cost is the cost to purchase the…

Q: Units produced and sold 150 300 Selling price per unit $400 $200 Variable expenses per…

A: Fixed costs are those costs which generally do not change with change in activity level. Variable…

Q: 8. (13) DK company has its Branch at Gorakhpur. Goods are invoiced to this Branch at 20% profit on…

A: Head office means from where the company mainly operate and all branches are controlled from that…

Q: . _______ A written order for a bank or other financial institution to pay a stated dollar amount to…

A: Money is very useful and important medium of exchange being used by two parties. If one party…

Q: to abose 91 101 noltotoo n 2019 2020 20210 Net income (loss) before dealings P 20,000 (P 70,000) P…

A: Net Capital Gain on 2021 ₱ 11,000 (A)

Q: Record the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500,…

A: Notes receivable is a negotiable instrument. In this one-party agree to pay a certain amount to…

Q: Sales Variable costs Contribution margin Fixed costs Operating income P200,000 120,000 80,000 60,000…

A: Solution: Sales = P200,000 Variable costs = P120,000 Contribution margin = P80,000 Contribution…

Q: 2. Current ratio x 3. Debt-to-equity ratio x

A: Solution:- 2)Calculation of current ratio as follows under:- Current ratio =Current assets / Current…

Q: Adele is planning for retirement. She would like to have $75,000 in her hand at the beginning of her…

A: Retirement means quite simple end of a phase of working for a time of years.This span of retirement…

Q: If either party fails to perform their contractual obligations according to the contract terms, it…

A: Auditing refers to the examination of the financial records of a business organization to verify the…

Q: What monthly payment will pay off this debt in 1 year 2 months?

A: Solution:- Given, A MasterCard balance = $560 Rate compounded monthly = 13.9% Number of Monthly…

Q: Tyler Hawes and Piper Albright formed a partnership, investing $210,000 and $70,000, respectively.…

A: The profits are distributed among partners on the basis of ratio as mentioned in partnership deed.…

Q: Explain realizable value less than cost or cost greater than net realizable value?

A: Introduction:- The following formula used to calculate net realizable value as follows under:- Net…

Q: The carrying amount of 10% note issued to Supreme Inc. as of December 31, 2022.

A: As per our protocol we provide solution to the one question only but as you have asked multiple…

Q: Starting from the separate cost of goods sold of the affiliates, the consolidated cost of goods…

A:

Q: A property was purchased on January 1 20x0 for $2 million (estimated depreciable amount $1…

A: Revaluation surplus: It implies to an increase in the current market or fair value of a fixed asset…

Q: What is ESG reporting and why does it matter?

A: Transparency on ecological and socially responsible actions is becoming more popular. Environmental,…

Q: No agreement concerning division of net income (equally); (b) Divided in the ratio of original…

A: Introduction:- A partnership is s an arrangement between two or more 'partners' carrying out a…

Q: lowing errors in the the Emma Company reveale financial statements: 500,000 800,000 250,000 December…

A: Net income is the amount which is calculated by subtracting expenses from the incomes. Understated…

Q: The accounts of RIX Itd for the year ended December 2019 shows the following: Particulars Rs.…

A: Cost accounting is one of the important branch of accounting. Under it, various type of costs are…

Q: In 2019, Osgood Corporation purchased $8.5 million worth of 10-year municipal bonds at face value.…

A: Loss on investment is the difference in fair value of the investment from the value it was…

Q: B-Marts' large proportion of merchandise held on consignment from suppliers. Which account balance…

A: Audit is the process of checking and verifying books of account of the business in order to ensure…

Q: At the beginning of the year, Cullumber had beginning inventory of 1680 scooters. Cullumber…

A: The sales budget is prepared to record the sales revenue earned during the period.

Q: Jacky saves $15,000 on 20 March 2019 in an account that offer r % simple interest per year. If the…

A: The question is based on the concept of Financial Management.

Q: 4. Use the same information given in Problem 1. After the split, the par value per share of the…

A: Under share split of 2 for 1 , the shareholders will received 2 shares for every one share held.

Q: What is the total share capital? 5. What is the retained earnings balance at the end of the year? 6.…

A: The total share capital is calculated as sum of par value and additional paid in capital. The…

Q: What is the Profit in 2019 under absorption costing? 2019

A: Absorption costing income statement The Absorption costing income statement is a statement prepared…

Q: Comparative Earnings per Share Lucas Company reports net income of $2,520 for the year ended…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: Swasey Company provided the following partial comparative balance sheets and the income statement…

A: The cash flow statement shows the cash inflow and cash outflow due to the operating, financing, and…

Q: An investment pays $2,000 every third year for 45 years (a total of 15 payments). Your opportunity…

A: Option C. $7317.16

Q: GAAP versus IFRS who do you agree with COLLAPSE APPLIED PRINCIPLE GAAP IFRS Allows LIFO inventory…

A: GAAP: The full form of GAAP is Generally accepted accounting principles. GAAP consists of…

Q: 1. Which of the following formulas is used to calculate break-even units? 1. Fixed Costs + Unit…

A: Introduction: Break even point: The point where there is no profit or loss of the units sold. Below…

Q: Question Content Area 1. Reformulate the segmented income statement using the additional information…

A: As per our protocol we solution to the one question only but as you have asked multiple questions…

Q: a. Compute the maximum depreciation deduction that Redwood can take in 2021 and igen 2022 on each of…

A: Item Cost Year of acquisition Year of Property Sec 179 deduction (half) Balance Depreciation rate…

Q: What is the difference between Agricultural activity and biological assets? Name two examples of…

A: The growing and production of agricultural products which includes harvesting, breeding of animals,…

Q: Hogan Company had the following account balances for 2021: Dec. 31 Jan. 1 Accounts receivable $…

A: The cash flow statement shows the cash inflow and cash outflow due to the operating activities,…

Q: Prepare the general journal entries required to record each of the following transactions. The…

A: Journal entries represent the record of a business entity’s day-to-day business transactions in…

Q: 8-33 qug tham acquired the following new properties. mis oli to dºch au 01 00 10. MACRS, Section…

A: Depreciation is an value able part of Accounting.It gives a clear picture or in basic accounting…

Q: Consolidated inventory balance is composed of the book values of the parent’s and the subsidiary’s…

A: The answer is d i.e and nothing else.

Q: Question (1¹) On 31 December Year 4, T Lemon had the following account balance: Motor vehicle…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Charlene includes one coupon in each box of laundry soap it sells. A towel is offered as premium to…

A: Liabilities are the dues and obligations which needs to be settled or being paid out by the business…

Q: Beto Company pays $5.10 per unit to buy a part for one of the products it manufactures. With excess…

A: Variable cost means the cost which vary with the level of output and fixed cost means the cost which…

Q: Francis Company has 16,800 shares of common stock outstanding at the beginning of 2019. Francis…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Debt-deflation leads to lower income because: O falling prices redistribute income from debtors to…

A: Debt deflation is an economic theory. It occurs when fall in prices leads to increase of debt burden…

Q: rofit on end

A: Consolidation of accounting books means combination of accounts of parent company and subsidiary…

Q: 1. Determine the weighted average number of shares outstanding for computing the current earnings…

A: 1. oustanding Shares Months Weighted Average Beginning Balance 270000 2 Months…

Q: If various batches of inventories have been purchased at different times during the year and at…

A: Inventory valuation refers to determine the value of cost of goods sold and closing inventory…

Step by step

Solved in 2 steps

- 25. S1: Proof of deductions is mandatory. S2: Deductions are liberally construed in favor of the taxpayer. S3: All deductions are based on actual expenses incurred. Group of answer choices c. Only S3 is true d. All is false b. Only S2 is true a. Only S1 is true19. S1: The salaries of the Chief Justice and associate justices of the Supreme court are tax-exempt. S2: The salary of the Commissioner of Internal Revenue is exempt from income tax. Group of answer choices d. Both are false c. Both are true a. Only S1 is true b. Only S2 is trueGroup 1: Multiple Choice Questions LO 2.1 The definition of gross income in the tax law is: All items specifically listed as income in the tax law All cash payments received for goods provided and services performed All income from whatever source derived All income from whatever source derived unless the income is earned illegally LO 2.1 Which of the following is not taxable for income tax purposes? Prizes Severance pay Gifts Partnership income All of the above are taxable LO 2.1 All of the following items are taxable to the taxpayer receiving them, except: Life insurance proceeds Unemployment compensation Embezzled funds Prizes Gambling winnings LO 2.1 Which of the following types of income is tax exempt? Unemployment compensation Income earned illegally Dividends from foreign corporations Municipal bond interest Dividends from utility corporations’ stock LO 2.1 Which of the following is included in gross income? Loans…

- Ma3. e general rate reduction applies ONLY to ________. Question content area bottom Part 1 Choose the correct answer. A. income of CCPCs B. capital gains C. property income of Canadian corporations D. income of corporations that is NOT subject to other tax benefitsProblem 1-52 (LO 1-5) (Algo) Given the following tax structure: Taxpayer Salary Total tax Mae $ 32,000 $ 3,200 Pedro $ 49,000 ??? Required: What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount.Question 2a) Income tax is calculated as follows;Taxable Salary Rate of Tax (GH¢)First 1000 0. 05Next 1,000 0.10Next 3,000 0.25Next 4,000 0.40Remainder 0.60Calculate the tax on a taxable salary of;i. GH¢ 2,450ii. GH¢ 10,500 with GH¢ 450 as none taxable allowance. b) A card is picked at random from cards numbered from 1 to 20. Find the probability that the number on the card isi. divisible by 5ii. a prime number c) Find the following probabilities; P(0 < z < 2.32)

- Determine if this shall result in recognition of liabilities 11. withholding of taxes on employees' compensation a. yes b. noProblem 8-68 (LO 8-3) (Algo) [The following information applies to the questions displayed below.] Eva received $64,000 in compensation payments from JAZZ Corporation during 2021. Eva incurred $6,500 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a standard deduction of $12,550. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference.(Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount.) d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year?8. S1: Fringe benefit that is exempt from fringe benefit tax is likewise exempt from any other form of income tax. S2: Any amount given by the employer as de minimis to its employees, shall not constitute as deduction upon such employer. Group of answer choices a. Only S1 is true c. Both are true d. Both are false b. Only S2 is true

- Q.1.1 The government announced a change to the tax law which will have a significanteffect on the value of current tax expense that the company will pay in future years. For each of the events described above, discuss whether an adjusting or non‐adjusting eventoccurred. In order to get the mark allocated you will need to justify why you believe the event is either an adjusting or non‐adjusting event.Where the events are adjusting, describe the adjustment that must be made as well as theamount and where the events are non‐adjusting, discuss whether any disclosure needs to bemade in the notes to the financial statements. Justify your answers.Question2: Income tax The taxable income of Ahmed, Badriya and Sameer is $20,000, $45,000, $100,000 respectively. Use the following tax rates: 5% for income from 0 - $20,000 10% for income from $20,001 - $50,000 15% for income above $50,000 Calculate the tax payable by each person. Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?H6. 13 A claim for refund is a request for reimbursement of the overpayment of taxes paid in previous years. To be valid, a claim for refund must include which of the following features? Select one: a. The claim for refund can be made by telephone or in writing. b. The claim for refund must be signed only by the taxpayer c. The claim for refund must be filed within the set statute of limitations d. All of the above are correct Please explain also wrong options and explain with details