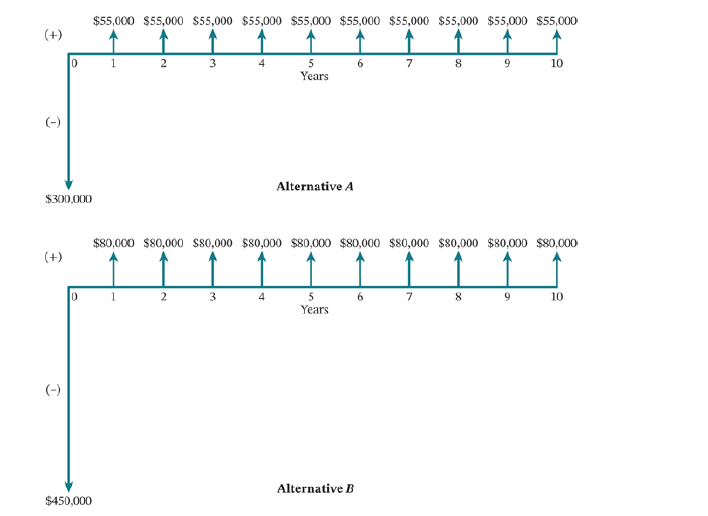

$55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 (+) 1 3 5 Years 6. 7 8 10 Alternative A $300,000 $80,000 $80,000 $80,000 $80,000 $80,000 $80,000 $80,000 $80,000 $80,000 $80,000 (+) 1 2 3 5 Years 6. 10 (-) Alternative B $450,000

Entertainment Engineers, Inc., is an Ohio-based design engineering firm that designs rides for amusement and theme parks all over the world. Two alternative designs are under consideration for a new ride called the Scream Machine at a theme park located in Florida. The two candidate designs differ in complexity, cost, and predicted revenue. The first alternative design (A) will require an investment of $300,000 and is estimated to produce after-tax revenue of $55,000 annually over a 10-year planning horizon. The second alternative design (B) will require an investment of $450,000 and is expected to generate annual after-tax revenue of $80,000. A negligible salvage value is assumed for both designs. Theme park management could decide to “do nothing”; if so, the present worth of doing nothing will be zero. An after-tax MARR of 10% is used.

Which alternative design, if either, should the theme park select?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps