Donald derives utility from only two goods, carrots (Q.) and donuts (Qa). His utility function is as follows: U(Q..Qa) = Q.*Q« Donald has an income (1) of $120 and the price of carrots (P.) and donuts (Pa) are both $1. a. What is Donald's budget constraint? b. What is Donald's utility-maximizing condition? c. What quantities of carrots and donuts will maximize Donald's utility?

Donald derives utility from only two goods, carrots (Q.) and donuts (Qa). His utility function is as follows: U(Q..Qa) = Q.*Q« Donald has an income (1) of $120 and the price of carrots (P.) and donuts (Pa) are both $1. a. What is Donald's budget constraint? b. What is Donald's utility-maximizing condition? c. What quantities of carrots and donuts will maximize Donald's utility?

Micro Economics For Today

10th Edition

ISBN:9781337613064

Author:Tucker, Irvin B.

Publisher:Tucker, Irvin B.

Chapter6: Consumer Choice Theory

Section6.A: Indifference Curve Analysis

Problem 3SQP

Related questions

Question

Explain why two indifference

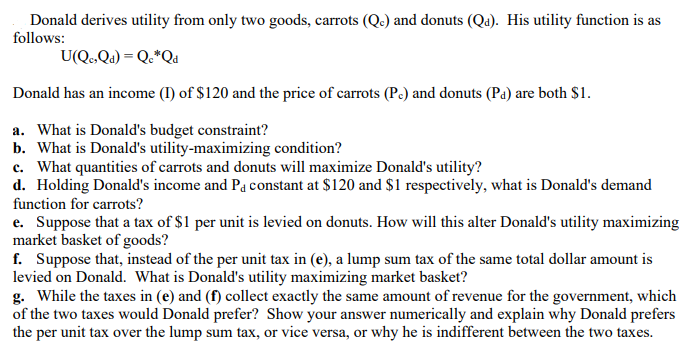

Transcribed Image Text:Donald derives utility from only two goods, carrots (Qe) and donuts (Qa). His utility function is as

follows:

U(Q,Qa) = Q•*Qa

Donald has an income (I) of $120 and the price of carrots (Pc) and donuts (Pa) are both $1.

a. What is Donald's budget constraint?

b. What is Donald's utility-maximizing condition?

c. What quantities of carrots and donuts will maximize Donald's utility?

d. Holding Donald's income and Pa constant at $120 and $1 respectively, what is Donald's demand

function for carrots?

e. Suppose that a tax of $1 per unit is levied on donuts. How will this alter Donald's utility maximizing

market basket of goods?

f. Suppose that, instead of the per unit tax in (e), a lump sum tax of the same total dollar amount is

levied on Donald. What is Donald's utility maximizing market basket?

g. While the taxes in (e) and (f) collect exactly the same amount of revenue for the government, which

of the two taxes would Donald prefer? Show your answer numerically and explain why Donald prefers

the per unit tax over the lump sum tax, or vice versa, or why he is indifferent between the two taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning