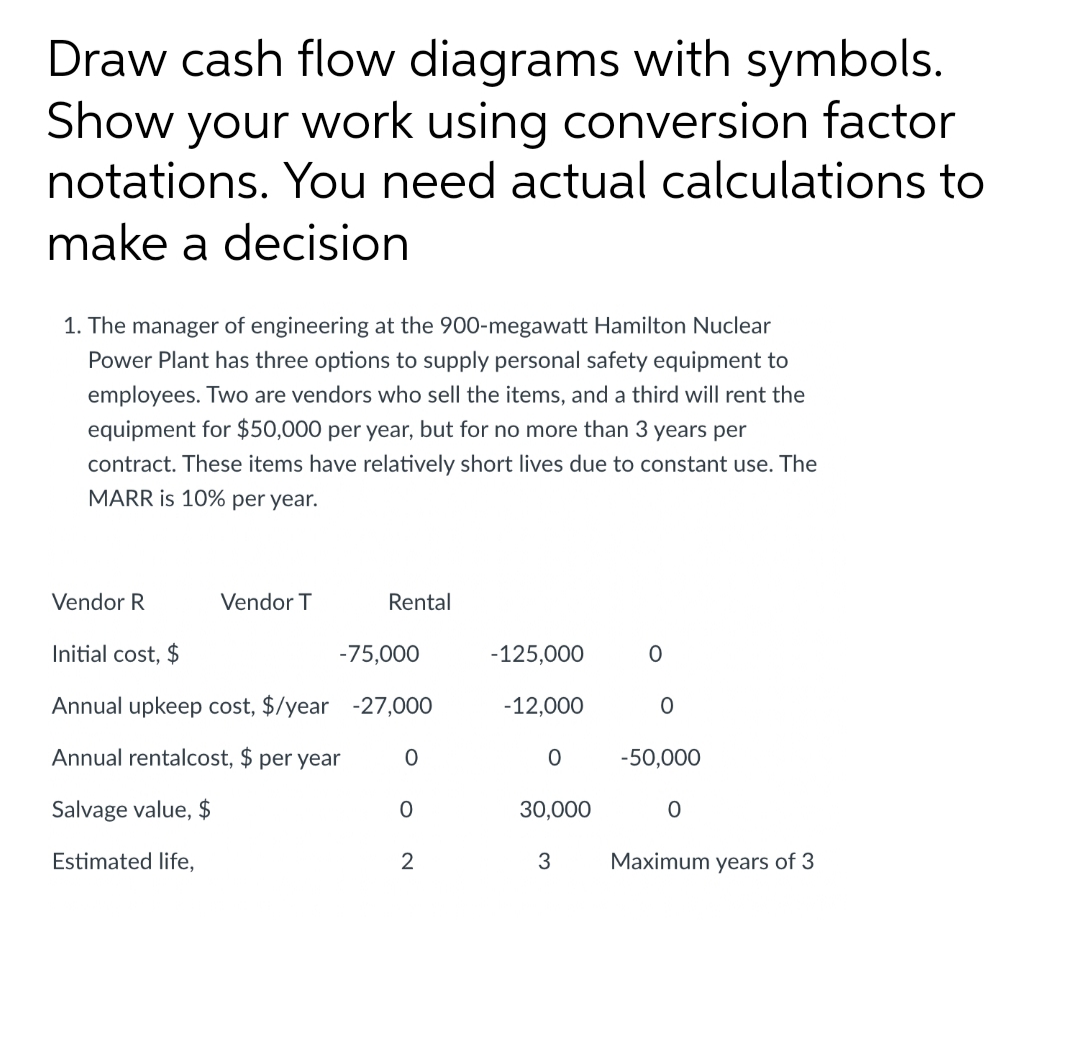

Draw cash flow diagrams with symbols. Show your work using conversion factor notations. You need actual calculations to make a decision 1. The manager of engineering at the 900-megawatt Hamilton Nuclear Power Plant has three options to supply personal safety equipment to employees. Two are vendors who sell the items, and a third will rent the equipment for $50,000 per year, but for no more than 3 years per contract. These items have relatively short lives due to constant use. The MARR is 10% per year. Vendor R Vendor T Rental Initial cost, $ -75,000 -125,000 Annual upkeep cost, $/year -27,000 -12,000 Annual rentalcost, $ per year -50,000 Salvage value, $ 30,000 Estimated life, 2 Maximum years of 3

Draw cash flow diagrams with symbols. Show your work using conversion factor notations. You need actual calculations to make a decision 1. The manager of engineering at the 900-megawatt Hamilton Nuclear Power Plant has three options to supply personal safety equipment to employees. Two are vendors who sell the items, and a third will rent the equipment for $50,000 per year, but for no more than 3 years per contract. These items have relatively short lives due to constant use. The MARR is 10% per year. Vendor R Vendor T Rental Initial cost, $ -75,000 -125,000 Annual upkeep cost, $/year -27,000 -12,000 Annual rentalcost, $ per year -50,000 Salvage value, $ 30,000 Estimated life, 2 Maximum years of 3

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 8P

Related questions

Question

!

Transcribed Image Text:Draw cash flow diagrams with symbols.

Show your work using conversion factor

notations. You need actual calculations to

make a decision

1. The manager of engineering at the 900-megawatt Hamilton Nuclear

Power Plant has three options to supply personal safety equipment to

employees. Two are vendors who sell the items, and a third will rent the

equipment for $50,000 per year, but for no more than 3 years per

contract. These items have relatively short lives due to constant use. The

MARR is 10% per year.

Vendor R

Vendor T

Rental

Initial cost, $

-75,000

-125,000

Annual upkeep cost, $/year -27,000

-12,000

Annual rentalcost, $ per year

-50,000

Salvage value, $

30,000

Estimated life,

2

3

Maximum years of 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning