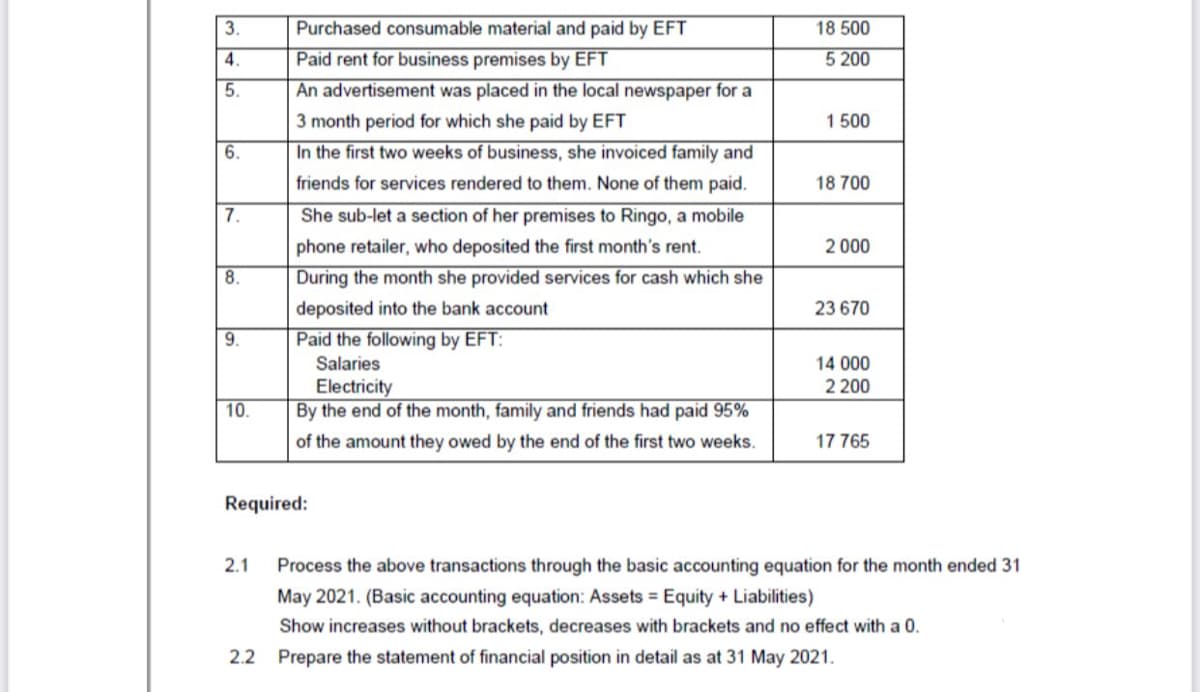

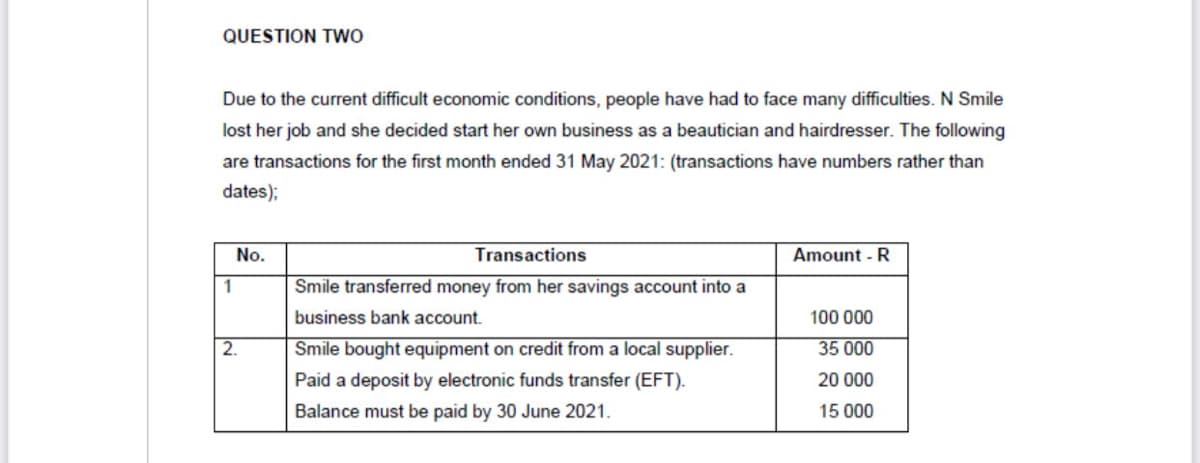

Due to the current difficult economic conditions, people have had to face many difficulties. N Smile lost her job and she decided start her own business as a beautician and hairdresser. The following are transactions for the first month ended 31 May 2021: (transactions have numbers rather than dates); No. Transactions Amount - R 1 Smile transferred money from her savings account into a business bank account. 100 000 2. Smile bought equipment on credit from a local supplier. 35 000 Paid a deposit by electronic funds transfer (EFT). 20 000 Balance must be paid by 30 June 2021. 15 000

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: On May 1, 2018, Ma Concepcion Manalo established the Manalo Rehab Clinic. Transactions completed…

A: Accounting equation in accounting says that total assets in the business should be equal to total…

Q: To practice how the use of debits, credits, and double entry accounting affect individual T accounts…

A: The accounting equation is written as: Assets = Liabilities + equity Equity can be calculated as :…

Q: Required: a) Prepare an Income Statement for the period ended 31st October 2021 The closing…

A: An income statement is one of the financial statements which shows the financial position of the…

Q: Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations began on…

A: Merchandise inventory refers to the value of goods in stock, whether it's finished goods or raw…

Q: Anne York is a sole trader who started the business of buying and selling furniture in Brighton on…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Global company, owned by Miss Aida, provides advertising poster. During January 2019, the following…

A: Date Particulars Ref Debit Credit 1st Jan Cash A/c Dr.…

Q: On January 1, 2020, Mohammed started a computer shop, a summary of January transactions are as…

A: Journal entries indicate the day to day summary of transactions made by the company related to…

Q: Colleen Fernandez, president of Rhino Enterprises, applied for a $175,000 loan from First Federal…

A: Accounting equation: The accounting equation refers to total assets equals total liabilities and…

Q: The following events concern Anita LeTourneau, a Manitoba law school graduate, for March 2021:…

A: As per the Accounting equation, the sum of assets is always equal to sum of liabilities and…

Q: Your friend, Dean McChesney, requested that you advise him on the effects that certain transactions…

A: 1.) Attached above are the t-accounts prepared by recording transactions with letters. The closing…

Q: Laila Ramos decided to open abicycle and car rental business on October 1, 2021 to augment the…

A: Laila Ramos Trial Balance As on October 31, 2021 Account Debit Credit Cash 2,23,000…

Q: Wernan Peralta, Attorney-at-Law, opened his office on September 1, 2018. The following transactions…

A: Accounting equation of the business says that total assets in the business must be always equal to…

Q: Werman Peralta, Attorney at Law, opened his office on Sept. 1, 2018. the following transactions were…

A: As per accounting equation, total assets in the business should be equal to total liabilities and…

Q: Colleen Fernandez, president of Rhino Enterprises, applied for a $175,000 loan from First Federal…

A: Accounting Equation:Accounting equation refers total assets equal to total liabilities and total…

Q: Colleen Fernandez, president of Rhino Enterprises, applied for a $175,000 loan from First Federal…

A: Accounting equation: The accounting equation refers to total assets equals total liabilities and…

Q: Anne York is a sole trader who started the business of buying and selling furniture in Brighton on…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: Peter Smart used to wash cars in the back yard of his home. He set up a car cleaning business and…

A: A business is set up by bringing the capital in the form of cash and other assets. The capital…

Q: Loida Cardenas recently established her own business, which she called Cardenas Delivery Service.…

A: Trial balance is the statement that accumulates the balances of all the accounts in the books of…

Q: Emerita Modesto established a. Deposited P120,000 in a bank account in the name of the business.…

A: Accounting equation of the business says that total assets always must be equal to total liabilities…

Q: The following transactions of Willy Manalo, an attorney, took place during January 2016 Manalo…

A: Journal entries records the transaction in such a way that there are 2 effects in the financial…

Q: On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs.…

A: A two-column journal is a journal that has two columns to enter the amounts. One is a debit column,…

Q: Mohammed started a delivery company in Muscat in June 2018 (Mohammed Delivery Service). During the…

A: The accounting equation states that assets equal to sum of liabilities and equity.

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: 1. Journal entries are as follows:

Q: A B Loida Cardenas recently established her own business, which she called Cardenas Delivery…

A:

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Income Statement An income statement's purpose is to disclose the business transactions' as a result…

Q: Anne York is a sole trader who started the business of buying and selling furniture in Brighton on…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Jean Smith Profit and Loss A/c for the Year ended 31-03-206…

Q: On October 1, 20Y6, Jay Pryor established an interior decorating business, Pioneer De- signs. During…

A:

Q: Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the…

A:

Q: Lisa Vozniak started her own business, We Do Windows. She offers interior and exterior window…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: March 2021 1 The owner, Gina, invested the following: filing cabinets and fixtures- 15,000; cash,…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Anne York is a sole trader who started the business of buying and selling furniture in Brighton on…

A: As per our protocol we provide solution to one question only and to the non-graded questions but you…

Q: Andy Norris started a personal training business on 1 January 2019 called "Chuck the Phat. The…

A: The accounting equation states that Assets = Liabilities + owners equity

Q: In March, Abby's Employment Agency had the following transactions: 2022 1 Abby Todd invested $5,000…

A: Here in this question, we are required to prepare journal entries. Journal entry is made for record…

Q: Your friend, Dean McChesney, requested that you advise him on the effects that certain transactions…

A: T-account refers to a set of financial records that uses the method of double-entry bookkeeping. It…

Q: On October 01 2021, Gina Jose opened Self-Service Laundry. During October, the following…

A: Journal entries recording is the first step, after that journal entries are posted into ledger…

Q: GO has a security service business and completed the following transactions ing October 2021: ober 1…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Chris Nuts has a car repair business, Nuts and Bolts, that he started on 1 July 2020 after he lost…

A:

Q: st to be paid using a loan from Bank of Newington is $200k. Question Newington Bank is considering…

A: A loan refers to the sum of money taken by the borrower from an entity or a financial institution at…

Q: On April 5, Timothy established an interior decorating business, Tim’s Design, with a cash…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: After all of the transactions, what is the amount of total liabilities?

A: A liability can be defined as the financial obligation which is to be paid in future, for which the…

Q: i am doing chart of accounting general journal, question is 4/30 Reimbursed one of the…

A: General Journal: In order for transactions to happen according to the year the general journal…

Q: On November 6 Jason Taylor withdrew $90,000 from personal savings and deposited it in a new business…

A: According to the double entry system of accounting, one account is debited and other account is…

Q: Donato Menorca was a service advisor in a car dealership. He supervised a team of mechanics that…

A: Journal is the recording of financial transactions and posting these transactions in ledgers helps…

Q: On December 1. 2021 Ebenezer Buenaventura opened EB Computer Shop, by investing P250,000 cash from…

A: Journal entry recording is the initial step in accounting process, under which atleast one account…

Q: Madam Halimah is the owner of Hally Laundry Services located in Alor Setar, Kedah. She started…

A: "Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: On April 5, Timothy established an interior decorating business, Tim's Design, with a cash investmen…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Journalize entries for transactions Jan. 1 through 9. Refer to the Chart of Accounts for exact…

A: Note:- Since you have asked questions with multiple subparts, We will solve first three subparts for…

Step by step

Solved in 3 steps with 2 images

- The transactions completed by PS Music during June 2016 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: July 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2016. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2016. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2016 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2016, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2016.Case 3-72 Cash- or Accrual-Basis Accounting Karen Ragsdale owns a business that rents parking spots to students at the local university. Karens typical rental contract requires the student to pay the years rent of $450 ($50 per month) on September 1. When Karen prepares financial statements at the end of December, her accountant requires that Karen spread the $450 over the 9 months that each parking Spot is rented. Therefore, Karen can recognize only $200 of revenue (4 months) from each parking spot rental contract in the year the cash is collected and must defer (delay) recognition of the remaining $250 (5 months) to the next year. Karen argues that getting students to agree to rent the parking Spot is the most difficult part of the activity so she Ought to be able to recognize all $450 as revenue when the cash is received from a student. Required: Why do generally accepted accounting principles require the use of accrual accounting rather than cash-basis accounting for transactions like the one described here?Exercise 2-38 Events and Transactions The following economic events related to K the bill need not be paid until March 1, 2019. On February, 15, Kqualify and does not qualify. indicate whether each of the above events would qualify as a transaction and be recognized and recorded in the accounting system on the date indicated. 2. CONCEPTUAL CONNECTION For any events that did not qualify as a transaction to be recognized and recorded, explain why it does not qualify.

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.Continuing Problem 4.Total of Debit column: 40,750 The transactions completed by PS Music during June 20Y5 were described .it the end of Chapter 1. The following transactions were completed during July, the second month of businesss operations: July 1. Peyton Smith made an additional investment k PS Music in exchange for common stock by depositing 5,000 in PS Mu wet checking account. 1.Instead of continuing to share office space with a local real estate agency. Peyton decided to rent office space near a local musk store, Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft and fire. The policy covers a one year period. 2.Received 1,000 on account 3. On behalf of PS Musk, Peyton signed a contract with a local radio station. KXMD, to provide guest spots for the next three months. The contract requires PS Musk to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 2SO on account 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart. 7,500. 8.Paid for a newspaper advertisement 200. 11.Received 1.000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Pane 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account 850 21.Paid 620 to Upload Musk for use of its current musk demos in making various musk sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500 Received 750, with the remainder due August 4.20YS. 27.Paid electric Ml 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500, Received S00 with the remainder due on August 9. 20Y5. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1.400 royalties (musk expense) to National Musk Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts Receivable 1,000 14 Supplies 170 15 Prepaid Insurance 17 Office Equipment 21 Accounts Payable 250 23 Unearned Revenue 31 Common Stock 4.000 33 Dividends 500 41 Fees Earned 6,200 50 Wages Expense 400 51 Office Rent Expense 800 52 Equipment Rent Expense 67S 53 Utilities Expense 300 54 Music Expense 1.590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.Problem 2-593 Journalizing Transactions Monilast Chemicals engaged in the following transactions during December 2019: Dec 2 Paid rent on office furniture, $1,200. 3 Borrowed $25,030 on a 9-month, 3% note. 7 Provided services on credit. $42,600. 10 Purchased supplies on credit, $2,850. 13 Collected accounts receivable, $20,150. 19 Issued common stock, $50000. 22 Paid employee wages for December. $13,825. 23 Paid accounts payable, $1,280. 25 Provided services for cash, $13,500. 30 Paid utility bills for December, $1,975. Required: Prepare a journal entry for each transaction.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.

- QUESTION 2 May Li started in business running a nursery on 1 September 2020. At the end of her first year’strading, she has asked you to prepare her accounts for her.Her trial balance at 31 August 2021 was as follows: DR CR RM RM Capital 5000 Cash 4321 Purchases(Food, Nappies, Clothing and etc) 2521 Sales 11231 Rent and Rates 2321 Electricity 1515 Telephone 296 Sundry Expenses 39 Wages 1215 Debtors 225 Creditors 196 Fixtures and Fittings (Cost RM1140) 1000 Drawings 2974 16427 16427 Additional information:a) Closing stock of nursery requisite amounts to RM195.b) Rent and rates have been paid for the period up to 30 November 2021 in advance, on 31 August2021, of RM455.c) An electricity bill for August 2021 has just arrived showing an amount owing of RM150. Thishas not been recorded in the books.d) Debtors include an amount of RM25 due…Part A Anne York is a sole trader who started the business of buying and selling furniture in Brightonon the 1st of October 2021.She is going to prepare accounts to 31st of September 2021. She contributed to the businesswith £10,000 in the Bank, £4,800 cash, 45,000 flat and 12,000 Car. The transactions duringthe month are as follows:2/10 Purchased furniture £5400 for sale on credit from Home Ltd4/10 She bought a computer for £800 and a printer £200 from a local shop in London andpaid by cheque.5/10 Sold goods for £ 2800 and received the money via Bank account12/10 Paid in Cash £110 for repairing printer18/10 Part of furniture returned to Home Ltd £25021/10 The owner received rent £800 for flat and deposited it to the bank account23/10 Sold goods to Rayan £2100; from this amount £1800 cash received immediately andthe rest remains on credit.23/10 Sold goods of £700 to David and received cash24/10 Bought a new Laptop for business use by issuing a cheque £170026/10 Paid the month’s wages…Note ANSWER PART d , e and f Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the followingtransactions were completed.Mar. 1: Invested $15,000 cash in the business.Mar. 1: Purchased used Lorry for $6,000, paying $3,000 cash and the balance onaccount.Mar. 3: Purchased cleaning supplies for $1,500 on account.Mar. 5: Paid $1,200 cash on one-year insurance policy effective March 1.Mar. 14: Billed customers $4,800 for cleaning services.Mar. 18: Paid $1,500 cash on amount owed on Lorry and $500 on amount owed oncleaning supplies.Mar. 20: Paid $2,000 cash for employee salaries.Mar. 21: Collected $2,800 cash from customers billed on March 14.Mar. 28: Billed customers $2,500 for cleaning services.Mar. 31: Paid advertising expenses of $500.Mar. 31: Withdrew $1000 cash for personal use. Requirements: d) Journalize the following adjustments and prepare an adjusted Trial Balance:(i) Earned but unbilled revenue at March 31 was $500.(ii) Depreciation on…