Peter Smart used to wash cars in the back yard of his home. He set up a car cleaning business and rented premises, hired 2 staff and moved personal equipment to his business premises where a small office was available. He kept very basic records and after 3 months provided you with the following balances at 1 April 2022: Account balances at 1 April 2022 R Bank balance 23 000 Equipment 41 000 Consumables on hand 5 200 Creditors 3 700 |Capital ?? The following transactions took place for the month of April 2022:

Peter Smart used to wash cars in the back yard of his home. He set up a car cleaning business and rented premises, hired 2 staff and moved personal equipment to his business premises where a small office was available. He kept very basic records and after 3 months provided you with the following balances at 1 April 2022: Account balances at 1 April 2022 R Bank balance 23 000 Equipment 41 000 Consumables on hand 5 200 Creditors 3 700 |Capital ?? The following transactions took place for the month of April 2022:

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 2PA: On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account...

Related questions

Question

100%

Please see the attached and kindly assist?

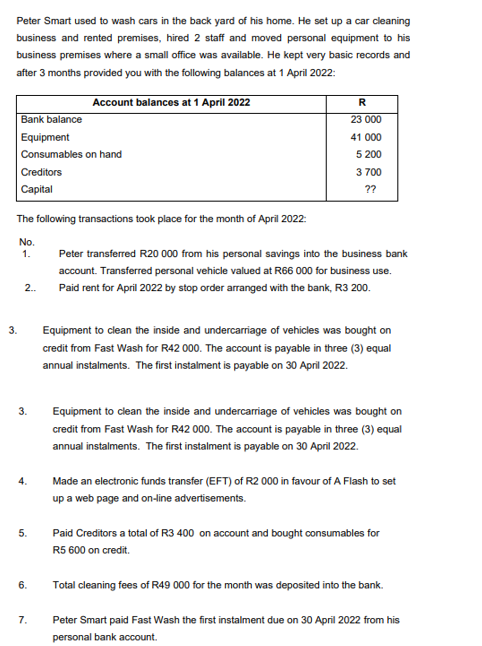

Transcribed Image Text:Peter Smart used to wash cars in the back yard of his home. He set up a car cleaning

business and rented premises, hired 2 staff and moved personal equipment to his

business premises where a small office was available. He kept very basic records and

after 3 months provided you with the following balances at 1 April 2022:

Account balances at 1 April 2022

R

Bank balance

23 000

Equipment

41 000

Consumables on hand

5 200

Creditors

3 700

Capital

??

The following transactions took place for the month of April 2022:

No.

1.

Peter transferred R20 000 from his personal savings into the business bank

account. Transferred personal vehicle valued at R66 000 for business use.

2.

Paid rent for April 2022 by stop order arranged with the bank, R3 200.

3.

Equipment to clean the inside and undercarriage of vehicles was bought on

credit from Fast Wash for R42 000. The account is payable in three (3) equal

annual instalments. The first instalment is payable on 30 April 2022.

3.

Equipment to clean the inside and undercarriage of vehicles was bought on

credit from Fast Wash for R42 000. The account is payable in three (3) equal

annual instalments. The first instalment is payable on 30 April 2022.

4.

Made an electronic funds transfer (EFT) of R2 000 in favour of A Flash to set

up a web page and on-line advertisements.

5.

Paid Creditors a total of R3 400 on account and bought consumables for

R5 600 on credit.

6.

Total cleaning fees of R49 000 for the month was deposited into the bank.

7.

Peter Smart paid Fast Wash the first instalment due on 30 April 2022 from his

personal bank account.

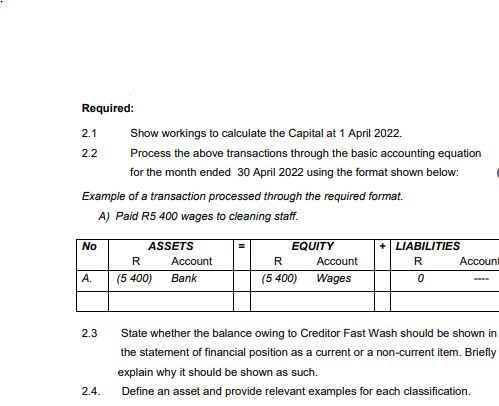

Transcribed Image Text:Required:

2.1

Show workings to calculate the Capital at 1 April 2022.

2.2

Process the above transactions through the basic accounting equation

for the month ended 30 April 2022 using the format shown below:

Example of a transaction processed through the required format.

A) Paid R5 400 wages to cleaning staff.

No

ASSETS

EQUITY

LIABILITIES

R

Account

R

Account

R

Account

А.

(5 400)

Bank

(5 400)

Wages

2.3

State whether the balance owing to Creditor Fast Wash should be shown in

the statement of financial position as a current or a non-current item. Briefly

explain why it should

e shown as such.

2.4.

Define an asset and provide relevant examples for each classification.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,