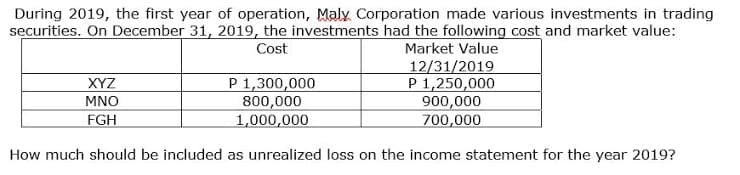

During 2019, the first year of operation, Maly Corporation made various investments in trading securities. On December 31, 2019, the investments had the following cost and market value: Cost Market Value P 1,300,000 800,000 1,000,000 12/31/2019 P 1,250,000 900,000 700,000 XYZ MNO FGH How much should be included as unrealized loss on the income statement for the year 2019?

During 2019, the first year of operation, Maly Corporation made various investments in trading securities. On December 31, 2019, the investments had the following cost and market value: Cost Market Value P 1,300,000 800,000 1,000,000 12/31/2019 P 1,250,000 900,000 700,000 XYZ MNO FGH How much should be included as unrealized loss on the income statement for the year 2019?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 12RE: Refer to the information in RE13-11. Assume that on December 31, 2019, the investment in Cornett...

Related questions

Question

Transcribed Image Text:During 2019, the first year of operation, Maly Corporation made various investments in trading

securities. On December 31, 2019, the investments had the following cost and market value:

Cost

Market Value

P 1,300,000

800,000

1,000,000

12/31/2019

P 1,250,000

900,000

700,000

XYZ

MNO

FGH

How much should be included as unrealized loss on the income statement for the year 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning