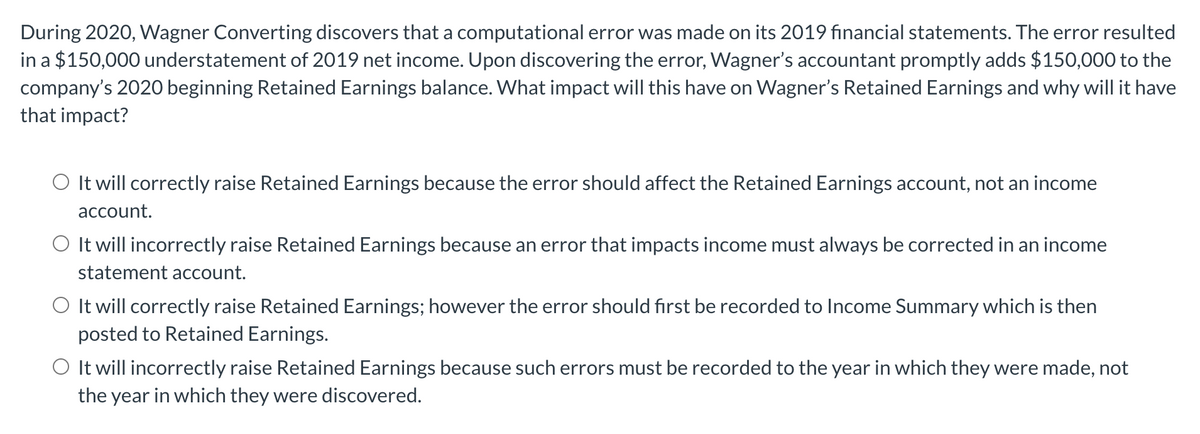

During 2020, Wagner Converting discovers that a computational error was made on its 2019 financial statements. The error resulted in a $150,000 understatement of 2019 net income. Upon discovering the error, Wagner's accountant promptly adds $150,000 to the company's 2020 beginning Retained Earnings balance. What impact will this have on Wagner's Retained Earnings and why will it have that impact? O It will correctly raise Retained Earnings because the error should affect the Retained Earnings account, not an income account. O It will incorrectly raise Retained Earnings because an error that impacts income must always be corrected in an income statement account. O It will correctly raise Retained Earnings; however the error should first be recorded to Income Summary which is then posted to Retained Earnings. O It will incorrectly raise Retained Earnings because such errors must be recorded to the year in which they were made, not the year in which they were discovered.

During 2020, Wagner Converting discovers that a computational error was made on its 2019 financial statements. The error resulted in a $150,000 understatement of 2019 net income. Upon discovering the error, Wagner's accountant promptly adds $150,000 to the company's 2020 beginning Retained Earnings balance. What impact will this have on Wagner's Retained Earnings and why will it have that impact? O It will correctly raise Retained Earnings because the error should affect the Retained Earnings account, not an income account. O It will incorrectly raise Retained Earnings because an error that impacts income must always be corrected in an income statement account. O It will correctly raise Retained Earnings; however the error should first be recorded to Income Summary which is then posted to Retained Earnings. O It will incorrectly raise Retained Earnings because such errors must be recorded to the year in which they were made, not the year in which they were discovered.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

Transcribed Image Text:During 2020, Wagner Converting discovers that a computational error was made on its 2019 financial statements. The error resulted

in a $150,000 understatement of 2019 net income. Upon discovering the error, Wagner's accountant promptly adds $150,000 to the

company's 2020 beginning Retained Earnings balance. What impact will this have on Wagner's Retained Earnings and why will it have

that impact?

O It will correctly raise Retained Earnings because the error should affect the Retained Earnings account, not an income

account.

O It will incorrectly raise Retained Earnings because an error that impacts income must always be corrected in an income

statement account.

O It will correctly raise Retained Earnings; however the error should first be recorded to Income Summary which is then

posted to Retained Earnings.

O It will incorrectly raise Retained Earnings because such errors must be recorded to the year in which they were made, not

the year in which they were discovered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT