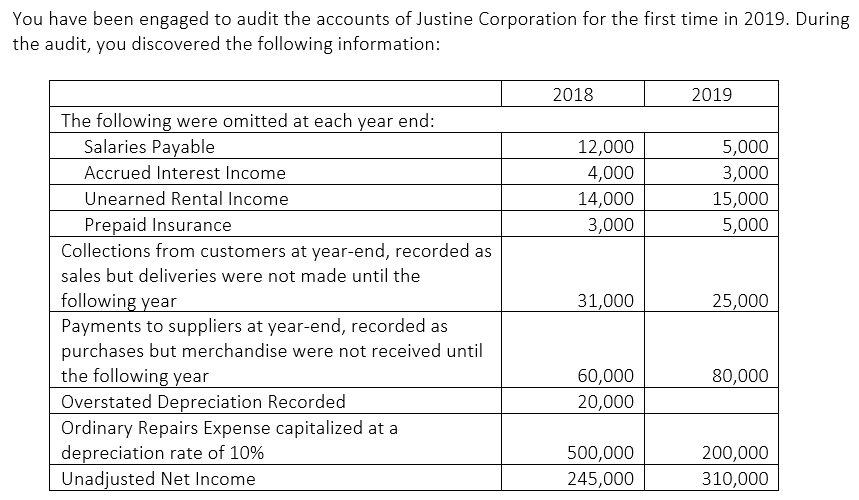

What is the effect of the errors to the Retained Earnings at the beginning of 2019? * 400,000 410,000 415,000 420,000

Q: Calculate the net income earned during the year. Assume that the change to stockholders’ equity…

A: Total assets = Total liabilities + Total equity Beginning equity = Beginning assets - Beginning…

Q: 16.On 12/31/2019, Meet People, LLC, reported a $64,000 loss on its books. The items included in the…

A: Income: Income includes all the income that belongs to the taxpayer, both taxable and non-taxable.…

Q: If the percentage of completion method had been used, the The cumulative effect of the accounting…

A: The increase in income due to a change in the method of depreciation shall be adjusted towards…

Q: 2022, Draper Company discovered errors made in 2019-2021, its first thre years of operation 2021…

A: Calculations of Restated 2021 Net Income. Hence, Restated 2021 Net Income is $23,350. Working…

Q: Berlin Company paid or collected during 2020 the following items: Insurance premiums paid P462,000;…

A: Given: - Prepaid insurance (beginning)= 36,000 Insurance paid during Year= 462,000 Prepaid insurance…

Q: During 2020, Company discovered that the ending inventories on its financial statements were…

A: A periodic inventory system is the method of the inventory system that measures physical available…

Q: The unadjusted net income for the year 2019 is: a. P1,540,200 b. P1,458,200 c. P1,482,200 d.…

A: Net income Net income is the difference between total revenues minus related expenses. Net income…

Q: C Co. reported a retained earnings balance of $200,000 at December 31, 2020. In September 2021, the…

A: Prepaid Insurance is an advance payment made towards Insurance of goods and assets used in the…

Q: Flushing, Inc. initially reported a retained earnings balance of $100,000 at December 31, 2020. In…

A: Adjusting journal entry: To record any unrecognized income or expenses for the period company made…

Q: 7. The balance sheets of Bonifacio Company include the following: 12/31/2019 12/31/2019 PO Interest…

A: Solution: Total supplies purchased during the period = Supplies expense +Ending supplies -…

Q: Requirement: a. What is the effect of the errors on Biden's December 31, 20x2 retained earnings?…

A: Net profit means the difference between the income and expenses. Financial statement means the…

Q: Elliott Corp. failed to record accrued salaries for 2019, $2,000; 2020, $2,100; and 2021, $3,900.…

A: Retained earnings: Retained earnings are that portion of profits which are earned by a company but…

Q: What amount should be reflected as the effect of change in accounting estimate in the statement of…

A: For Year 2017, the value of the closing stock increased by 5,400,000-4,500,000=900,000 which means a…

Q: The corrected net income in 2021 a. P752,900 b. P846,100 c. P799,900 d. P751,100 The effect of the…

A: The income and expenditure is adjusted on the basis of revenue earned or expenses incurred during…

Q: ARR Corporation's account balances during 2019 showed the following changes, all increases: Assets -…

A: The income statement is prepared by the business organizations so as to know how much amount of…

Q: Elliott Corp. failed to record accrued salaries for 2016,$2,000; 2017, $2,100; and 2018, $3,900.…

A: Accounting error:Accounting errors can be defined as omission of the fundamental accounting…

Q: E5-17 Income Statement and Retained Earnings Huff Company presents the following items derived from…

A: Multiple-step income statement is a statement that shows detailed information about the expenses and…

Q: What total amount should be recognized in profit or loss of Sushi Inc. for the year ended December…

A: An event after the reporting period that provides further evidence of conditions that existed at the…

Q: What amount should be reported as income from discontinued operations for 2020? * 5,000,000…

A: Net income refers to the income earned after deducting the company’s expenditures from the company’s…

Q: Determine the following as à 1. What is the total effect of the errors on the 2020 net income? a.…

A: Auditing is a process of checking the financial statement of a company by an auditor. The auditor…

Q: 33. As of Dec. 31, 2020, Unadjusted Interest Income account of Entity A was P5,000. It was learned…

A: Income that is not earned should be transferred to the Unearned income account. 1. journal entry to…

Q: Zebra Company has determined the 2021 net income to be P 5,000,000. Revenue received in advance in…

A: Adjusted net income = Net income calculated - unearned revenue - Loss on sale of equipment Where,…

Q: Using the information in AA8, how much is the total amount of Retained Earnings? P 150,000 P 100,000…

A: Retained earnings means the amount that is left after paying all the expenses and amount that…

Q: Two or more items are omitted in each of the following tabulations of income statement data. Fill in…

A: Cost of goods sold is defined the as the value or carrying value of the products sold during the…

Q: Based on the data above, Retained Earnings at December 31, 2020 was O $951,920 O $952,220 O $948,920…

A: Retained earning means amount of profit remain after all the adjustment of expense and adjustments.

Q: What pretax amount should be reported in the 2021 statemen of changes in equity as the cumulative…

A: Calculation of cumulative effect of change in accounting policy Year FIFO Weighted average effect…

Q: 1. What amount should be reported as net effect of the errors on net income for 2020? a. 250000…

A: Here discuss the details of the effect of errors which are incurred to the net income and retained…

Q: ABC Company reported net income and retained earnings for a two – year period as follows:…

A: Retained Earnings: It refers to the amount of earnings that are not paid to the shareholders, rather…

Q: ow much uncollectible accounts expense should be presented on the statement of comprehensive income…

A: Allowance for doubtful accounts means where we expect some debts to become bad in near future then…

Q: on December 31, 2019, retained earnings has a normal balance of $18,500. on December 31, 2020,…

A: Ending retained earnings = Opening retained earnings + Net Income during the period - Dividends paid…

Q: tive expenses, P84,000 p00 280,000

A: Retained earnings: Retained earnings refer to the sum value of money remaining at a company after…

Q: State the effect the following situations would have on the amount of annual net income reported for…

A: The adjustment entries are generally passed at the year end. The following adjustment entry is…

Q: Year Net Income Cumulative (Loss) Net Income 2018 6,500,000 6,500,000 2019 400,000 What is the…

A: Cumulative income = Net income for 2018 + Net income for 2019

Q: gnoring income tax, the accounting change should preferably be reported by the company in its year…

A: As the question specified ignoring income taxes, the cumulative effect on retained earnings will be…

Q: Based on the given data, what is the returns for Company JFC? Company Dec. 30, 2020 Dec. 29, 2019…

A: Investors have different options to make investments, and the motive behind investments is to…

Q: 1. What is the total effect of the errors on the 202 a. Understated by P45,000 b. Understated by…

A: 1) Total effect of error in 2020 Particulars Amount Overstated Inventory (10,000) Advances to…

Q: P 67,000 overstated D. P 82,000 overstat

A: Assets - treated as income so added to the net income except for beginning inventory because it will…

Q: 1. How much is overstatement(understatement) of the retained earnings by the end of 2019? (if UNDER,…

A: Retained Earnings The purpose of keeping retained earning is to reserve the amount of profit which…

Q: For how much should retained earnings be retroactively adjusted at January 1, 2019? A. P250,000…

A: Step 1 As in given case, the error of 2017 is already being reflected in 2018, being adjusted…

Q: Accrued salaries of P 20,000 was overlooked at the end of 2021. What would be the adjusting entry if…

A: Note: Due to overlooking of accrued salaries, profit will be decline in the year of expense booking.…

Q: How much would the December 31,2020 retained earnings be misstated if the books are not yet closed?

A: (1) The Audited Net Income for 2019 = P1,600,000 (2) The Unadjusted Net Income for 2020 = P1,920,000

Q: adjusted balance of accounts payable on December 31, 2021?

A: Answer: Unadjusted Balance of Accounts payable as on Dec 31,2021…

Q: Based on the given data, what is the returns for Company JFC? Company Dec. 30, 2020 Dec. 29, 2019…

A: Dividend adjusted return is a total return that takes into account the both the change in the market…

Q: Berlin Company paid or collected during 2020 the following items: Insurance premiums paid P462,000;…

A: Salary expense is calculated by adding the ending Salaries payable to the salaries paid during the…

Q: Eeport Date cale let sales lembership & other income otal revenues ost of sales 2019 Thousands 2018…

A: Average ReceivableTurnover Ratio- It shows the relationship between credit revenue from the…

Q: .An entity reported wages expense of P3,500,000 for 2019. The wages payable at the beginning of year…

A: Adjusting entries: Adjusting entries can be defined as the journal entries that are prepared by the…

Q: 4. The corrected net income in 2020 a. P692,500 b. P709,500 c. P708,500 d. P690,500 5. The effect of…

A: Computation of Correct Net Income of 2020 Net Income before Adjustments 700000 Add: Prepaid…

Q: What amount should be reflected as the effect of change in accounting estimate in the statement of…

A: The entity decided to change the inventory valuation method From FIFO to the weighted average the…

Q: The following balances were reported by ABC Co. at December 31, 2019 and 2020: 12/31/20 P2,600,000…

A: Purchases = Ending accounts payable balance + Amount paid to suppliers - Beginning accounts payable…

Q: Analyzing the effect of prior-period adjustments Taylor Corporation discovered in 2019 that it had…

A: Requirement 1:

What is the effect of the errors to the Retained Earnings at the beginning of 2019? *

400,000

410,000

415,000

420,000

Step by step

Solved in 2 steps with 1 images

- At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.Abrat Company failed to accrue an allowance for doubtful accounts of 13,500 in 2019. Upon discovery of this error in 2020 prior to making its estimate of doubtful accounts, what correcting journal entry should Abrat make? Ignore income taxes.Complex Balance Sheet Presented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporations bookkeeper. Your company has been engaged to perform an audit, during which you discover the following information: 1. Checks totaling 14,000 in payment of accounts payable were mailed on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank returned a customers 2,000 check marked NSF, but no entry was made. Cash includes 100,000 restricted for building purposes. 2. Included in accounts receivable is a 30,000 note due on December 31, 2022, from Zeuss president. 3. During 2019, Zeus purchased 500 shares of common stock of a major corporation that supplies Zeus with raw materials. Total cost of this stock was 51,300, and fair value on December 31, 2019, was 51,300. Zeus plans to hold these shares indefinitely. 4. Treasury stock was recorded at cost when Zeus purchased 200 of its own shares for 32 per share in May 2019. This amount is included in investments. 5. On December 31, 2019, Zeus borrowed 500,000 from a bank in exchange for a 10% note payable, manning December 31, 2024. Equal principal payments are due December 31 of each year beginning in 2020. This note is collateralized by a 250,000 tract of land acquired as a potential future building site, which is included in land. 6. The mortgage payable requires 50,000 principal payments, plus interest, at the end of each month. Payments were made on January 31 and February 28, 2020. The balance of this mortgage was due June 30, 2020. On March 1, 2020, prior to issuance of the audited financial statements, Zeus consummated a non-cancelable agreement with the lender to refinance this mortgage. The new terms require 100,000 annual principal payments, plus interest, on February 28 of each year, beginning in 2021. The final payment is due February 28, 2028. 7. The lawsuit liability will be paid in 2020. 8. Of the total deferred tax liability; 5,000 is considered a current liability. 9. The current income tax expense reported in Zeuss 2019 income statement was 61,200. 10. The company was authorized to issue 100,000 shares of 50 par value common stock.

- You are the accountant for Speedy Company and are preparing the financial statements for 2019. Near the end of 2019, Speedy loaned its president 100,000 (a material amount) because she was having financial difficulties. The note was properly recorded as a note receivable by Speedy. You are unsure of how to classify this note on the 2019 ending balance sheet and ask the president when the note is due. She replies, We never really set a due date; I might repay it in 2020 or maybe in a couple of years when I get more financially secure. It would be best to classify this note as a current asset in the usual manner because that will increase our working capital and current ratio, which will make our creditors and shareholders happy. Required: From financial reporting and ethical perspectives, what do you think of the presidents suggestion?Dudley Company failed to recognize the following accruals. It also recorded the prepaid expenses and unearned revenues as expenses and revenues, respectively', in the following year when paid or collected. The reported pretax income was 20,000 in 2018, 25,000 in 2019, and 23,000 in 2020. Required: 1. Compute the correct pretax income for 2018, 2019, and 2020. 2. Prepare the journal entries necessary in 2020 if the errors are discovered at the end of that year. Ignore income taxes. 3. Prepare the journal entries necessary in 2021 if the errors are discovered at the end of that year. Ignore income taxes.Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.

- Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800Elegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Linens considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.Noren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Noren Company considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.

- Soon after December 31, 2019, the auditor requested a depreciation schedule for trucks of Jarrett Trucking Company, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2016 to 2019, inclusive. The following data were in the Trucks account as of January 1, 2016: The Accumulated DepreciationTrucks account, previously adjusted to January 1,2016, and duly entered in the ledger, had a balance on that date of 16,460. This amount represented the straight-line depreciation on the four trucks from the respective dates of purchase, based on a 5-year life and no residual value. No debits had been made to this account prior to January 1, 2016. Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows: 1. July 1, 2016: Truck no. 1 was sold for 1,000 cash. The entry was a debit to Cash and a credit to Trucks, 1,000. 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was 12,000. Jarrett paid the other company 1,780 cash on the transaction. The entry was a debit to Trucks, 1,780, and a credit to Cash, 1,780. 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for 50 cash. Jarrett received 950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, 1,000, and credits to Miscellaneous Revenue, 50, and Trucks, 950, 4. July 1, 2018: A new truck (no. 6) was acquired for 20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life. Entries for depreciation had been made at the close of each year as follows: 2016, 8,840; 2017, 5,436; 2018, 4,896; 2019, 4,356. Required: 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the companys errors in determining or entering depreciation or in recording transactions affecting trucks. 2. Prove your work by one compound journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.Refer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.In your audit of Pink Corporation’s liabilities accounts in relation to the company’s financial statements audit for the period ended December 31, 2020, an excerpt of the company’s unadjusted trial balance showed the following information: Accounts payable, net of a P12,000 debit balance P399,000 Accrued expenses 17,400 Provision for warranties 276,375 12% Notes payable, Bank due December 31, 2023 500,000 Audit notes: (A) Purchases cut-off procedure information: December Purchases Journal Entries RR Number Receiving Report Date Amount Particulars 82101 Dec. 26, 2020 P12,900 FOB Destination 82102 Dec. 28, 2020 15,200 FOB Shipping Point 82103 Dec. 29, 2020 11,900 On consignment 82105 Dec. 31, 2020 9,500 FOB Destination 82106 Jan. 2, 2021 13,200 Goods in transit; FOB Buyer 82107 Jan. 3, 2021 8,900 Goods in transit; FOB Shipping Point January Purchases…