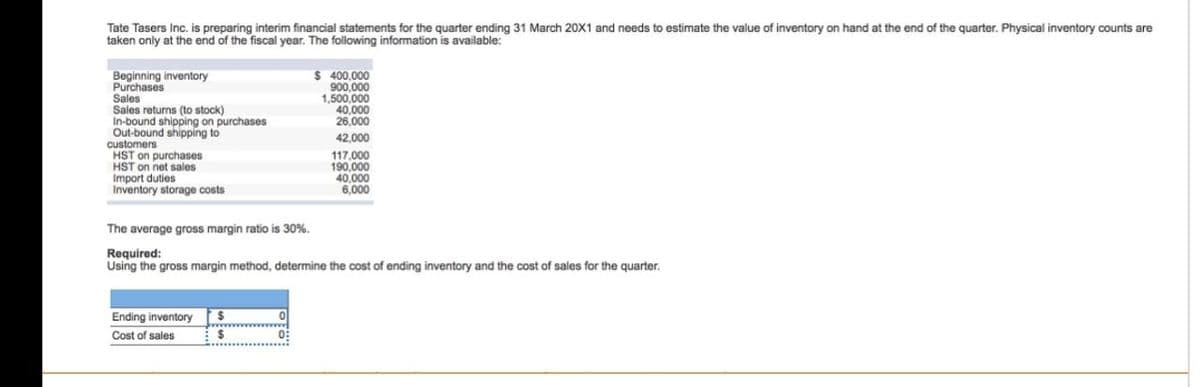

Tate Tasers Inc. is preparing interim financial statements for the quarter ending 31 March 20X1 and needs to estimate the value of inventory on hand at the end of the quarter. Physical inventory counts are taken only at the end of the fiscal year. The following information is available: $ 400,000 900,000 1,500,000 40,000 26,000 Beginning inventory Purchases Sales Sales returns (to stock) In-bound shipping on purchases Out-bound shipping to customers HST on purchases HST on net sales Import duties Inventory storage costs 42,000 117,000 190,000 40,000 6,000 The average gross margin ratio is 30%. Required: Using the gross margin method, determine the cost of ending inventory and the cost of sales for the quarter. Ending inventory Cost of sales

Tate Tasers Inc. is preparing interim financial statements for the quarter ending 31 March 20X1 and needs to estimate the value of inventory on hand at the end of the quarter. Physical inventory counts are taken only at the end of the fiscal year. The following information is available: $ 400,000 900,000 1,500,000 40,000 26,000 Beginning inventory Purchases Sales Sales returns (to stock) In-bound shipping on purchases Out-bound shipping to customers HST on purchases HST on net sales Import duties Inventory storage costs 42,000 117,000 190,000 40,000 6,000 The average gross margin ratio is 30%. Required: Using the gross margin method, determine the cost of ending inventory and the cost of sales for the quarter. Ending inventory Cost of sales

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

please giveall details correct calculation

Transcribed Image Text:Tate Tasers Inc. is preparing interim financial statements for the quarter ending 31 March 20X1 and needs to estimate the value of inventory on hand at the end of the quarter. Physical inventory counts are

taken only at the end of the fiscal year. The folowing information is available:

$ 400,000

900,000

1,500,000

40,000

26,000

Beginning inventory

Purchases

Sales

Sales returns (to stock)

In-bound shipping on purchases

Out-bound shipping to

customers

HST on purchases

HST on net sales

Import duties

Inventory storage costs

42,000

117,000

190,000

40,000

6,000

The average gross margin ratio is 30%.

Required:

Using the gross margin method, determine the cost of ending inventory and the cost of sales for the quarter.

Ending inventory

Cost of sales

0:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,