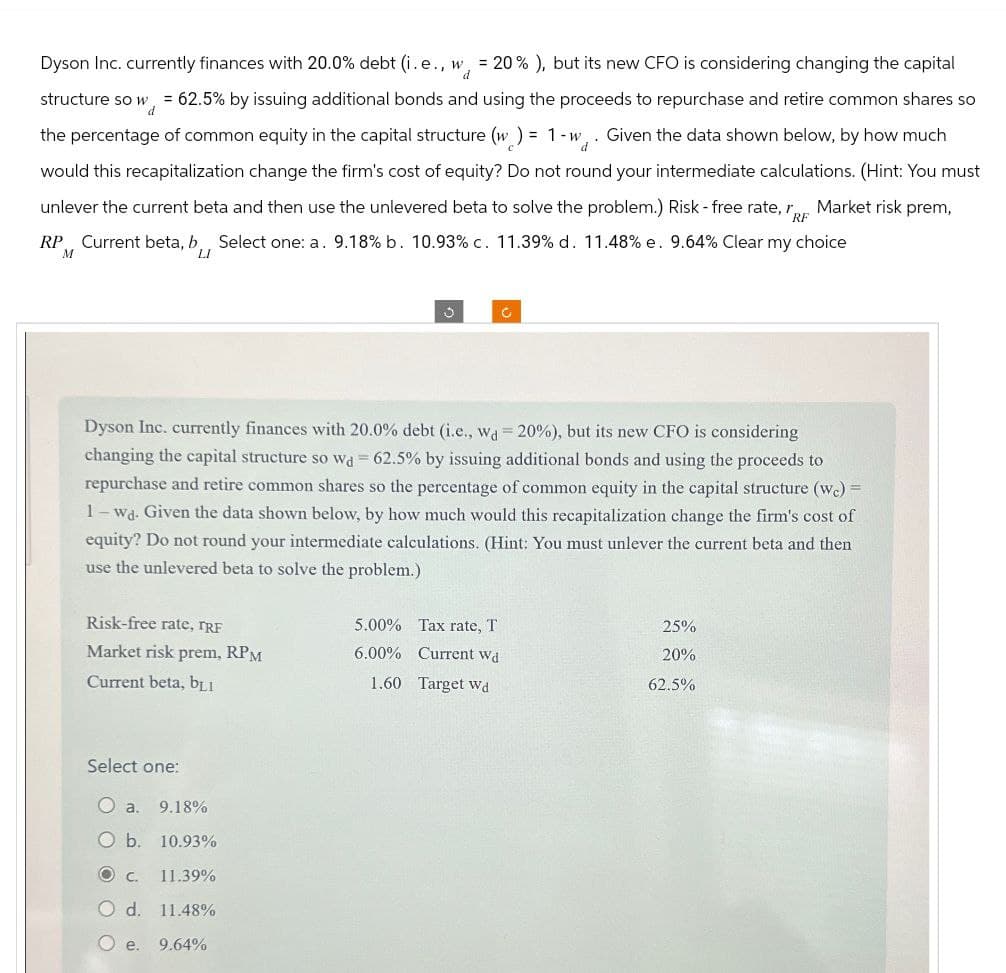

Dyson Inc. currently finances with 20.0% debt (i.e., w = 20% ), but its new CFO is considering changing the capital d d structure so w = 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (w) = 1-w. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate, Market risk prem, RP Current beta, b Select one: a. 9.18% b. 10.93% c. 11.39% d. 11.48% e. 9.64% Clear my choice M LI RF 3 c Dyson Inc. currently finances with 20.0% debt (i.e., wd=20%), but its new CFO is considering changing the capital structure so wa 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1-wd. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate, TRF 5.00% Tax rate, T 25% Market risk prem, RPM 6.00% Current wd 20% Current beta, b₁₁ 1.60 Target wd 62.5% Select one: O a. 9.18% ○ b. 10.93% O c. 11.39% O d. 11.48% ○ e. 9.64%

Dyson Inc. currently finances with 20.0% debt (i.e., w = 20% ), but its new CFO is considering changing the capital d d structure so w = 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (w) = 1-w. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate, Market risk prem, RP Current beta, b Select one: a. 9.18% b. 10.93% c. 11.39% d. 11.48% e. 9.64% Clear my choice M LI RF 3 c Dyson Inc. currently finances with 20.0% debt (i.e., wd=20%), but its new CFO is considering changing the capital structure so wa 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1-wd. Given the data shown below, by how much would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate, TRF 5.00% Tax rate, T 25% Market risk prem, RPM 6.00% Current wd 20% Current beta, b₁₁ 1.60 Target wd 62.5% Select one: O a. 9.18% ○ b. 10.93% O c. 11.39% O d. 11.48% ○ e. 9.64%

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 4P

Related questions

Question

None

Transcribed Image Text:Dyson Inc. currently finances with 20.0% debt (i.e., w = 20% ), but its new CFO is considering changing the capital

d

d

structure so w = 62.5% by issuing additional bonds and using the proceeds to repurchase and retire common shares so

the percentage of common equity in the capital structure (w) = 1-w. Given the data shown below, by how much

would this recapitalization change the firm's cost of equity? Do not round your intermediate calculations. (Hint: You must

unlever the current beta and then use the unlevered beta to solve the problem.) Risk-free rate,

Market risk prem,

RP Current beta, b Select one: a. 9.18% b. 10.93% c. 11.39% d. 11.48% e. 9.64% Clear my choice

M

LI

RF

3

c

Dyson Inc. currently finances with 20.0% debt (i.e., wd=20%), but its new CFO is considering

changing the capital structure so wa 62.5% by issuing additional bonds and using the proceeds to

repurchase and retire common shares so the percentage of common equity in the capital structure (wc) =

1-wd. Given the data shown below, by how much would this recapitalization change the firm's cost of

equity? Do not round your intermediate calculations. (Hint: You must unlever the current beta and then

use the unlevered beta to solve the problem.)

Risk-free rate, TRF

5.00% Tax rate, T

25%

Market risk prem, RPM

6.00% Current wd

20%

Current beta, b₁₁

1.60 Target wd

62.5%

Select one:

O a. 9.18%

○ b. 10.93%

O c. 11.39%

O d. 11.48%

○ e. 9.64%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning