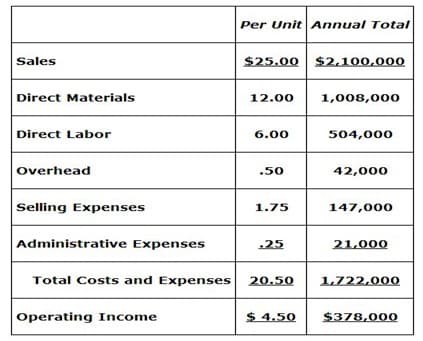

e Party Connection prepares complete party kits for various types of celebrations. It is currently operating at 80% of its capacity. It costs The Party Connection $20.50 to make a packet that it sells for $25.00. It currently makes and sells 84,000 packets per year. Detailed information attached The Party Connection has received a special order request for 25,000 packets at a price of $23 per packet to be shipped overseas. Suppose the following information is discovered with further analysis: o The per unit overhead cost of $0.50 is 50% variable ($0.25) and 50% fixed ($0.25). o The per unit Selling costs of $1.75 is 26.67% variable ($0.47) and 73.33% fixed ($1.28). o Administrative expenses would not change.

the Party Connection prepares complete party kits for various types of celebrations. It is currently operating at 80% of its capacity. It costs The Party Connection $20.50 to make a packet that it sells for $25.00. It currently makes and sells 84,000 packets per year. Detailed information attached

The Party Connection has received a special order request for 25,000 packets at a price of $23 per packet to be shipped overseas. Suppose the following information is discovered with further analysis:

o The per unit overhead cost of $0.50 is 50% variable ($0.25) and 50% fixed ($0.25).

o The per unit Selling costs of $1.75 is 26.67% variable ($0.47) and 73.33% fixed ($1.28).

o Administrative expenses would not change.

• Should the Party Connection accept this special order?

Step by step

Solved in 2 steps