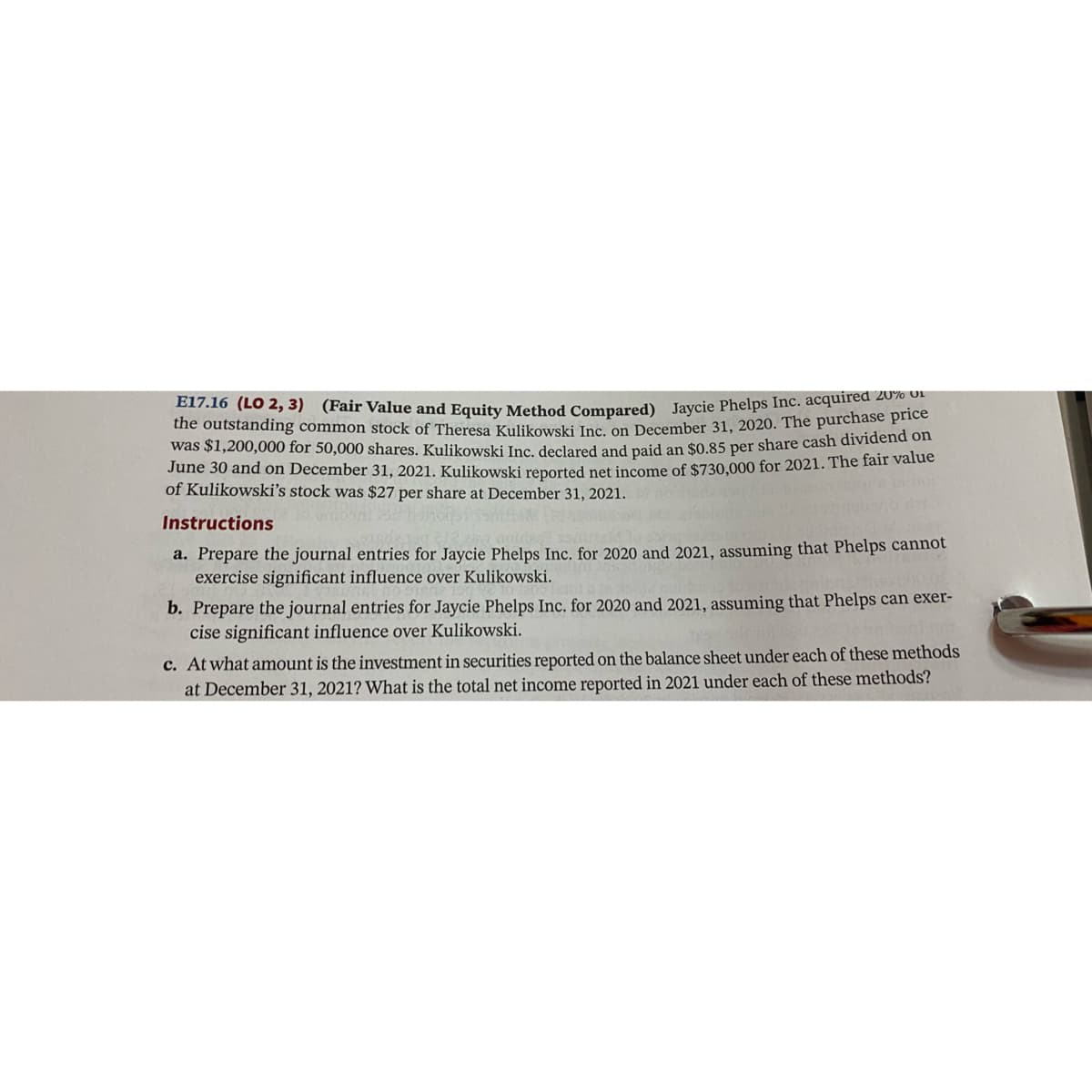

E17.16 (LO 2, 3) (Fair Value and Equity Method Compared) Jaycie Phelps me. de the outstanding common stock of Theresa Kulikowski Inc on December 31, 2020. The purchase price was $1,200,000 for 50,000 shares. Kulikowski Inc. declared and paid an $0.85 per share cash dividend on June 30 and on December 31, 2021. Kulikowski reported net income of $730,000 for 2021. The fair value of Kulikowski's stock was $27 per share at December 31, 2021. Instructions a. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps cannot exercise significant influence over Kulikowski. b. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps can exer- cise significant influence over Kulikowski. c. At what amount is the investment in securities reported on the balance sheet under each of these methods at December 31, 2021? What is the total net income reported in 2021 under each of these methods?

E17.16 (LO 2, 3) (Fair Value and Equity Method Compared) Jaycie Phelps me. de the outstanding common stock of Theresa Kulikowski Inc on December 31, 2020. The purchase price was $1,200,000 for 50,000 shares. Kulikowski Inc. declared and paid an $0.85 per share cash dividend on June 30 and on December 31, 2021. Kulikowski reported net income of $730,000 for 2021. The fair value of Kulikowski's stock was $27 per share at December 31, 2021. Instructions a. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps cannot exercise significant influence over Kulikowski. b. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps can exer- cise significant influence over Kulikowski. c. At what amount is the investment in securities reported on the balance sheet under each of these methods at December 31, 2021? What is the total net income reported in 2021 under each of these methods?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 24E

Related questions

Question

Transcribed Image Text:E17.16 (LO 2, 3) (Fair Value and Equity Method Compared) Jaycie Phelps Inc. acquired 2o ice

the outstanding common stock of Theresa Kulikowski Inc on December 31, 2020. The purchase price

was $1,200,000 for 50,000 shares. Kulikowski Inc. declared and paid an $0.85 per share cash dividend on

June 30 and on December 31, 2021. Kulikowski reported net income of $730,000 for 2021. The air varde

of Kulikowski's stock was $27 per share at December 31, 2021.

Instructions

a. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps cannot

exercise significant influence over Kulikowski.

b. Prepare the journal entries for Jaycie Phelps Inc. for 2020 and 2021, assuming that Phelps can exer-

cise significant influence over Kulikowski.

c. At what amount is the investment in securities reported on the balance sheet under each of these methods

at December 31, 2021? What is the total net income reported in 2021 under each of these methods?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT