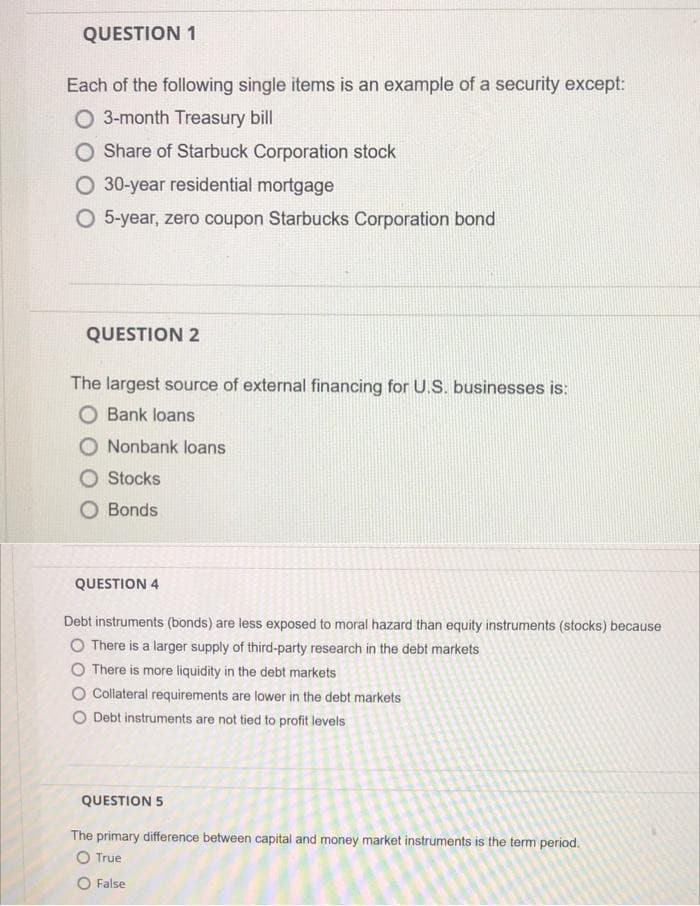

Each of the following single items is an example of a security except: O 3-month Treasury bill O Share of Starbuck Corporation stock O 30-year residential mortgage O 5-year, zero coupon Starbucks Corporation bond

Q: For large countries an import tariff will deteriorate the terms of trade with other countries.…

A: A tariff refers to a tax that one nation levies on products and services imported from…

Q: 1. Illustrate the market for labor among gas station attendants. Imagine that demand for gas, and…

A: The markets are where the goods and services are bought and sold. The markets tend to operate with…

Q: a) is more difficult to calculate. 5) is not updated as frequently. =) underestimates true…

A: CPI is used to calculate inflation level in the economy.

Q: During the Great Recession, the U.S. aggregate demand curve shifted to the left, in part, because a)…

A: Recession refers to a period of time where fall in economic activity can be observed all across the…

Q: 450 so0 550 soo eso 700 750 000 De Refer to the Figure. If there are no fixed costs of production,…

A: Answers 1) option cthe profit = TR - TCHere TR = 250*22.5, ie, $5625.The TC = AC *Q, ie, 250*10,…

Q: The expenditure multiplier implies that a dollar spent in the economy leads to. Select the correct…

A: Expenditure multiplier is the factor by which aggregate spending changes due to change in initial…

Q: Show solution numbers 1 and 2 on how the answer is obtained using interest formulas Note: Without…

A: Future value (FV) is defined as the value of a current asset at some point in the future, using a…

Q: A security that represents a debt to be paid is known as a(n) O a) bank. b) rating. O c) bond. O d)…

A: In a market, different terms are used to represent different form of market interaction between…

Q: Households

A: A circular flow model shows us the direction flow of money and goods and services between the agents…

Q: Refer to the accompanying table to answer the next six questions. Quantity of Quantity of Monthly…

A: Equilibrium in the market occurs at the intersection of demand and supply curves.

Q: Given the following optimization problem: max(500-q)q-50q Profit:50,600 O True O False

A: Ans. b. False let P = Max. (500-q)q - 50q P = 500q - q2 - 50q P = 450q - q2…

Q: Use Cramer's rule to find the solutions for x.y and z given the following equations: 5x - 6y + 4z =…

A: Answer; Ans. Option 1: is correct answer.

Q: The ___________ is the Fed’s primary tool for adjusting the ___________ . a. interest on reserve…

A: The interest on reserve balances rate is an administered rate, the Fed can steer the federal funds…

Q: When making decisions about saving and borrowing, people care most about O a) the nominal rate of…

A: In an economy, people make their consumption and savings decisions based on their income level and…

Q: The two primary "levers" that immigration policymakers can manipulate are: the number of immigrants…

A: Immigrant is a person who settles in a foreign country permanently.

Q: Explain why a sudden, large burst of inflation could lead to a recession?

A: Inflation is the continuous rise in the price level of commodities in a nation over a period of…

Q: Two players, Row and Column, will simultaneously and independently decide whether to 'share' or…

A: Introduction Two players row and column play independently and simultaneously to decide whether…

Q: 1. Consider the figure below, which depicts the matching of jobs and workers. There are two jobs at…

A: Risk averse people will not be willing to take risks.

Q: Suppose the inverse market supply for good X is given by P,-15 + 5Qs and the inverse market demand…

A: Consumer surplus refers to the area above the price and below the demand curve. Producer surplus…

Q: When the Fed raises the legal reserve requirement, it Question 47 options: a) increases the…

A: Answer) Reserve requirements is considered as an amount of cash that bank should retain with them.…

Q: Consider the short-run and long-run Phillips Curves illustrated in the figure below. Suppose…

A: PLEASE FIND THE ANSWER BELOW. INFLATION RATE: The rate at which prices increase over time,…

Q: Institutions that help to channel funds from savers to borrowers are known as a) corporations. b)…

A: People do not consume their entire income rather they like to save a part of the income for future…

Q: The _____ oversee(s) the main tool of monetary policy. a. Congressional Budget Office b. 12…

A: * ANSWER :- (4) From above information the answer is provided below as

Q: Given the graph below the Fed will use monetary policy to interest rates and aggregate demand. Price…

A: In the given graph, the economy is producing more than its potential which generates an inflationary…

Q: If the labour market is perfectly competitive, labour demand function is given by ND = a + bW and…

A: Labour marker is in equilibrium where labour demand is equal to labour supply.

Q: Which of the following two types of unemployment occur even when the economy is healthy and growing?…

A: Answer : The right answer is option (c) frictional and structural unemployment. Frictional…

Q: Antipoverty programs are often set up so that the amount of government benefits will decline…

A: Antipoverty programs which benefits the individual when some one liew below the poverty line and…

Q: Describe the idea of cost of a life-cycle in your own terms. Why is the life-cycle cost savings…

A: In a market, when a product is produced, there are different types of cost incurred in converting…

Q: Analyze the graph below, showing the Gross Federal Debt as a percentage of GDP for the United States…

A: GDP: It refers to the gross domestic product of the economy. The GDP helps in showing the wealth of…

Q: Which of the following are the three major categories of resources? a) natural resources, physical…

A: Resources are the factors of production of goods and services.

Q: Some individuals are unemployed because they are laid off from their jobs when the economy is…

A: Unemployment occurs when people are not able to find a job but they are willing to do a job.

Q: The labor supply curve is upward sloping because workers are willing to work more hours at…

A: Labor supply curve shows different combinations of wage and quantity of labor supplied.

Q: A) The figure below shows the bid rent curves for land for use in housing (R), commercial purposes…

A: 3 Bid Rent Curves are given: RR - Bid Rent Curve for land used for Housing Rc - Bid Rent Curve for…

Q: Cinnamon Toast Crunch cereal and Trix cereal are considered substitute goods. Because of this, one…

A: When the two goods are substitutes. Consumption of both goods yield almost the same level of…

Q: It is thought that the most important source of labour market discrimination facing women is that:…

A: Women are still facing the discrimination at the work places. These women are not being paid…

Q: O a) changes in tastes and preferences

A:

Q: Question 55 In the figure given below, we observe Price Level LRAS SRAS P1 AD Real GDP Y1 YP Oal a…

A: The curve that depicts various quantities of goods and services being demanded at various levels of…

Q: Consider Alexei who makes $1,400 per week and just won a 'set for life lottery ticket which involves…

A: Budget Constraint shows that the value of all the goods that a consumer consumes should be less than…

Q: According to the Keynesian IS - LM model, what is the effect of the following on output, the real…

A:

Q: How do you see the FUTURE OF GLOBALIZATION?

A: There has been an increase in the number of people, corporations, and governments engaging and…

Q: Which area(s) represent the amount of consumer surplus lost due to the tax? O a) B-C O b) B+F O)A c)…

A: Consumer surplus refers to the ads abound the price and below the demand curve.

Q: In the neoclassical model, low inflation is good because Select the correct answer below: O it…

A: The neo-classical model revolves around the concepts of market demand and supply and believes that…

Q: How does monopolistic competition differ from perfect competition A) There are more sellers in a…

A: The monopolistically competitive market is different from the perfectly competitive market in a way…

Q: Import quotas and import tariffs have qualitatively similar effects on equilibrium outcomes in…

A: Import Quotas:- Import quotas are a sort of trade limitation that places a practical limitations on…

Q: The Chinese government controls all factors of production, the Chinese government has which type of…

A: Let us understand the different market systems in question: A) Capitalism: Under capitalism, the…

Q: Since the Russia-Ukraine conflict escalated in February 2022, many businesses and investors have…

A: A actual rate is a percentage rate which has been adjusted to exclude the impacts of inflation to…

Q: Which of the following does NOT fall into the degrees of competition continuum? A) Perfect…

A: Market structures modelled as a continuum are the four general market structures: perfect…

Q: Economic growth is determined by a) population, birth rates, and death rates. b) resources,…

A: Economic growth is the increase in price adjusted value of goods and services produced by an…

Q: ne the economy is in short-run macro-equilibrium at E1. If the federal nment engages in expansionary…

A: Fiscal policy is associated with changes in expenditure and taxes so as to alter the AD(aggregate…

Step by step

Solved in 3 steps

- Suppose the economy of a large nation has a defense industry, a banking industry, and apharmaceutical industry. 1-unit output of defense requires 0.6 inputs of defense, 0.2 inputs ofbanking, and 0.2 inputs of pharmaceuticals. 1-unit output of banking requires 0.1 inputs ofdefense, 0.4 inputs of banking, and 0.5 inputs of pharmaceuticals. 1-unit output of pharmaceuticalsrequires 0.1 inputs of defense, 0.2 inputs of banking, and 0.2 inputs of pharmaceuticals.If the nation wants to have surpluses of 106 units of defense production, 243 units of bankingproduction, and 216 units of pharmaceutical production, find the gross production of eachindustry.How coronavirus will dominate African interest rate decisionsJOHANNESBURG ‐ Central bankers in five key sub‐Saharan African countries will meet on interestrates in the next ten days as the focus turns to them for measures to shore up their economies thatare expected to be hit by the novel coronavirus.“We expect the Covid‐19 outbreak and current market turmoil to be major points of discussion aspolicymakers deliberate on the rate decision, with the bias certainly downwardsfor those countrieswhich have scope to cut,” said Ridle Markus, an economist for sub‐Saharan Africa at Absa Bank Ltd.Policymakers in oil‐producing countries “will need to balance the significant downside risks togrowth, brought by the slump in oil prices, against the risksresulting from the deteriorating balanceof payments and worsening inflation outlook,” he said.Here’s what central bankers in the region may do in the next ten days:South Africa, March 18 ‐ Repurchase rate: 6.25%Inflation rate: 4.5% (January) By…**Practice** suppose that many insurance companies sell contracts of the following format:- The insurance premium P is the same for everyone in this market, regardless of the value of their cell phone. That’s because regulations prevent the companies from charging different premiums based on cell phone value. - If the cell phone is stolen, they get the value of the phone back (that is, Anne would get$700 from the insurance company if her phone were stolen, and Bob would get $600) Assume that the insurance companies are all risk-neutral and that market is competitive, and so the contract is such that the insurance companies have zero profits. Also assume that 50% of consumers in the market are identical to Anne, and 50% are identical to Bob. What is the actuarially fair premium and who buys the full insurance plan?a. The actuarially fair premium is 260 and only Bob buys itb. The actuarially fair premium is 130 and both Anne and Bob buy itc.The actuarially fair premium is 180 and both…

- **Practice** suppose that many insurance companies sell contracts of the following format: - The insurance premium P is the same for everyone in this market, regardless of the value of their cell phone. That’s because regulations prevent the companies from charging different premiums based on cell phone value.- If the cell phone is stolen, they get the value of the phone back (that is, Anne would get $700 from the insurance company if her phone were stolen, and Bob would get $600) Assume that the insurance companies are all risk-neutral and that market is competitive, and so the contract is such that the insurance companies have zero profits. Also assume that 50% of consumers in the market are identical to Anne, and 50% are identical to Bob. Continue assuming that the insurance companies are risk-neutral and competitive, but now instead of assuming that the risks are correlated instead of independent. Specifically, suppose that with probability 0.2, a bandit group raids the city and…Now suppose agent C can produce private information about the true realization x at t=1 at the cost γ. Suppose lA=lB=φA=φB=1. Suppose γ=4. - Suppose agent B proposes to borrow LB=50 by posting the bond. Does agent C always lend?- What is the maximum amount LB that agent B can borrow with probability 1? What is the haircut?When company executives buy and sell stock basedon private information they obtain as part of theirjobs, they arc engaged in insider lmding.:t Give an example of inside information that mi~;htbe useful for buying or selling stock.h. "rho,::,.. who trnriP "'tnrh hMM nn in"irlPinformation usuaUy cam very high rates ofreturn. Docs this fact violate the efficient marketshypothesis?c. Insider trading is illegal. Why do you supposethat is?

- Do you think that a U.S. Treasury bill will have a riskpremium that is higher than, lower than, or the sameas that of a similar security (in terms of maturity andliquidity) issued by the government of Colombia?You are in the market for a used car. At a used carlot, you know that the Blue Book value of the car youare looking at is between $15,000 and $19,000. Ifyou believe the dealer knows as much about the caras you do, how much are you willing to pay? Why?Assume that you care only about the expected valueof the car you will buy and that the car values aresymmetrically distributed.23. Refer to Problem 22. Now you believe the dealerknows more about the car than you do. How muchare you willing to pay? Why? How can this asymmetric information problem be resolved in a competitivemarket?5. Consider the set-up in the lecture slides on credit: There are two borrowers (denoted by S and R respectively) each of whom need 1 unit of credit for an investment. There is one lender (denoted by L) with one unit of credit and can only lend to one borrower. both the lender and borrowers are risk-neutral (that is, they only care about the expected profits and expected returns respectively). Further, the borrowers and lender have a reservation return of zero (that is, they will undertake to borrow or lend as long as the expected return or profit is strictly greater than zero). Finally, each borrower will repay if she is able to and nothing is repaid if the investment fails (i.e. there is limited liability). (a) Suppose that there are two states of the world (g,b) each occurring with equal probability. In state g the return to S is 1.4 and R’s return is 1 + d for some d > 0. In state b, S’s return is 1.4 and R’s return is 0. Suppose that the bank can charges a separate interest…

- What do the authors mean when they state that financial intermediaries can achieve economies of scale with respect to transaction costs? A. Intermediaries can spread transaction costs across larger transaction volumes, so the cost per unit is lower. B. Intermediaries tend to specialize in certain types of transactions, so their costs are lower because they operate at lower volume than other types of financial firms.In what way might consumer protection regulationsnegatively affect a financial intermediary’s profits?Can you think of a positive effect of such regulationson profits?Explain why you would be more or less willing to buylong-term Delta Air Lines bonds under the followingcircumstances:a. The company just released its financial statements, indicating that income decreased and liabilities increased.b. You expect a bull market in stocks (stock prices areexpected to increase).c. You have analyzed your country’s monetary policyand expect interest rates to decrease.d. Brokerage commissions on bonds fall.e. Your income and wealth increased over the last two years