8 0.69384 0.77997 10 0.89265 Assume that buyers always bid according to the relevant symmetric equilibrium bidding strategy. Round all numeric answers to at least three decimal places. 00 Q2 Anglo-Dutch auction Consider an Anglo-Dutch auction in which one item is for sale. In the first-round of the auction, buyers bid in an ascending-bid auction. The two buyers with the highest bids proceed to the second round. In the second round, the two remaining buyers submit sealed bids (that cannot be lower than the price at which the bidding stopped in the first round) and the buyer with the highest bid wins the item and pays what he or she bid. Valuations are drawn from the uniform(0, 1) distribution. The following table depicts the valuations for each buyer in the auction. Buyer # 1 0.13134 0.18293 0.18709 4 0.20800 0.33763 6. 0.34580 7 0.35594

8 0.69384 0.77997 10 0.89265 Assume that buyers always bid according to the relevant symmetric equilibrium bidding strategy. Round all numeric answers to at least three decimal places. 00 Q2 Anglo-Dutch auction Consider an Anglo-Dutch auction in which one item is for sale. In the first-round of the auction, buyers bid in an ascending-bid auction. The two buyers with the highest bids proceed to the second round. In the second round, the two remaining buyers submit sealed bids (that cannot be lower than the price at which the bidding stopped in the first round) and the buyer with the highest bid wins the item and pays what he or she bid. Valuations are drawn from the uniform(0, 1) distribution. The following table depicts the valuations for each buyer in the auction. Buyer # 1 0.13134 0.18293 0.18709 4 0.20800 0.33763 6. 0.34580 7 0.35594

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter18: Auctions

Section: Chapter Questions

Problem 5MC

Related questions

Question

Q2.1

In the second round with two buyers remaining, the probability that a buyer with valuation v wins is vN-1, where N is the number of buyers in the first round. Use the revenue equivalence theorem to derive the symmetric equilibrium bidding function b(v) for the buyers in stage two. Show your work.

Q2.2

At the end of the auction what is the value of the actual (not expected) revenue that the seller receives? Round your answer to at least three decimal spaces.

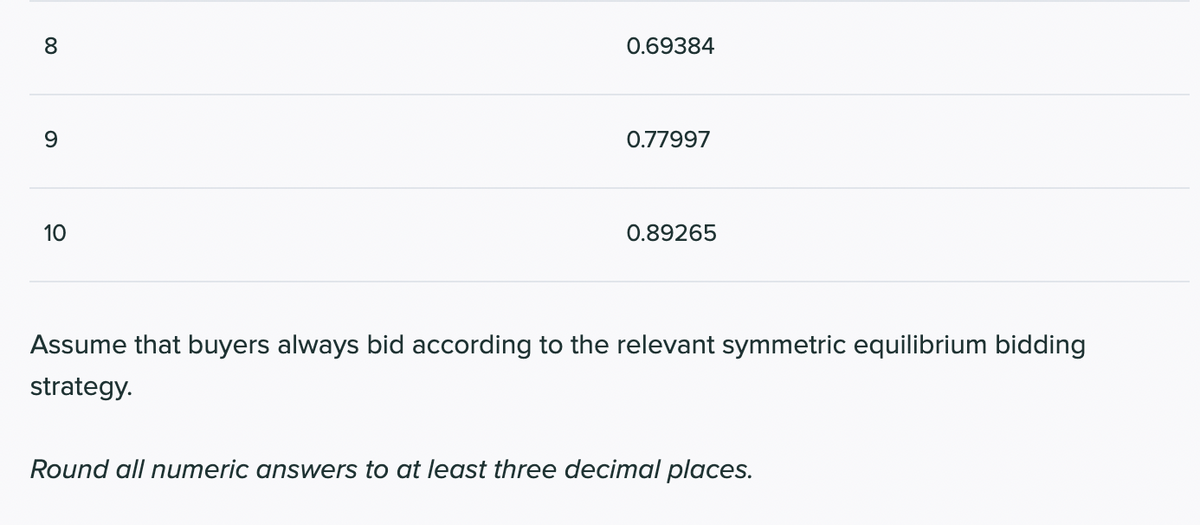

Transcribed Image Text:8

0.69384

0.77997

10

0.89265

Assume that buyers always bid according to the relevant symmetric equilibrium bidding

strategy.

Round all numeric answers to at least three decimal places.

00

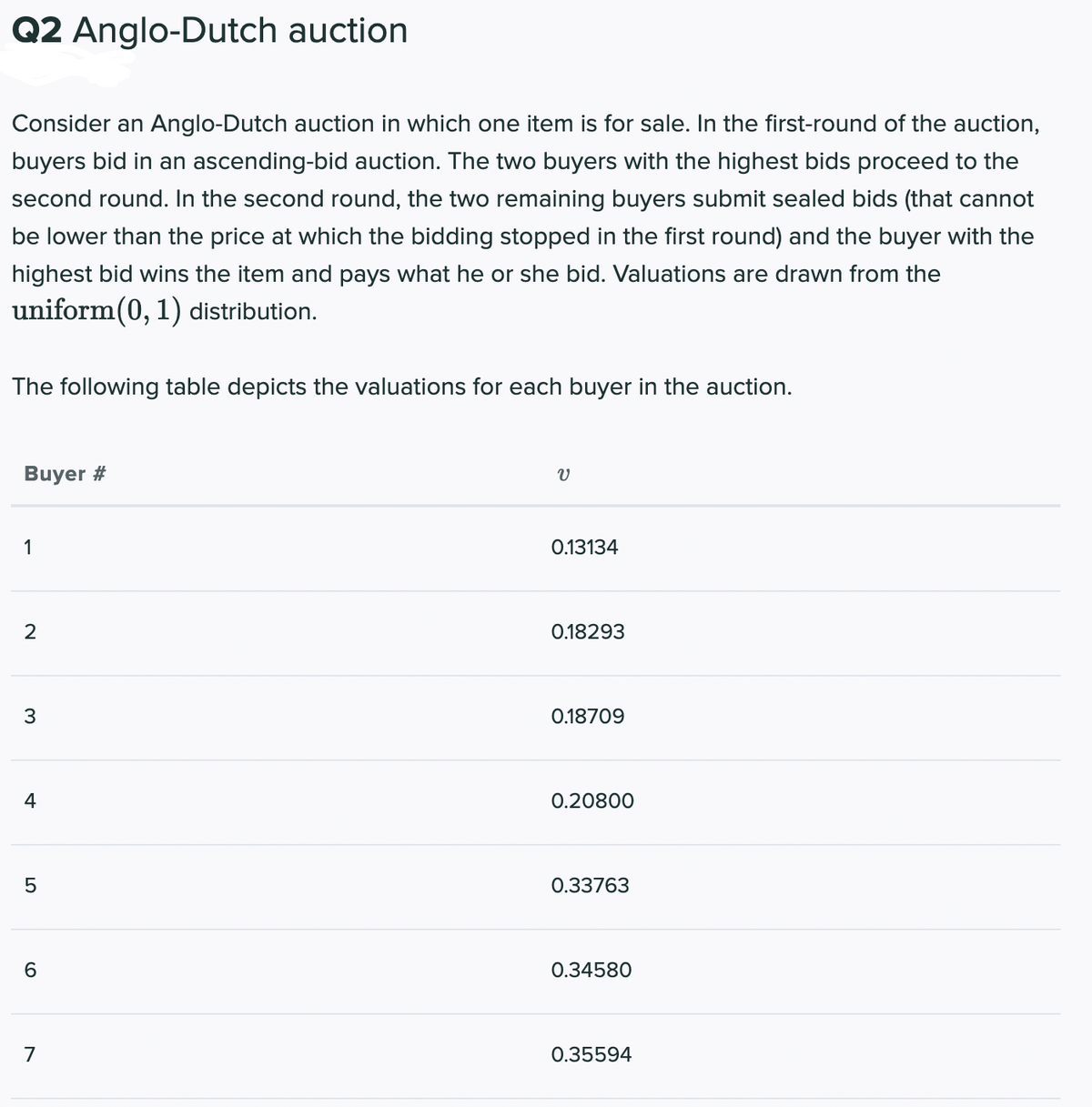

Transcribed Image Text:Q2 Anglo-Dutch auction

Consider an Anglo-Dutch auction in which one item is for sale. In the first-round of the auction,

buyers bid in an ascending-bid auction. The two buyers with the highest bids proceed to the

second round. In the second round, the two remaining buyers submit sealed bids (that cannot

be lower than the price at which the bidding stopped in the first round) and the buyer with the

highest bid wins the item and pays what he or she bid. Valuations are drawn from the

uniform(0, 1) distribution.

The following table depicts the valuations for each buyer in the auction.

Buyer #

1

0.13134

0.18293

0.18709

4

0.20800

0.33763

6.

0.34580

7

0.35594

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning