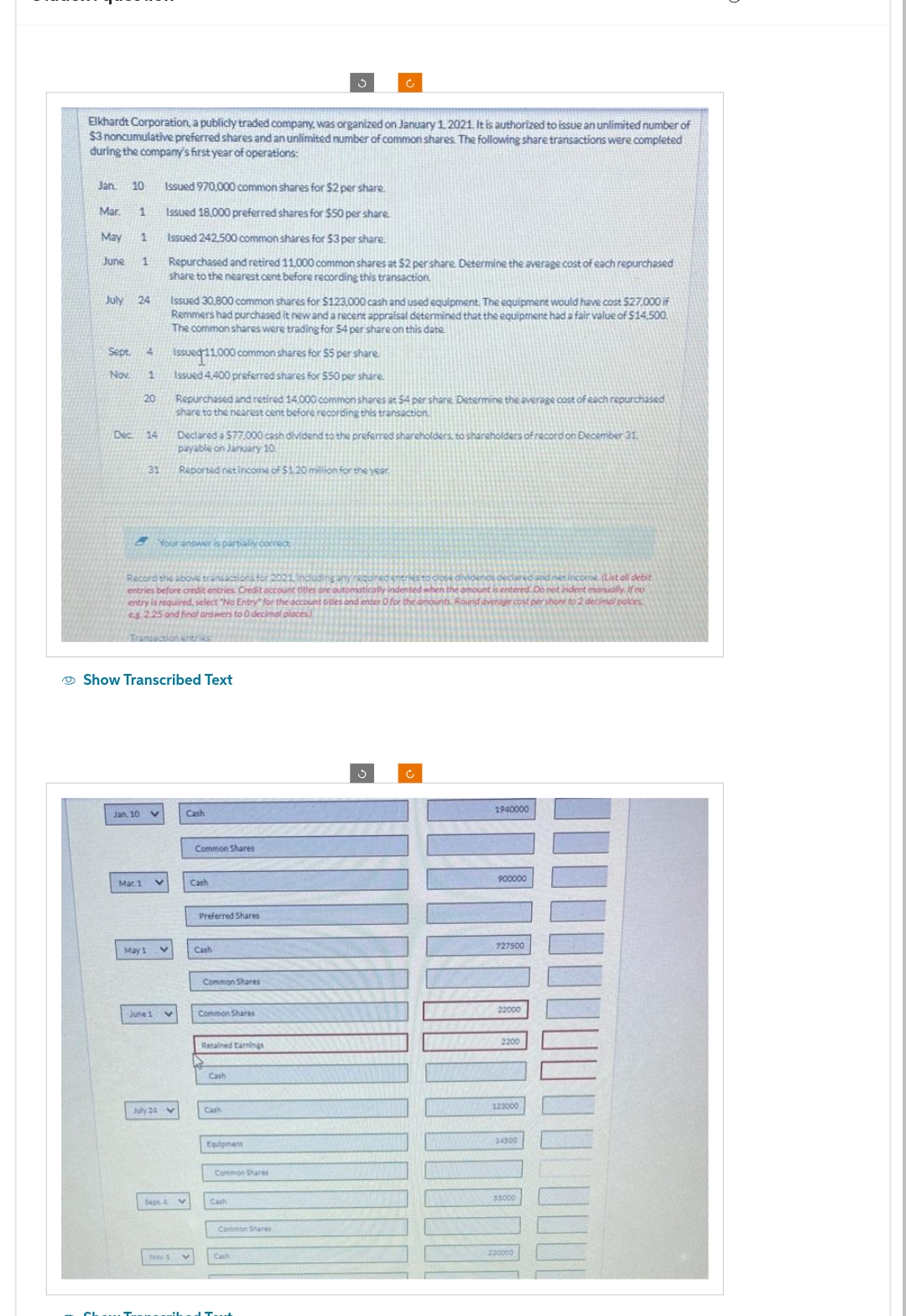

Elkhardt Corporation, a publicly traded company, was organized on January 1, 2021. It is authorized to issue an unlimited number of $3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed during the company's first year of operations: Jan. 10 Issued 970,000 common shares for $2 per share. Issued 18,000 preferred shares for $50 per share. Issued 242,500 common shares for $3 per share. Repurchased and retired 11,000 common shares at $2 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Mar. 1 May 1 June 1 July 24 Sept. 4 Nov. 1 Dec 20 Jan, 10 14 Mar. 1 31 May 1 Record the above transactions for 2021. Including any required entries to close dividends declared and net income (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter D for the amounts. Round average cost per shore to 2 decimal palces es. 2.25 and final answers to 0 decimal places) Show Transcribed Text Issued 30,800 common shares for $123,000 cash and used equipment. The equipment would have cost $27.000 if Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $14.500. The common shares were trading for $4 per share on this date Your answer is partially correct V July 24 Issued 11.000 common shares for $5 per share. Issued 4.400 preferred shares for $50 per share June 1 v Sept Repurchased and retired 14,000 common shares at $4 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Nov 1 Declared a $77,000 cash dividend to the preferred shareholders, to shareholders of record on December 31. payable on January 10 Reported net income of $1.20 million for the year, Cash Common Shares Cash v Preferred Shares Cash Common Shares Common Shares Retained Earnings Cash Cash Equipment Common Shares Cash Common Shares Cash 1940000 900000 727500 22000 2200 123000 14500 35000 220000

Elkhardt Corporation, a publicly traded company, was organized on January 1, 2021. It is authorized to issue an unlimited number of $3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed during the company's first year of operations: Jan. 10 Issued 970,000 common shares for $2 per share. Issued 18,000 preferred shares for $50 per share. Issued 242,500 common shares for $3 per share. Repurchased and retired 11,000 common shares at $2 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Mar. 1 May 1 June 1 July 24 Sept. 4 Nov. 1 Dec 20 Jan, 10 14 Mar. 1 31 May 1 Record the above transactions for 2021. Including any required entries to close dividends declared and net income (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter D for the amounts. Round average cost per shore to 2 decimal palces es. 2.25 and final answers to 0 decimal places) Show Transcribed Text Issued 30,800 common shares for $123,000 cash and used equipment. The equipment would have cost $27.000 if Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $14.500. The common shares were trading for $4 per share on this date Your answer is partially correct V July 24 Issued 11.000 common shares for $5 per share. Issued 4.400 preferred shares for $50 per share June 1 v Sept Repurchased and retired 14,000 common shares at $4 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Nov 1 Declared a $77,000 cash dividend to the preferred shareholders, to shareholders of record on December 31. payable on January 10 Reported net income of $1.20 million for the year, Cash Common Shares Cash v Preferred Shares Cash Common Shares Common Shares Retained Earnings Cash Cash Equipment Common Shares Cash Common Shares Cash 1940000 900000 727500 22000 2200 123000 14500 35000 220000

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 9PA: Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000...

Related questions

Question

N4.

Account

Transcribed Image Text:Elkhardt Corporation, a publicly traded company, was organized on January 1, 2021. It is authorized to issue an unlimited number of

$3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed

during the company's first year of operations:

Jan. 10 Issued 970,000 common shares for $2 per share.

Mar. 1

Issued 18,000 preferred shares for $50 per share

May 1

Issued 242,500 common shares for $3 per share.

June 1

Repurchased and retired 11,000 common shares at $2 per share. Determine the average cost of each repurchased

share to the nearest cent before recording this transaction.

July 24

Sept. 4

Nov. 1

Dec

20

14

Jan, 10

Mar. 1

31

May 1

Record the above transactions for 2021 Including any required er

and net income (List all debit

entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no

entry is required, select "No Entry for the account titles and enter 0 for the amounts. Round average cost per share to 2 decimal palces

es.2.25 and final answers to 0 decimal places)

ansaction entries

June 1

Show Transcribed Text

July 24

Issued 30,800 common shares for $123,000 cash and used equipment. The equipment would have cost $27.000 if

Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $14,500.

The common shares were trading for $4 per share on this date

Issued 11,000 common shares for $5 per share

Issued 4.400 preferred shares for $50 per share.

Your answer is partially correct

Sept. 4

Repurchased and retired 14.000 common shares at $4 per share. Determine the average cost of each repurchased

share to the nearest cent before recording this transaction.

Nox 1

Declared a $77,000 cash dividend to the preferred shareholders, to shareholders of record on December 31.

payable on January 10

Reported net income of $1.20 million for the year,

Cash

v

Common Shares

Cash

Preferred Shares

Cash

Common Shares

Common Shares

Retained Earnings

Cash

Ĉ

Cash

Equipment

Common Shares

Cash

Common Shares

Cash

Ĉ

1940000

900000

727500

22000

2200

123000

14500

35000

220000

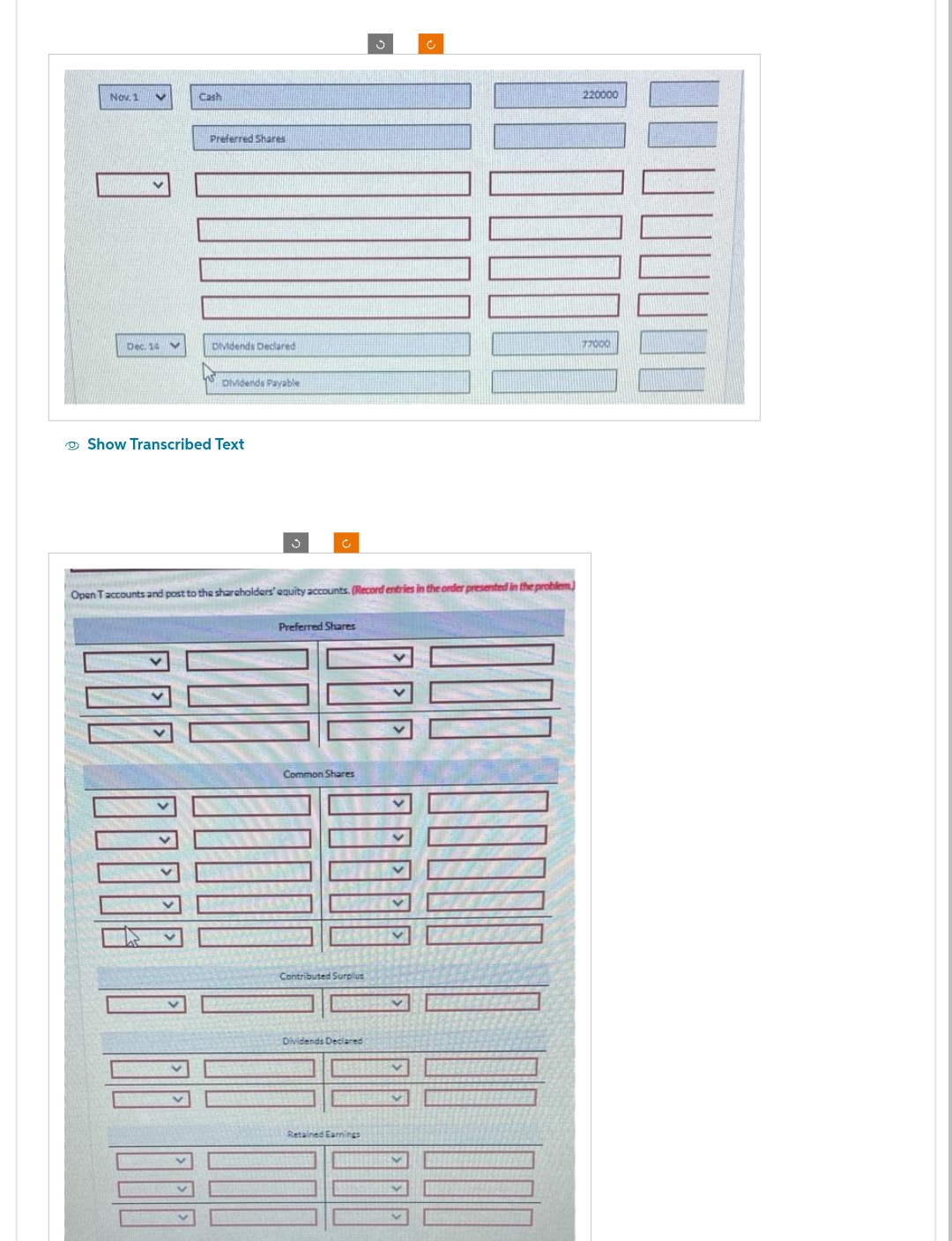

Transcribed Image Text:Nov. 1 V

Dec. 14 V

Cash

Preferred Shares

00000

Dividends Declared

Dividends Payable

Show Transcribed Text

Ĉ

Open Taccounts and post to the shareholders' equity accounts. (Record entries in the order presented in the problem)

Preferred Shares

Common Shares

Contributed Surplus

Dividends Declared

Retained Earnings

V

Ć

v

220000

77000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning