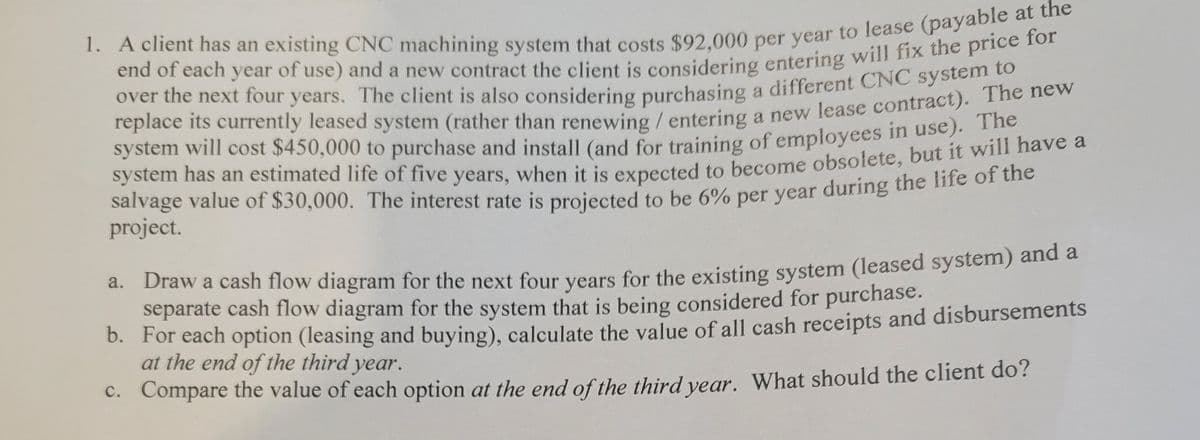

end of each year of use) and a new contract the client is considering entering will fix the pree over the next four years. The client is also considering purchasing a different CNC systenhe replace its currently leased system (rather than renewing /entering a new lease contract). 1he new system will cost $450,000 to purchase and install (and for training of employees in use). salvage value of $30,000. The interest rate is projected to be 6% per year during the life of the project. a. Draw a cash flow diagram for the next four vears for the existing system (leased system) and a separate cash flow diagram for the system that is being considered for purchase. b. For each option (leasing and buying), calculate the value of all cash receipts and disbursements at the end of the third year. C. Compare the value of each option at the end of the third year. What should the client do?

end of each year of use) and a new contract the client is considering entering will fix the pree over the next four years. The client is also considering purchasing a different CNC systenhe replace its currently leased system (rather than renewing /entering a new lease contract). 1he new system will cost $450,000 to purchase and install (and for training of employees in use). salvage value of $30,000. The interest rate is projected to be 6% per year during the life of the project. a. Draw a cash flow diagram for the next four vears for the existing system (leased system) and a separate cash flow diagram for the system that is being considered for purchase. b. For each option (leasing and buying), calculate the value of all cash receipts and disbursements at the end of the third year. C. Compare the value of each option at the end of the third year. What should the client do?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

Transcribed Image Text:over the next four years. The client is also considering purchasing a different CNC systeme

Teplace its currently leased system (rather than renewing /entering a new lease contract). The new

system will cost $450,000 to purchase and install (and for training of employees in use).

salvage value of $30,000. The interest rate is projected to be 6% per year during the life o1 the

project.

a. Draw a cash flow diagram for the next four vears for the existing system (leased system) and a

separate cash flow diagram for the system that is being considered for purchase.

b. For each option (leasing and buying), calculate the value of all cash receipts and disbursements

at the end of the third year.

C. Compare the value of each option at the end of the third vear. What should the client do?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College