endar * Chapter 12 Homework * CengageNoWv2 | Onlin X now.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator E Print Item Entries for Stock Dividends Healthy Life Co. is an HMO for businesses in the Fresno area. The following account balances appear on Healthy Life's balance sheet: Common stock (340,000 shares authorized ; 4,000 shares issued), $50 par, $200,000; Pald-In Capital in excess of par- common stock, $20,000; and Retained earnings, $1,600,000. The board of directors declared a 1% stock dividend when the market price of the stock was $66 a share. Healthy Life reported no income or loss for the current year. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown. al. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to market value. a2. Journalize the entry to record the Issuance of the stock certificates. (2) total retained earnings, and (3) total ndar *Chapter 12 Homework e CengageNOw2|Onlin X mow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator &inprogressafalse a2. Journalize the entry to record the issuance of the stock certificates. b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders equity. Total paid-in capital Total retained earnings %24 Total stockholders' equity C. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital Total retained earnings Total stockholders' equity

endar * Chapter 12 Homework * CengageNoWv2 | Onlin X now.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator E Print Item Entries for Stock Dividends Healthy Life Co. is an HMO for businesses in the Fresno area. The following account balances appear on Healthy Life's balance sheet: Common stock (340,000 shares authorized ; 4,000 shares issued), $50 par, $200,000; Pald-In Capital in excess of par- common stock, $20,000; and Retained earnings, $1,600,000. The board of directors declared a 1% stock dividend when the market price of the stock was $66 a share. Healthy Life reported no income or loss for the current year. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown. al. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to market value. a2. Journalize the entry to record the Issuance of the stock certificates. (2) total retained earnings, and (3) total ndar *Chapter 12 Homework e CengageNOw2|Onlin X mow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator &inprogressafalse a2. Journalize the entry to record the issuance of the stock certificates. b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders equity. Total paid-in capital Total retained earnings %24 Total stockholders' equity C. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital Total retained earnings Total stockholders' equity

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1TCL: CONDUCTING A FINANCIAL RATIO ANALYSIS ON HP INC. Use online resources to work on this chapters...

Related questions

Question

100%

Sorry I couldn't get all the problems in one picture

Transcribed Image Text:endar

* Chapter 12 Homework

* CengageNoWv2 | Onlin X

now.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false

eBook

Show Me How

Calculator

E Print Item

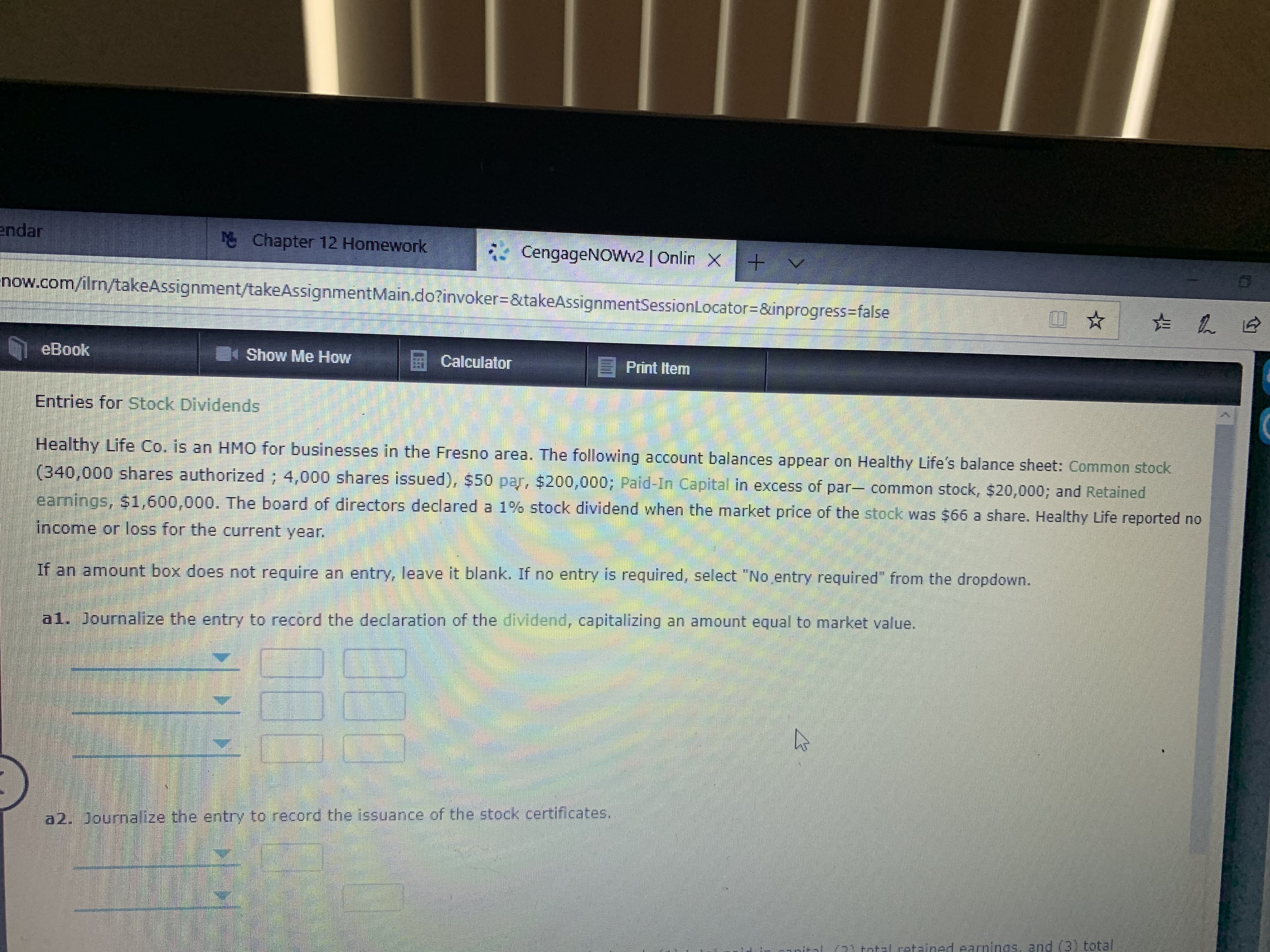

Entries for Stock Dividends

Healthy Life Co. is an HMO for businesses in the Fresno area. The following account balances appear on Healthy Life's balance sheet: Common stock

(340,000 shares authorized ; 4,000 shares issued), $50 par, $200,000; Pald-In Capital in excess of par- common stock, $20,000; and Retained

earnings, $1,600,000. The board of directors declared a 1% stock dividend when the market price of the stock was $66 a share. Healthy Life reported no

income or loss for the current year.

If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown.

al. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to market value.

a2. Journalize the entry to record the Issuance of the stock certificates.

(2) total retained earnings, and (3) total

Transcribed Image Text:ndar

*Chapter 12 Homework

e CengageNOw2|Onlin X

mow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator &inprogressafalse

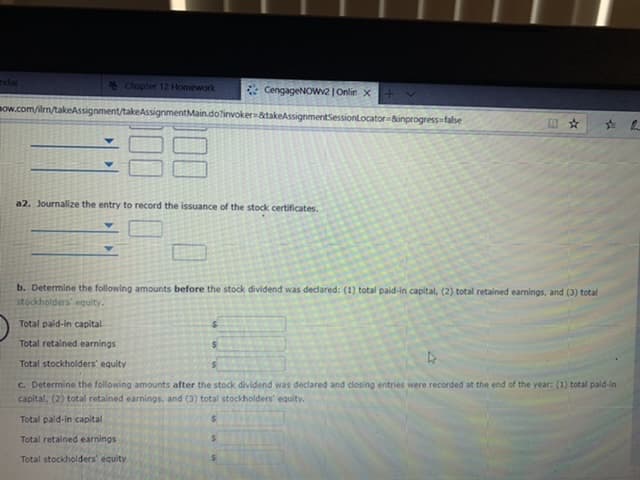

a2. Journalize the entry to record the issuance of the stock certificates.

b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total

stockholders equity.

Total paid-in capital

Total retained earnings

%24

Total stockholders' equity

C. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid-in

capital, (2) total retained earnings, and (3) total stockholders' equity.

Total paid-in capital

Total retained earnings

Total stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,