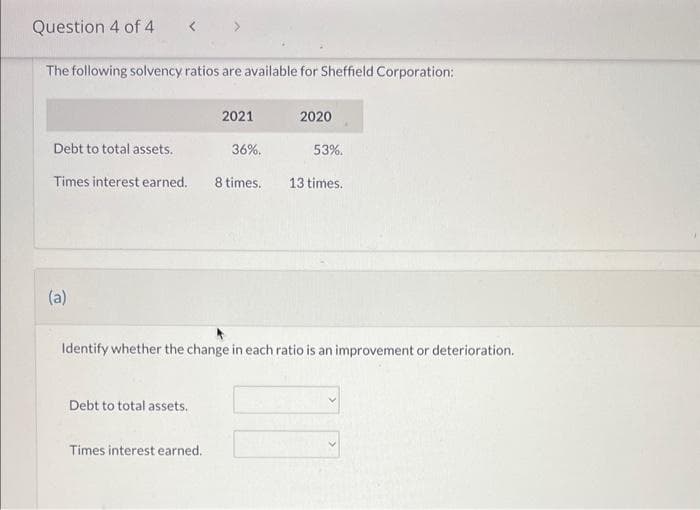

Identify whether the change in each ratio is an improvement or deterioration. Debt to total assets. Times interest earned.

Q: a. Determine the standard rate per direct labor-hour. (Round your answer to 2 decimal places. Omit…

A: Formulas used to calculate - Standard rate per direct labor-hour = Basic direct labor wage rate +…

Q: At the beginning of the period, the Cutting Department budgeted direct labor of $66,360 and…

A: The budget is an estimate of the income that will be earned and expenditures that will be incurred…

Q: Leo Corporation uses the perpetual inventory system and began business on April 1. During the month…

A: There are several possible reasons why the physical count of inventory would be lower than the…

Q: Required information [The following information applies to the questions displayed below.) Ramort…

A: Cost volume profit analysis is the technique used by management for decision-making. The methods…

Q: coupons were presented for redemption in 2020. It is estimated that 60% ption.

A: Answer : Journal entries : Date Account title Dr. Cr. 2020 Inventory of premiums $7,050…

Q: Required: Prepare journals, ledger and whorksheet MAY 2 UP opened a service shop, she deposited P…

A: An entry in a journal or diary is a written account of a particular experience, observation, or…

Q: Compute MACRS depreciation for the following qualified assets for the calendar years 2022 and 2023:…

A: Depreciation is used to allocate capital expenditure on assets over the period of useful life of…

Q: Jeremiah and Jonnie Chalk are married and have three dependent children, ages 3, 6, and 9. Assume…

A: Dependent & Child Care Credit Requires care for a dependent child (under 13 years) or disabled…

Q: At the end of its first year of trading a company has total trade receivables (debtors) of £20,000.…

A: A provision for doubtful debts is an accounting entry made by a company to account for the…

Q: A department adds raw materials to a process at the beginning of the process and incurs conversion…

A: Material is the cost incurred on the making of the goods. It is the cost of production.

Q: The Lux Company experiences the following unrelated events and transactions during Year 1. The…

A: Lets understand the basics. Ratio analysis is used to evaluate management performance in…

Q: During the taking of its physical inventory on December 31, 2014, Barry's Bike Shop incorrectly…

A: Given, Bike shop incorrectly counted it's inventory as $216,669 instead of correct amount of…

Q: Indigo Corporation made credit sales of $19,800 which are subject to 7% sales tax. The corporation…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Units of production data for the two departments of Mediterranean Cable and Wire Company for…

A: Calculation of Direct material and conversion equivalent units of production for November for…

Q: Cash Supplies Prepaid insurance Equipment Total assets Accounts payable Unearned consulting revenue…

A: Retained earning: It is the remaining amount of profit that a company has after paying all its…

Q: On March 1, 2022, Lindor Corp. (a private company) factored receivables with a carrying amount of…

A: Loss on disposal refers to an amount that shows the difference between the cost and sale price of…

Q: Ms. Fresh bought 1,000 shares of Ibis Corporation stock for $5,000 on January 15, 2013. On December…

A: A recognized loss is a loss that has been acknowledged and recorded in an entity's financial…

Q: How should a company measure DEI progress? What are the most important metrics and why?

A: DEI stands for Diversity, Equity, and Inclusion. It refers to the values, practices, and policies…

Q: Each project requires an investment of $900,000. A rate of 15% has been selected for the net present…

A: Payback period and net present values are capital budgeting tools. They are used to determine the…

Q: The US GAAP provides rules and guidance for what two primary financial reporting purposes?

A: The US GAAP which has given and contributed in the field of the accounting a very massive work which…

Q: The following is Addison Corporation's contribution format income statement for last month: Sales…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end…

A: Journal Entries: On April 1, 2024: Equipment $45,360 To Cash $45,360 To record the…

Q: Junior plc is a company that, during the year ended 31 December 2020, paid $25,000 debenture…

A: As per the given information: Debenture interest - $25,000Ordinary dividend- 8% per share on 1…

Q: Explain all why will increase, decrease or stay the same

A: Lets understand the basics. As per balance sheet or accounting equation, total assets are always…

Q: The Lux Company experiences the following unrelated events and transactions during Year 1. The…

A: Investors and creditors may use the current ratio to assess a company's financial health and ability…

Q: Stark and Company is a manufacturer that sells robots predominantly in the Asian market. Times have…

A: In today's business world, it is essential to have an effective cost allocation process to evaluate…

Q: Exercise 15-17 (Algo) Lessee and lessor; operating lease [LO15-4] On January 1, 2021, Nath-Langstrom…

A: As per the given information: Rent payments - $14,500 each payable semiannually on June 30 and…

Q: A company that manufactures cushions wants to have the following sales budget for the following…

A: Solution: Correct answer : (a) $7230 The projected sales for February: 8700 cushions x 0.85 = 7395…

Q: Prepare the operating activities section of the statement of cash flows using the indirect method.…

A: Introduction:- Cash flows from operating activities:- Cash flow from operating activities is the…

Q: Support Department Cost Allocation-Reciprocal Services Met Blue Africa Inc. produces laptops and…

A: Lets understand the basics. Service department costs needs to allocate to production department in…

Q: Problem 1.6: The records of your audit client, Anna Corp., which maintains records under cash-basis,…

A:

Q: direct labor-hour, respectively. The company's direct labor wage rate is $18.00 per hour. The…

A: Answer : Calculation of the total manufacturing cost of Job N - 60 : Particular Assembly Testing…

Q: Financial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: National Supply’s shareholders’ equity included the following accounts at December 31, 2020:…

A: Average paid-in capital-excess of par = Paid-in capital in excess of par/Number of shares =…

Q: It is an important use of managerial accounting a. determine direct cost by adding direct…

A: Managerial accounting, also known as management accounting, is a branch of accounting that involves…

Q: Sunn Company manufactures a single product that sells for $180 per unit and whose variable costs are…

A: Introduction: Contribution margin income statement is prepared by first calculating contribution…

Q: Buford Botanicals has the following information: Number of units sold = 27,000 Selling price per…

A: Gross Margin = Sales Revenue - Cost of Goods Sold (COGS) COGS = Beginning Inventory + Purchases -…

Q: On October 15, 2020, the board of directors of Ensor Materials Corporation approved a stock option…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Perpetual inventory using weighted average Beginning inventory, purchases, and sales for WCS12 are…

A: Under weighted average model, cost of the goods that are available for sale divided by the number of…

Q: share price is $22, it has 10 million shares outstanding, and its tax rate is 30%, does Marine Tech…

A: Free cash flow is calculated to measure the financial performance of a company. It is calculated by…

Q: reate your own company (any company) describing the nature of the company and what it provides…

A: Journal Entry The purpose of providing the journal entry to enter the required transaction into…

Q: How does the statement of cash flows explain the reasons for the change in cash between balance…

A: 12.) As we all know, Balance sheet is a financial statement which shows the Assets and Liabilities…

Q: Yumi's grandparents presented her with a gift of $21,000 when she was 8 years old to be used for her…

A: Time value of money is a financial concept which is used to calculate the value of money in present…

Q: Required information [The following information applies to the questions displayed below] Portions…

A:

Q: Laura Strand’s regular hourly wage rate is $20, and she receives an hourly rate of $30 for work in…

A: Payroll Taxes: Payroll taxes refer to those taxes paid by both employer and employee in order to…

Q: During 2022, Bridgeport Corp. produced 35,910 units and sold 35,910 for $14.00 per unit. Variable…

A: calculation of manufacturing cost per unit with necessary calculation and preparation of income…

Q: Last year T, Inc., had the following expenditures related to developing its trademark: General…

A: Capitalization of expense means to treat the expense as if it is of capital nature and a long term…

Q: June July August September October expects the Units 6,060 6,560 7,260 7,860 8,860 Tigle pro…

A: The production and direct materials budget is prepared after the sale budget. The production budget…

Q: The inside basis is defined as a partner's basis in the partnership interest. True False

A: Answer:- Partnership:- A partnership is a type of firm where two or more people share ownership,…

Q: Saddlery Company sells leather saddles and equipment for horse enthusiasts Saddlery uses the…

A: Under FIFO method the oldest products in inventory have been sold first. Under weighted average…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- A Preparation of Ratios Refer to the financial statements for Burch Industries in Problem 12-89A and the following data. Required: 1. Prepare all the financial ratios for Burch for 2019 and 2018 (using percentage terms where appropriate and rounding all answers to two decimal places). 2. CONCEPTUAL CONNECTION Explain whether Burchs short-term liquidity is adequate. 3. CONCEPTUAL CONNECTION Discuss whether Burch uses its assets efficiently. 4. CONCEPTUAL CONNECTION Determine whether Burch is profitable. 5. CONCEPTUAL CONNECTION Discuss whether long-term creditors should regard Burch as a high-risk or a low-risk firm. 6. Perform a Dupont analysis (rounding to two decimal places) for 2018 and 2019.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callableRATIO ANALYSIS The Corrigan Corporations 2015 and 2016 financial statements follow, along with some industry average ratios. a. Assess Corrigans liquidity position, and determine how it compares with peers and how the liquidity position has changed over time. b. Assess Corrigans asset management position, and determine how it compares with peers and how its asset management efficiency has changed over time. c. Assess Corrigans debt management position, and determine how it compares with peers and how its debt management has changed over time. d. Assess Corrigans profitability ratios, and determine how they compare with peers and how its profitability position has changed over time. e. Assess Corrigans market value ratios, and determine how its valuation compares with peers and how it has changed over time. f. Calculate Corrigans ROE as well as the industry average KOE, using the DuPont equation. From this analysis, how does Corrigans financial position compare with the industry average numbers? g. What do you think would happen to its ratios if the company initiated cost-cutting measures that allowed it to hold lower levels of inventory and substantially decreased the cost of goods sold? No calculations are necessary. Think about which ratios would be affected by changes in these two accounts. Corrigan Corporation: Balance Sheets as of December 31 2016 2015 Cash 72,000 65,000 Accounts receivable 439,000 328,000 Inventories 894,000 813,000 Total current assets 1,405,000 1,206,000 Land and building 238,000 271,000 Machinery 132,000 133,000 Other fixed assets 61,000 57,000 Total assets 1,836,000 1,667,000 Accounts payable 80,000 72,708 Accrued liabilities 45,010 40,880 Notes payable 476,990 457,912 Total current liabilities 602,000 571,500 Long-term debt 404,290 258,898 Common stock 575,000 575,000 Retained earnings 254,710 261,602 Total liabilities and equity 1,836,000 1,667,000 Corrigan Corporation: Income Statements for Years Ending December 31 2016 2015 Sales 4,240,000 3,635,000 Cost of goods sold 3,680,000 2,980,000 Cross operating profit 560,000 655,000 General administrative and selling expenses 303,320 297,550 Depreciation 159,000 154,500 EBIT 97,680 202,950 Interest 67,000 43,000 Earnings before taxes (EBT) 30,680 159,950 Taxes (40%) 12,272 63,980 Net income 18,408 95,970 Per-Share Data 2016 2015 EPS 0.80 4.17 Cash dividends 1.10 0.95 Market price (average) 12.34 23.57 P/E ratio 15.42 5.65 Number of shares outstanding 23,000 23,000 Industry Financial Ratiosa 2016 Current ratio 2.7 Inventory turnoverb 7.0 Days sales outstandingc 32.0 days Fixed assets turnoverb 13.0 Total assets turnoverb 2.6 Return on assets 9.1% Return on equity 18.2% Return on invested capital 14.5% Profit margin 3.5% Debt-to-capital ratio 50.0% P/E ratio 6.0 aIndustry average ratios have been constant for the past 4 years. bbased on year-end balance sheet figures. cCalculation is based on a 365-day year.