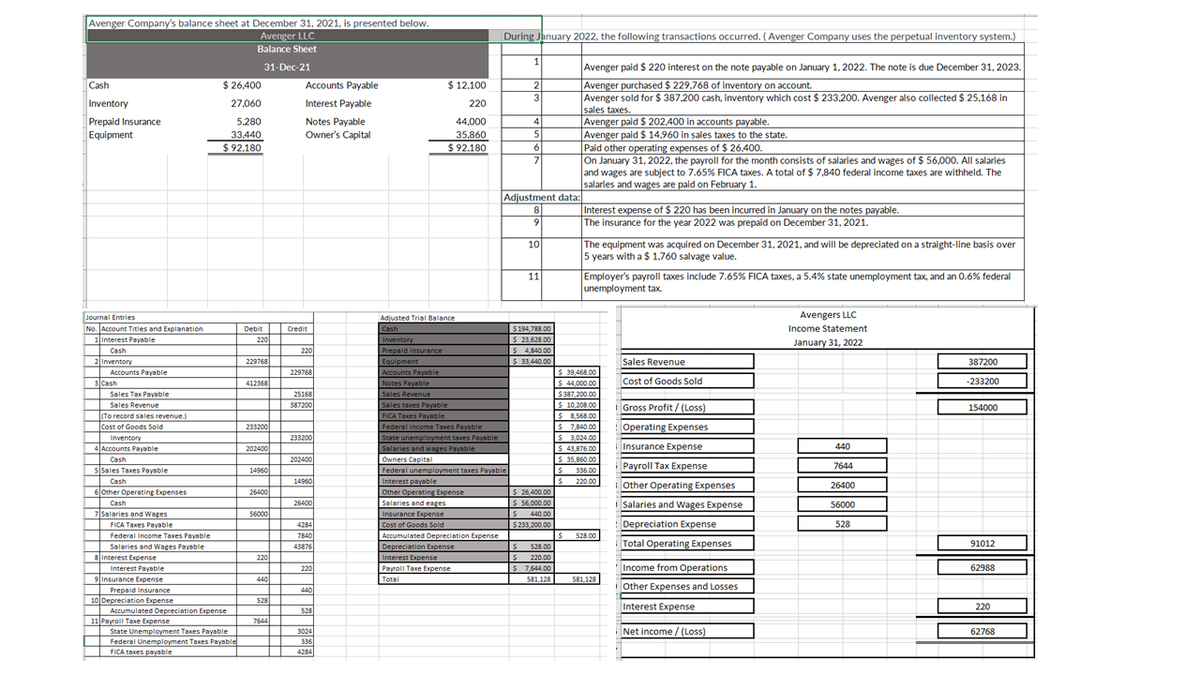

entory Avenger Company's balance sheet at December 31, 2021. is presented below. Avenger LLC During Jhnuary 2022. the following transactions occurred. (Avenger Company uses the perpetual inventory system.) Balance Sheet Avenger paid $ 220 interest on the note payable on January 1, 2022. The note is due December 31, 2023. Avenger purchased $ 229.768 of inventory on account. Avenger sold for $ 387.200 cash, inventory which cost $ 233.200. Avenger also collected $ 25.168 in Isales taxes Avenger paid $ 202400 in accounts payable. |Avenger paid $ 14,960 in sales taxes to the state. Paid other operating expenses of $ 26,400. On January 31, 2022, the payroll for the month consists of salaries and wages of $ 56.000. All salaries and wages are subject to 7.65% FICA taxes. A total of $ 7,840 federal income taxes are withheld. The salaries and wages are paid on February 1. 31-Dec-21 $ 26,400 Accounts Payable $ 12.100 2 3 Cash Inventory 27,060 Interest Payable 220 Prepaid Insurance Equipment 5,280 33,440 $92.180 Notes Payable Owner's Capital 44,000 4 35,860 $92.180 61 Adjustment data: 8. 9. |Interest expense of $ 220 has been incurred in January on the notes payable. The insurance for the year 2022 was prepaid on December 31, 2021. 10 The equipment was acquired on December 31. 2021. and will be depreciated on a straight-line basis over 5 years with a $ 1,760 salvage value. Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6% federal unemployment tax. 11 Journal Entries No. Account Titles and Explanation 1interest Payable Avengers LLC Income Statement Adjusted Trial Balance |Debit Cash $194,788.00 S 23.628.00 5 440 00 S 33,440 00 Credit Inventory Prepaid insurance Equipment Accounts Payable 220 January 31, 2022 Cash 220 inventory Accounts Payable alCash 22976 8 I 229768 Sales Revenue 387200 $ 39.44 00 s 44.000 00 S7.200 00 S 10.208 00 IS R568.00 4123 4 Notes Payable Cost of Goods Sold -233200 Sales Tax Payable Sales Revenue Ito record sales revenue Cost of Goods Seld Inventory 4Accounts Payable 2516 387200 Sales Revenue Sales taes Payable FICA Taxes Payable Federal incone Tases Payable State unemployment taes Payable Salaries and wages Payable Owners Capital Federal unemgloyment tases Payable Interest payable Other Operating Expense Salaries andeages Insurance Expense Cost of Goods Sold Accumulated Depreciation Expense Depreciation Expense Interest Expense Payoll Tae spense Total Gross Profit / (Loss) 154000 233200 Operating Expenses $7.84000 S 302400 $ 41,876 00 $35,860 00 336 00 S 220 00 233200 202400 Insurance Expense 440 Cash Sales Taxes Payable 202400 Раyroll Tax Expеnse 7644 140 Cash sOther Operating Expenses 14940 Other Operating Expenses 26400 26400 $ 26.400 00 S 56.000 00 440 00 $233 200 00 Salaries and Wages Expense Cash 26400 56000 56000 Salaries and Wages FICA Taves Pavable Depreciation Expense Total Operating Expenses 4284 528 7840 $$28.00 Federal income Tases Payable Salaries and Wages Pavable interest txpense Interest Payable linsurance Expense 91012 S28.00 Is 220 00 IS 7,644 00 43876 220 220 Income from Operations 62988 440 581128 581.128 Other Expenses and Losses Prepaid Insurance 10 Depreciation Expense Accumulated Depreciation Expense 1Payroll Tae Expense State Unemployment Taes Payable Ofederal Unemployment Tases Payable FICA es payable 440 520 Interest Expense 220 S28 7644 3024 Net income / (Loss) 62768 4284

entory Avenger Company's balance sheet at December 31, 2021. is presented below. Avenger LLC During Jhnuary 2022. the following transactions occurred. (Avenger Company uses the perpetual inventory system.) Balance Sheet Avenger paid $ 220 interest on the note payable on January 1, 2022. The note is due December 31, 2023. Avenger purchased $ 229.768 of inventory on account. Avenger sold for $ 387.200 cash, inventory which cost $ 233.200. Avenger also collected $ 25.168 in Isales taxes Avenger paid $ 202400 in accounts payable. |Avenger paid $ 14,960 in sales taxes to the state. Paid other operating expenses of $ 26,400. On January 31, 2022, the payroll for the month consists of salaries and wages of $ 56.000. All salaries and wages are subject to 7.65% FICA taxes. A total of $ 7,840 federal income taxes are withheld. The salaries and wages are paid on February 1. 31-Dec-21 $ 26,400 Accounts Payable $ 12.100 2 3 Cash Inventory 27,060 Interest Payable 220 Prepaid Insurance Equipment 5,280 33,440 $92.180 Notes Payable Owner's Capital 44,000 4 35,860 $92.180 61 Adjustment data: 8. 9. |Interest expense of $ 220 has been incurred in January on the notes payable. The insurance for the year 2022 was prepaid on December 31, 2021. 10 The equipment was acquired on December 31. 2021. and will be depreciated on a straight-line basis over 5 years with a $ 1,760 salvage value. Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6% federal unemployment tax. 11 Journal Entries No. Account Titles and Explanation 1interest Payable Avengers LLC Income Statement Adjusted Trial Balance |Debit Cash $194,788.00 S 23.628.00 5 440 00 S 33,440 00 Credit Inventory Prepaid insurance Equipment Accounts Payable 220 January 31, 2022 Cash 220 inventory Accounts Payable alCash 22976 8 I 229768 Sales Revenue 387200 $ 39.44 00 s 44.000 00 S7.200 00 S 10.208 00 IS R568.00 4123 4 Notes Payable Cost of Goods Sold -233200 Sales Tax Payable Sales Revenue Ito record sales revenue Cost of Goods Seld Inventory 4Accounts Payable 2516 387200 Sales Revenue Sales taes Payable FICA Taxes Payable Federal incone Tases Payable State unemployment taes Payable Salaries and wages Payable Owners Capital Federal unemgloyment tases Payable Interest payable Other Operating Expense Salaries andeages Insurance Expense Cost of Goods Sold Accumulated Depreciation Expense Depreciation Expense Interest Expense Payoll Tae spense Total Gross Profit / (Loss) 154000 233200 Operating Expenses $7.84000 S 302400 $ 41,876 00 $35,860 00 336 00 S 220 00 233200 202400 Insurance Expense 440 Cash Sales Taxes Payable 202400 Раyroll Tax Expеnse 7644 140 Cash sOther Operating Expenses 14940 Other Operating Expenses 26400 26400 $ 26.400 00 S 56.000 00 440 00 $233 200 00 Salaries and Wages Expense Cash 26400 56000 56000 Salaries and Wages FICA Taves Pavable Depreciation Expense Total Operating Expenses 4284 528 7840 $$28.00 Federal income Tases Payable Salaries and Wages Pavable interest txpense Interest Payable linsurance Expense 91012 S28.00 Is 220 00 IS 7,644 00 43876 220 220 Income from Operations 62988 440 581128 581.128 Other Expenses and Losses Prepaid Insurance 10 Depreciation Expense Accumulated Depreciation Expense 1Payroll Tae Expense State Unemployment Taes Payable Ofederal Unemployment Tases Payable FICA es payable 440 520 Interest Expense 220 S28 7644 3024 Net income / (Loss) 62768 4284

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PA: On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as...

Related questions

Topic Video

Question

Every example in my book shows Prepaid and Inventory as Current Assets. Does the order matter? In the Liabilites and Owner's Equity section the one liabilityis throwing off my Total Current Liabilities and the Total Liabilities number. I am completely at a loss for the Owner's Equity - where to even get that from. Can you help?

Transcribed Image Text:Avenger Company's balance sheet at December 31, 2021, is presented below.

Avenger LLC

During Jhnuary 2022, the following transactions occurred. (Avenger Company uses the perpetual inventory system.)

Balance Sheet

1

31-Dec-21

Avenger paid $ 220 interest on the note payable on January 1, 2022. The note is due December 31, 2023.

$ 26,400

$ 12,100

Avenger purchased $ 229,768 of inventory on account.

Avenger sold for $ 387,200 cash, inventory which cost $ 233,200. Avenger also collected $ 25,168 in

sales taxes.

Avenger paid $ 202.400 in accounts payable.

Avenger paid $ 14.960 in sales taxes to the state.

Paid other operating expenses of $ 26.400.

On January 31, 2022, the payroll for the month consists of salaries and wages of $ 56,000. All salaries

and wages are subject to 7.65% FICA taxes. A total of $ 7,840 federal income taxes are withheld. The

salaries and wages are paid on February 1.

Cash

Accounts Payable

2

3

Inventory

Prepaid Insurance

Equipment

27,060

Interest Payable

220

Notes Payable

Owner's Capital

5,280

44,000

4

33,440

$ 92,180

35.860

$92,180

6

7

Adjustment data:

Interest expense of $ 220 has been incurred in January on the notes payable.

The insurance for the year 2022 was prepaid on December 31, 2021.

10

The equipment was acquired on December 31, 2021, and will be depreciated on a straight-line basis over

5 years with a $ 1,760 salvage value.

Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6% federal

unemployment tax

11

Avengers LLC

Journal Entries

No. Account Titles and Explanation

1 Interest Payable

Adjusted Trial Balance

Debit Credit

220

$194,788.00

$ 23,628.00

Cash

Income Statement

Inventory

January 31, 2022

220

Prepaid insurance

Equipment

S 4.840.00

$ 33,440.00

Cash

2 Inventory

229768

Sales Revenue

387200

229768

S 39,468.00

5 44,000.00

$ 387,200.00

S 10,208.00

$ 8,568.00

$ 7,840.00

$ 3.024.00

Accounts Payable

Accounts Payable

Cost of Goods Sold

-233200

3 Cash

Sales Tax Payable

412368

Notes Payable

25168

Sales Revenue

Sales taxes Payable

FICA Taxes Payable

Federal income Taxes Payable

State unemployment taxes Payable

Sales Revenue

387200

Gross Profit / (Loss)

154000

(To record sales revenue.)

Cost of Goods Sold

Inventory

4 Accounts Payable

Cash

slsales Taxes Payable

Cash

6lother Operating Expenses

233200

Operating Expenses

233200

Insurance Expense

440

$ 43,876.00

S 35,860.00

$ 336.00

202400

Salaries and wages Payable

Owners Capital

Federal unemployment taxes Payable

202400

Payroll Tax Expense

7644

14960

14960

Interest payable

220.00

other Operating Expenses

26400

26400

Other Operating Expense

S 26,400.00

Cash

7Salaries and Wages

FICA Taxes Payable

Federal Income Taxes Payable

26400

Salaries and eages

$ 56,000.00

Salaries and Wages Expense

56000

56000

l

Insurance Expense

440.00

$233,200.00

:Depreciation Expense

528

4284

Cost of Goods Sold

7840

43876

Accumulated Depreciation Expense

S28.00

Salaries and Wages Payable

Depreciation Expense

S

528.00

Total Operating Expenses

91012

8 Interest Expense

220

Interest Expense

220.00

Interest Payable

Payroll Taxe Expense

$ 7,644.00

Income from Operations

62988

220

9insurance Expense

Prepaid Insurance

10 Depreciation Expense

440

Total

581.128

581,128

Other Expenses and Losses

440

528

Interest Expense

220

Accumulated Depreciation Expense

528

11 Payroll Taxe Expense

7644

Net income / (Loss)

State Unemployment Taxes Payable

Federal Unemployment Taxes Payable

FICA taxes payable

3024

62768

336

4284

Transcribed Image Text:Avengers LLC

Balance Sheet

31-Jan-22

Assets

Current Assets

Cash

194,788.00

Total Current Assets

Property, Plant, and Equipment

194,788.00

Equipment

33440

Less

Accum. Depr.-Equipment

-528

Total Property,Plant, and Equipment

32912

Total Assets

$4

227,700.00

Liabilities and Owner's Equity

Current Liabilities

Accounts Payable

39468

Interest Payable

220

Sales Taxes Payable

10208

FICA Taxes Payable

8568

Federal Income Taxes Payable

7840

Salaries and Wages Payable

43876

Federal Unemployment Taxes Payable

336

Total Current Liabilities

110516

Long Term Liabilities

Notes Payable

-44000

Total Liabilities

66516

Owner's Equity

Total Liabilities and Owner's Equity

66516

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning