The company completed the following transactions during 2020. Jan 10 sold inventory to Natty Paul, $11,000, on account • May 15 wrote off as uncollectible the accounts of Terry Carter, $2,500 and Maggie Cube $400 • August 04 received 70% of the amount owed by Natty Paul and wrote off the remainder as uncollectible

The company completed the following transactions during 2020. Jan 10 sold inventory to Natty Paul, $11,000, on account • May 15 wrote off as uncollectible the accounts of Terry Carter, $2,500 and Maggie Cube $400 • August 04 received 70% of the amount owed by Natty Paul and wrote off the remainder as uncollectible

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8E: In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because...

Related questions

Question

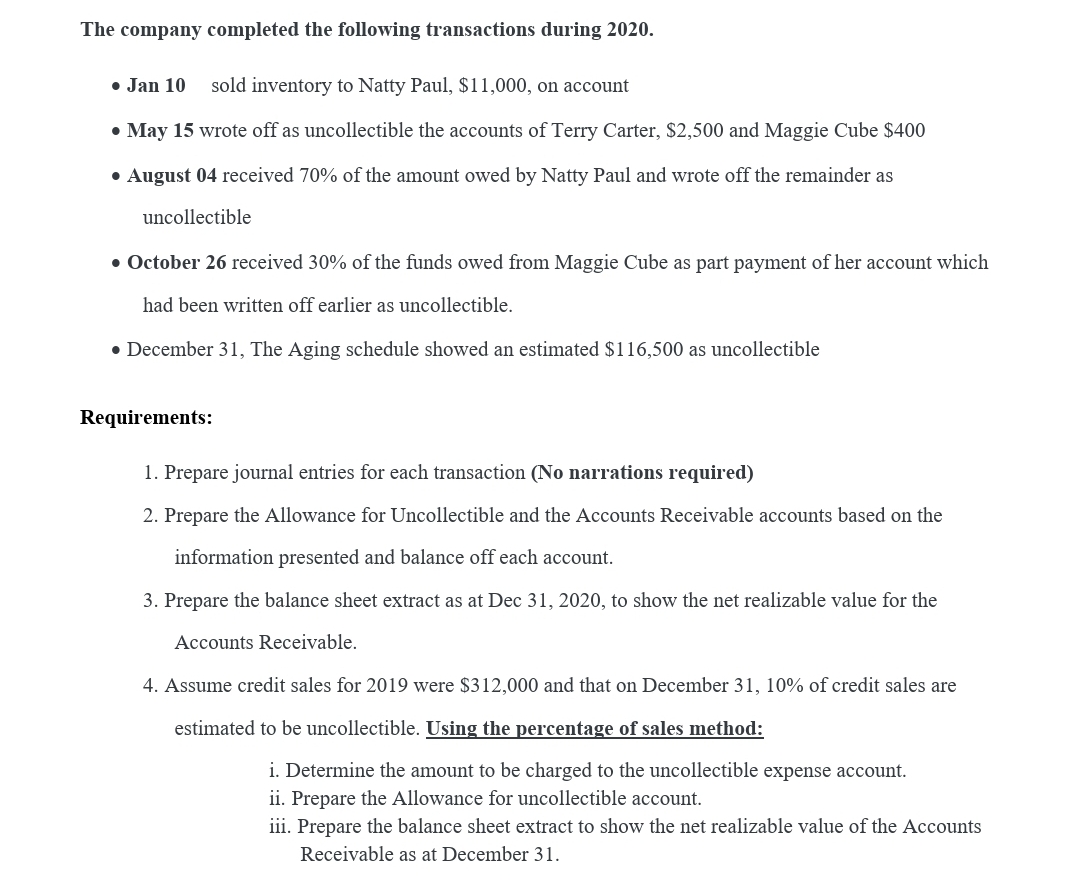

Transcribed Image Text:The company completed the following transactions during 2020.

• Jan 10

sold inventory to Natty Paul, $11,000, on account

• May 15 wrote off as uncollectible the accounts of Terry Carter, $2,500 and Maggie Cube $400

• August 04 received 70% of the amount owed by Natty Paul and wrote off the remainder as

uncollectible

• October 26 received 30% of the funds owed from Maggie Cube as part payment of her account which

had been written off earlier as uncollectible.

• December 31, The Aging schedule showed an estimated $116,500 as uncollectible

Requirements:

1. Prepare journal entries for each transaction (No narrations required)

2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the

information presented and balance off each account.

3. Prepare the balance sheet extract as at Dec 31, 2020, to show the net realizable value for the

Accounts Receivable.

4. Assume credit sales for 2019 were $312,000 and that on December 31, 10% of credit sales are

estimated to be uncollectible. Using the percentage of sales method:

i. Determine the amount to be charged to the uncollectible expense account.

ii. Prepare the Allowance for uncollectible account.

iii. Prepare the balance sheet extract to show the net realizable value of the Accounts

Receivable as at December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning