Q: A specialty chemical company is considering two alternative investments. The first one costs $40,000…

A: GIVEN, R = 8% THE CASHFLOW OF THE TWO INVESTMENTS ARE GIVEN BELOW. YEAR A B 0 -$40000 -$60000…

Q: An investment with an initial cost of $6,000 produces cash flows of 3,000, −$500, -$2,800, −$100,…

A: Solution- (1)- IRRr of the project given by=-6000+3000/1+r-500/1+r2+2800/1+r3-100/1+r4+6000/1+r5=0

Q: Lane Company is considering purchasing a capital investment that is expected to provide annual cash…

A: The correct answer is $26,832.

Q: You are considering an investment that will cost $15,000 and generate returns of $4,000 at the end…

A: Whenever an individual or a corporation has to evaluate the investment based upon the feasibility of…

Q: Payback, NPV, and IRR Rieger International is evaluating the feasibility of investing $94,000 in a…

A: Net present value is the difference between the present value of cash inflows and out flows. IRR is…

Q: You are considering an investment that will cost $15,000 and generate returns of $4,000 at the end…

A: NPV is the sum of present value of future cashflows less initial investment

Q: WhiteScreen LLC is evaluating Project T, which requires an initial investment of RO 17000. The…

A: Given: Initial investment = RO 17,000 Net cash flows = RO 5,000 Inflation rate = 5.5% Cost of…

Q: Snowflake Resorts is considering investing in a project that has a net investment of $240,000. This…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Payback, NPV, and IRR Rieger International is evaluating the feasibility of investing $69,000 in a…

A:

Q: A $15,000 investment is to be made with anticipated annual returns as shown in the spreadsheet in…

A: The Present value of an investment is the present worth of a future cash flows to be received at a…

Q: A company has two investment possibilities, with the following cash inflows: Investment Year 1 Year…

A: The present value of cash flows of investment is computed so that investors can decide whether to…

Q: ou are given three investment alternatives to analyze. The cash flows from these three investments…

A: Let CFn = Cashflow in year n Discount rate (r) = 13%

Q: Payback, NPV, and IRR Rieger International is evaluating the feasibility of investing $106,000 in a…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Imagineering, Inc., is considering an investment in CAD-CAM compatible design software with the cash…

A: Net Present Value (NPV): Net present value is computed by discounting all the cash inflows and…

Q: Find the profitability index for Oman Air conditioner Company if the initial investment is 4000 OMR…

A: Present value of cash inflows = Cash inflows x present value factor (5%, 4 years) =…

Q: Find the profitability index for Oman Air conditioner Company if the initial investment is 4000 OMR…

A: Profitability index is a part of capital budgeting decision where present value of cash inflows and…

Q: Hicks Company is considering an investment opportunity with the following expected net cash…

A: Net present worth (NPV) is the distinction between the current estimation of money inflows and the…

Q: You are evaluating the potential purchase of a small business currently generating $42,500 of…

A: We will use Discounted Cash Flow model to value the firm.

Q: . If money can be invested at 10%, find the NPV and PI for these investments and determine if the…

A: Information Provided: Initial Investment = 40,000 Year 1 Cash Inflow = 10,000 Year 2 Cash Inflow =…

Q: Park Company is considering an investment that requires immediate payment of $27,215 and provides…

A: The net present value method is used to evaluate investment projects. We can evaluate the project by…

Q: Nu Things, Inc., is considering an investment in a business venture with the following anticipated…

A: Worth of investment means the value which is expected to be generated from the investment. It…

Q: Nu Things, Inc., is considering an investment in a business venture with the following anticipated…

A: Net present value(NPV) is the difference between the present value of cash inflow and present value…

Q: A construction company wants to accumulate a given amount to buy a new equipment in the future. 1…

A: In investment management, the future value concept helps in the determination of the investments at…

Q: Using the payback and ARR methods to make capital investment decisions Suppose Hunter Valley is…

A: Payback method refers to total time taken by firm to be recover its cost of capital. ARR method is…

Q: A company has two investment possibilities, with the following cash inflows: Investment Year 1 Year…

A: This question is asking the net present value of these investments indirectly at a 6% discount rate.…

Q: Jupiter is considering investing time and administrative expense on an effort that promises one…

A: The question is based on the calculation of annual worth of cash flows at different time interval .…

Q: Morrisey Company has two investment opportunities. Both investments cost $6,900 and will provide the…

A: Net present value (NPV): Net present value is defined as the summation of the present value of cash…

Q: Jupiter is considering investing time and administrative expense on an effort that promises one…

A: Information Provided: MARR = 12% Year 0 cashflow = -$2 Year 1 cashflow = -$12 Year 2 cashflow = -$14…

Q: An investment has the following cash flow profile. For each value of MARR below, what is the minimum…

A: Investment is attractive only when IRR is equal to or greater than MARR. Hence, we need to find…

Q: he Zinger Corporation is considering an investment that has the following data: Year 1 Year 2 Year 3…

A: Pay back period is amount of period required to recover initial investment of the project from the…

Q: ARCABE Enterprises is trying to select the best investment from among four alternatives. Each…

A: Here, Discount Rate = 10% To Find: a) Discounted payback period =? b) Net present value =? c)…

Q: Nu Things, Inc., is considering investing in a business venture with the following anticipated cash…

A: Given, A project which has initial investment of $70000. MARR on the project is 20%.

Q: Jiminez Company has two investment opportunities. Both investments cost $5,000 and will provide the…

A: Present value: It can be defined as today’s worth of an investment that will be received in the…

Q: A delivery company is evaluating an investment to purchase vehicles. This is expected to generate a…

A: Present value can be calculated by using this equation. Present value =CF1/(1+r)…

Q: The HUT is evaluating a 5 year investment projected to yield the following relevant cash flows over…

A: Solution:- Net Present Value (NPV) means the net present value of cash inflows net of initial…

Q: Dalvi Incorporated is considering a new Investment. The table below lists the cash flows. Year Cash…

A: The payback period is the time period in which the Initial amount is fully recovered from future…

Q: You are interested buying a business and the current owner is asking $180,000 for it. You require a…

A: Interest refers to the amount charged by the lender on the lent amount. The borrower of the loan is…

Q: You are considering an investment in a clothes distributer. The company needs $105,000 today and…

A: Initial Cash outflow = C0 = $ 105,000; Cash inflow next year = C1 = $ 120,000If R is the IRR then,…

Q: A company is considering a R250 000 investment with the following cash flows Year 1 : R30 000…

A: a) Working note:

Q: Cannonier, Inc., has identified an investment project with the following cash flows: Year Cash Flow…

A: In this question we need to compute the future value of stream of cash flows after 4 years. Future…

Q: Smolinski Company is considering an investment that will return a lump sum of $500,000 five years…

A: solution: Future Value (FV) 500000 Period (Nper) 5 Interest rate (Rate) 4% Present Value…

Q: Payback, NPV, and IRR Rieger International is evaluating the feasibility of investing $115,000 in a…

A: NPV - it is the difference of present value of cash inflow and present value of cash outflow at cost…

Q: Find the profitability index for Oman Air conditioner Company if the initial investment is 4000 OMR…

A: Profitability index is a part of capital budgeting decision where present value of cash inflows and…

Q: Find the profitability index for Oman Clothing Company if the initial investment is 700 OMR and the…

A: The profitability index shows how much time is taken to recover the initial investment made in the…

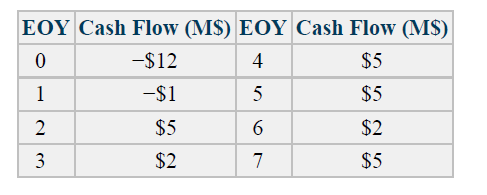

Imagineering, Inc., is considering an investment in CADCAM compatible design software with the cash flow profile shown in the table below. Imagineering’s MARR is 18%/year. a. What is the present worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on present worth? c. Should Imagineering invest?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Revenue R100 000, Debtors (opening R50 000, closing R110 000), Calculate Cash Receipts from Customers. Select one: a. R60 000 b. R40 000 c. R110 000 d. R100 0001. Compute the current assets.Cash Php 25,867.00Barney’s drawing 50,485.00Accounts Payable 78,584.00Notes Receivable 45,051.00Building 1,500,125.00Inventory 33,669.002. Compute the Net Income.Service Income Php 356,867.00Prepaid Rent 16,800.00Interest Expense 1,523.00Barney’s drawing 21,786.00Taxes 4,544.00Utilities Expense 3,651.003. The liabilities of Bb Barn are equal to 1/3 of thetotal assets. The owner's equity is P 6,300,500. Whatis the amount of the liabilities?4. Prepare journal entries to the following transactionsfor the year 2020.Sept. 1 V Barney invested Php 150,000 in Barney repair ShopSept 3 Purchased equipment worth Php 80,000 on account.Sept. 12 Paid Php 25, 000 for the equipmentpurchased dated Sept. 3, 2020.Sept. 15 Rendered service amounting toPhp 45,000.Sept. 17 Paid salaries to employees, Php16,000Identify the relevant transaction for this entry: Assets Owner’s equity Liabilities +R8000 +R8000 0 Received R8000 cash for debtors R8 000 cash paid for rent Cash sales of inventory R8 000 Received R8 000 cash for rent

- Exercise 1-50 Statement of Cash Flows OBJECTIVE o Walters Inc. began operations on January I. 2019. The following information relates to Walters cash flows during 2019. Required: 1. Calculate the cash provided/fused for each cash flow category. 2. CONCEPTUAL CONNECTION Comment on Walters creditworthiness.Case 1-74 Comparative Analysis: Under Armour, lnc., versus Columbia Sportswear Refer to the 10-K reports of Under Armour, Inc., and Columbia Sportswear that are available for download from the companion website at CengageBrain.com Required: Answer the following questions: What were the major sources and uses of cash for each company?information to answer question 5. Cash R10 000 Accounts receivable(debtors control) R30 000 Inventory R80 000 Prepaid insurance R 6 000 Fixed assets R200 000 Accounts payable (creditors control) R30 000 Income received in advance R25 000 Wages payables R5 000 Long-term liabilities R70 000 Capital R196 000 Calculate the acid test ratio. A. 0.83:1 B. 1:1 C. 1.3:1 D. 0.76:1

- (Basic Accounting Equation) Fill up the missing amounts for each case Case 1 Case 2 Case 3 Assets P 100,000 __________ P 120,000 Liabilities 45,000 35,000 _________ Owner’s Equity P _______ 35,000 65,0006. Identify the most relevant transaction for this entry:Assets Owners’ Equity Liabilities+50 000 0 +50 000 A. Bought inventory on credit R50 000.B. Sold inventory on credit R50 000.C. Sold inventory on credit R50 000.D. Cash paid to creditors R50 000.12/31/2018 12/31/2019 Unearned revenue $12,900 $6,200 Cash 33,600 13,350 Prepaid rent 9,500 6,500 Supplies 5,800 2,800 Taxes payable 5,200 5,800 Wages payable 9,000 9,450 Using the above account balances, compute working capital and current ratio. Round "Current ratio" answers to two decimal places. 12/31/2018 12/31/2019 A. Working capital $_______ $_______ B. Current ratio _______ _______

- 1/2 Purchased $600 of supplies from Office Hoard Corp on account with terms 2/10, n/30. 1/ 8 Paid off account with Office Hoard Corp with cash. Record these transacationsub : Accounting pls aswer ASAP.dont CHATGPT. i ll upvote. Please type the answer. Thank You Payment Cash Payment Interest Decrease in Balance Outstanding Balance $87,867 1 $13,000 $0 $13,000 74,867 2 13,000 7,487 5,513 69,354 3 13,000 6,935 6,065 63,289 4 13,000 6,329 6,671 56,618 5 13,000 5,662 7,338 49,280 6 13,000 4,928 8,072 41,208 7 13,000 4,121 8,879 32,329 8 13,000 3,233 9,767 22,562 9 13,000 ? ? ? 10 13,000 ? ? 0 What amount would the lessee record as annual amortization on the right of use asset using the straight line method? A) $13,000 B) $7,487 C) $8,787 D) $8,851Part A : Multiple Choice Questions The balance day adjustment for salaries accrued of $1,100 is: Dr salaries expense $1,100; Cr salaries payable $1,100. Dr salaries expense $1,000; Dr GST paid $100; Cr expense accrued $1,100. Dr expense accrued $1,100 Cr; salaries expense $1,100. Dr expense accrued $1,100; Cr salaries expense $1,000; Cr GST paid $100. Which of the following items decreases the balance in the accounts receivable? Cash paid to creditors Discounts received Credit sales Discounts allowed Which of the following statements is not true? Expense is the amount incurred or paid in earning the revenue and running the business. Expenses includes the cost of goods sold (that is, the cost of the goods or inventory that have been sold). The expense account should be credited when an expense is incurred. Wages, electricity and motor vehicle expenses are all examples of expenses. If inventory was purchased for $2 288 inclusive of GST, what would the GST…