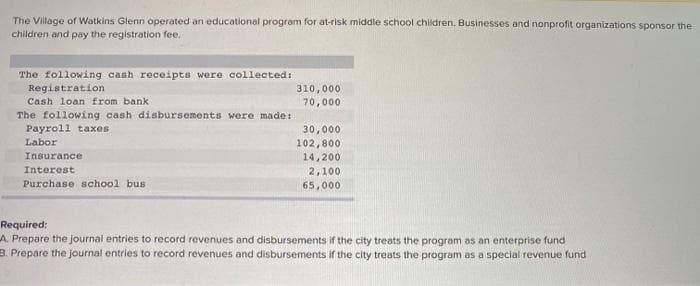

equired: Prepare the journal entries to record revenues and disbursements if the city treats the program as an enterprise fund Prepare the journal entries to record revenues and disbursements if the city treats the program as a special revenue fund

Q: Amazon purchased a piece of land for $5 million and plans to build a $25 million distribution…

A: The term depreciation refers to the method of calculation used to allocate the cost of a tangible or…

Q: If unit sales for both divisions increased 10%, the company would report which of the following?…

A: Solution:- Preparation of proposed income statement if sales of both divisions increased by 10% as…

Q: Describe how you would do a financial analysis (refer to trends and ratios)

A: Financial analysis is a process of determining performance and compatibility by evaluating…

Q: A company invests in a fitness facility for its employees that costs $2,000,00 company saves…

A: Discounted Payback Period A capital budgeting tool for determining a project's profitability is the…

Q: There are a number of benefits associated with budgeting. Which of the following is not frequently…

A: Budgeting refers to the process of estimation of revenues and expenses for an entity over a specific…

Q: Last month when Holiday Creations, Incorporated, sold 41,000 units, total sales were $164,000, total…

A: Formula: Contribution margin ratio = ( Total contribution margin / Sales ) x 100

Q: Chapter 9: A Closer look on Cost Accounting 15. The EUP is 57,000 units. The beginning inventory…

A: FIFO means the first in first in which the degree of opening work in progress will be considered and…

Q: xercise 10-32 (Algo) Activity-Based Costing of Customers (LO 10-3, 4) Rock Solid Bank and Trust…

A: Activity-based costing (ABC) is a method of assigning overhead and indirect expenses, such as…

Q: Why is it important to set a credit limit?

A: Solution:- Given, Credit Limit :- The term credit limit refers to the maximum amount of credit a…

Q: Required: Prepare comparative statement of income and retained earnings.

A: Answer:

Q: Question 1: The Aseel Co. produces 3 products, A, B and C. All are made from the same materials. The…

A: Introduction:- Any technique for allocating expenses to a business piece is known as cost.…

Q: A company had net income of $282,000. Depreciation expense is $26,000. During the year, accounts…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flows statements.…

Q: Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue…

A: Statement of Cash Flow - Cash Flow Statement includes movement of cash during the financial year. It…

Q: 2001 for a value of $75,000. If the Company had barrowed money from the bank it w outd 8%. What is…

A: In the given case, the company has purchased the crane on 1st January 1997 for 75,000 payable on…

Q: e amount received compared to the present value was due to the conversion feature. Each $100 bond…

A: Bonds refer to the financial instrument which entitles a promise made by the borrower to the lending…

Q: If c/s =25% , prime cost $140, fixed cost $4600 ,contribution 80 and absorption cost is 40. What is…

A: The question is related to Cost Management. The Contribution Margin Ratio is calculated with the…

Q: Pls answer number 10 with solutions On January 1, 20x1, SALIENT PROMINENT Co. issued 1,000, ₱4,000,…

A: A Bond is a loan from investor to borrower such as company or government.

Q: 200,000 board feet $2.50 Cost per bd. ft. per bd. ft. $1.25 50.50 60,000 er bd. ft. $2.00 sells to…

A: Contribution margin refers to the sum value of money that remained at a company after it has…

Q: Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for…

A: Solution:- Given, Billy’s BBQ reported sales = $750,000 Net income = $29,500. Billy’s also reported…

Q: Journalize the following transactions using the allowance method of accounting for uncollectible…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Q1) Pier 1 Imports operates almost 1,000 stores around the world. Assume you are dealing with a Pier…

A: The perpetual inventory system records the cost of goods sold and sales with every transaction made…

Q: Amount (in Normal balances) 239,186 353,700 504,944 (1)? 83,259 1,594,927 110,800 (2)? (3)? Account…

A: The balance sheet represents the financial position of the business with total assets, total…

Q: Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and…

A: Net operating income = Total sales - Total variable costs - Traceable fixed expense - Common fixed…

Q: Why do we need internal, external and government auditor in a company?

A: An auditor is a person who is authorized to review and verify the correctness of financial documents…

Q: What is the major shortcoming of using operating income as a performance measure for investment…

A: The Operating income is an absolute measure of performance evaluation of a division. It does not…

Q: allable S 365.000 S 0.25 Sales Freight out per unit sold Depreciation on Admin. Equipment S 14,500…

A: These are the costs that do change along with the level of production during a period. These are…

Q: Which of the following is a false statement about scrap and by-products? Select one: a. Both scrap…

A: Scrap is the incidental residue from material used in production activities that can be recovered…

Q: Date Blankets Units Cost May 3 Purchase $15 10 Sale 17 Purchase 12 $18 Sale 20 23 Sale 30 Purchase…

A: Introduction: LIFO: LIFO Stands for Last in First out. Which means Last received inventory to be…

Q: 3. At a certain interest rate compounded semiannually, P5000 will amount to P20000 after 10 years.…

A: Interest Rate- The costs levied on the borrower for assets borrowed from lenders are referred to as…

Q: On January 1, 20--, Dover Company’s retained earnings accounts had the following balances:…

A: 1. Journal entries for the transactions Date Account title and explanation Debit Credit Mar 15…

Q: Diamond Corp. earned net income of $550,000 in 2021 and had 120,000 shares of common stock…

A: Diluted earnings per share = (Net income + interest expense net of tax) / (No. of shares of common…

Q: OI and Investment Decisions Jarriot, Inc., presented two years of data for its Furniture Division…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $170,000. It is…

A: Under straight line depreciation method, the annual depreciation expense is calculated as the…

Q: The following data relate to product PQ Selling price $215 per unit…

A: Solution .. Selling price per unit = $215 Variable cost per unit = $120 Contribution margin per…

Q: A certain car was purchased for $11,900. The car has a resale value of $8,300 after a useful life of…

A: Depreciation is charged against the value of fixed assets. It can be calculated by using the…

Q: Wooden Grain Co. has organized a new division to manufacture and sell specially designed tables for…

A: In this question, there are 3 requirements: Unit inventorial costs under absorption costing and…

Q: If the budget for your hotel had 100 rooms, open 300 days a year, with 50% occupancy and an ADR of…

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Presented here is the income statement for Fairchild Co. for March: Sales $ 81,500 Cost…

A: A contribution margin income statement subtracts all variable expenses from sales to calculate the…

Q: negative figure.

A: Cash flow is the inflow and outflow of cash and helps in determining the net cash balance with the…

Q: Venturer B contributed technology with a fair value of $900,000 for a 53% interest n JV. All three…

A: A joint venture refers to an agreement between two or more parties to develop a single enterprise…

Q: Seth Feye established Reliance Financial Services on July 1, 20Y2. Reliance Financial Services…

A: Shareholders' equity (or corporate net worth) is a measurement of how much money or earnings a…

Q: Wooden Grain Co. has organized a new division to manufacture and sell specially designed tables for…

A:

Q: 1: An employee works 51 hours (51 - 40 were overtime hours) during a workweek in December of 2021.…

A: You have posted multiple questions, so as per Bartleby policy only the first question is answered,…

Q: Discuss the limitations of cost volume profit analysis for planning and decision making.…

A: The question is related to the Cost Volume Profit Analysis. Cost-Volume-Profit (CVP) Analysis is an…

Q: what is the basics of banking and discuss the various type of deposits

A: A bank is a sort of financial entity that may accept deposits and lend money. Banks may provide…

Q: The Chowning Company manufactures ear buds that sell for $20 a pair. The variable cost of each set…

A: Lets understand the basics. Total costs is a total of fixed and variable costs. Variable cost is a…

Q: Below are departmental income statements for a guitar manufacturer. The company classifies…

A: Direct expenses are those which are associated to the goods directly. This simply means that the…

Q: Auga Company Ltd Comparative Balance Sheet December 31, 2021 and 2020 2021…

A: Statement of Cash Flow - Statement of Cash Flow shows the increase and decrease in cash for the…

Q: On January 1, 20x1, DOC WILLIE Company acquired equipment from Catanduanes Factory Supplies with an…

A: Note: As per the norms of Bartleby, in case of many independent questions, 1 question can be…

Q: On January 1, 2021, BBB Company issued 10% bonds payable dated January 1, 2021 with a face amount of…

A: Present Value of Bond = PV of Coupon Payments + PV of Redemption Value PV of Coupon Payments =…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program’s bank account for the year. At the beginning of 2020, the program had unrestricted cash of $26,000. Cash Basis 12 months Cash receipts: Registration fees $ 130,000 Borrowing from bank 56,000 Total deposits 186,000 Cash disbursements: Wages 70,800 Payroll taxes 9,500 Insurance (paid monthly) 6,500 Purchase of bus 65,000 Interest on bank note 1,680 Total checks 153,480 Excess of receipts over disbursements $ 32,520 The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of…The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program’s bank account for the year. At the beginning of 2024, the program had unrestricted cash of $7,000. Cash Basis 12 months Cash receipts: Registration fees $96,500 Borrowing from bank 75,000 Total deposits 171,500 Cash disbursements: Wages 44,000 Payroll taxes and employee benefits 9,575 Insurance (paid monthly) 8,000 Purchase of bus 80,000 Interest on bank note 2,250 Total checks 143,825 Excess of receipts over disbursements $27,675 The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2024. The bus was purchased on April 1 with the proceeds…Create a transaction report for the following February transactions for the Access to Learning nonprofif organization: - On Feb 1, the nonprofit paid $20,000 in salaries. - On Feb 2, the nonprofit used $5,000 in cash to pay down its accounts payable by that amount. - On Feb5, the nonprofit received $5,000 in cash from a foundation, and that donation had previously been recorded in accounts receivable. - On Feb 10, the executive director talked to a foundation program officer who said that the foundation would be giving a $25000 grant to the nonprofit within the next 2 months. - On Feb 15, the nonprofit incurred another $1,000 in salaries payable. - On Feb 20, the nonprofit received $5,000 in cash from pledges. - On Feb 22, the nonprofit received a second payment of $10,000 from the $50,000 foundation grant. - On Feb 23, the nonprofit conducted the workshops that were paid for in Jan ($10,000), and payment had been recorded as deferred revenue. - On Feb 24, the nonprofit made a mortgage…

- 2. The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program’s bank account for the year. At the beginning of 2024, the program had unrestricted cash of $28,000. Cash Basis 12 months Cash receipts: Registration fees $ 132,000 Borrowing from bank 58,000 Total deposits 190,000 Cash disbursements: Wages 72,400 Payroll taxes and employee benefits 9,700 Insurance (paid monthly) 6,700 Purchase of bus 80,000 Interest on bank note 1,740 Total checks 170,540 Excess of receipts over disbursements $ 19,460 The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2024. The bus was purchased on April 1 with the…Gerald Inc. of Session opens a sales agency in Julia and a working fund of ₱100,000 isestablished on imprest basis. The first payment from the fund is ₱5,000 for rent of thestore space. What is the entry in the books of the home office to record the payment ofrent by the agency?The village of Old Road orders a computer costing $600,000. The village finances the computer by issuing a $600,000 long-term bond at face value. The village receives the computer and pays cash of $600,000. b) Prepare the journal entries to record these events assuming they were recorded in the Enterprise Fund. If no entry is required, select 'No debit (or credit) entry required' in the account field and enter 0 or leave the debit and credit fields blank.

- For the summer session of 20X1, Armando University (AU), a non-profit organization, assessed its studentsP1,700,000 (net of refunds), covering tuition and fees for educational and general purposes. However, anamount of P1,500,000 was only expected to be realized. It is because P150,000 were granted to students,and P50,000 tuition remissions were allowed to faculty member’s children attending the university. Whatamount should AU include in its unrestricted funds as revenues from tuition fees? 2. The League, a non-profit organization, received the following pledges:Unrestricted P200,000Restricted for Capital Additions 150,000All pledges are legally enforceable. However, the League’s experience indicates that 10% of all pledgesprove to be uncollectible. What amount should the League report as pledges receivable net of any requiredallowance account?shak City creates a new internal service fund. To get the internal service fund started, the City's general fund loans $100,000 to the newly created internal service fund. What journal entry will be recorded in the general fund as a result of the transaction? None of these Debit cash $100,000; credit due to internal service fund $100,000 Debit due from internal service fund $100,000; credit cash $100,000 Debit transfers in/out $100,000; credit cash $100,000 Debit cash $100,000; credit transfers in/out $100,000The government makes appropriations of RO 200,000 to Sohar School for the month of January 2019. During the month the following transactions occurred: Salary paid RO 50,000 Purchase orders were placed for office supplies RO 72,000 Office supplies were received with a voucher for RO 60,000 An amount of RO 25,000 was transferred to Debt service fund. The unreserved fund balance at the end of the period is: a. 90,000 b. 150,000 c. 78,000 d. 65,000

- The government makes appropriations of RO 150,000 to Muscat School for the month of January 2019. During the month the following transactions occurred:Salary paid RO 35,000Purchase orders were placed for office supplies RO 49,000Office supplies were received with a voucher for RO 45,000An amount of RO 15,000 was transferred to Debt service fund.The unreserved fund balance at the end of the period is:Which of the following journal entry is appropriate to recognize that a not-for-profit organization collected P200,000 of amounts pledged and wrote off P10,000 of amounts pledged as amounts uncollectible? a.Debit Pledges Receivable P200,000; Credit Cash P200,000. b.Debit Cash P200,000; Debit Allowance for uncollectible pledges P10,000; Credit Pledges Receivable P210,000. c.Debit Pledges Receivable P200,000; Credit Allowance for uncollectible pledges P10,000, Credit Cash P210,000. d.Debit Cash P200,000; Credit Pledges Receivable P200,000. e.Debit Cash P200,000; Debit Allowance for uncollectible pledges P10,000; Credit Unrestricted net assets-contributions P210,000.The Shannon Community Kitchen provides hot meals to homeless and low-income individuals and families; it is the organization’s only program. It is the policy of the community kitchen to use restricted resources for which the purpose has been met before resources without donor restrictions. The Kitchen had the following revenue and expense transactions during the 2020 fiscal year. Cash donations without donor restrictions of $25,000 were received. A local philanthropist also contributed $3,000, which was to be used for the purchase of Thanksgiving dinner foodstuffs. A local grocery store provided fresh produce with a fair value of $100. The produce was immediately used. Volunteers from the local university contributed 100 hours to preparation and serving of meals. The estimated fair value of their labor was $750. The Kitchen received a $5,000 federal grant for the purchase of institutional kitchen appliances. At Thanksgiving time, the Kitchen spent $4,100 on foodstuffs for preparation…