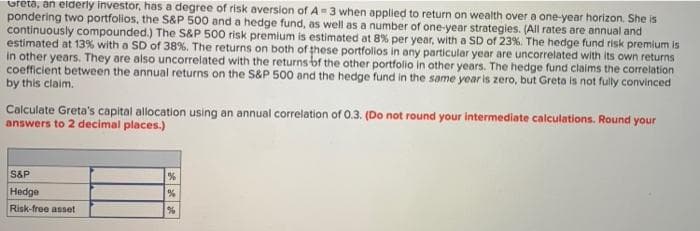

ereta, an eiderly investor, has a degree of risk aversion of A=3 when applied to return on wealth over a one-year horizon. She is ondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and ontinuously compounded.) The S&P 500 risk premium is estimated at 8% per year, with a SD of 23%. The hedge fund risk premium is stimated at 13% with a SD of 38%. The returns on both of these portfolos in any particular year are uncorrelated with its own returns - other years. They are also uncorrelated with the returns bf the other portfolio in other years. The hedge fund claims the correlation pefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced y this claim. alculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your nswers to 2 decimal places.) S&P Hedge Risk-free asset

ereta, an eiderly investor, has a degree of risk aversion of A=3 when applied to return on wealth over a one-year horizon. She is ondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and ontinuously compounded.) The S&P 500 risk premium is estimated at 8% per year, with a SD of 23%. The hedge fund risk premium is stimated at 13% with a SD of 38%. The returns on both of these portfolos in any particular year are uncorrelated with its own returns - other years. They are also uncorrelated with the returns bf the other portfolio in other years. The hedge fund claims the correlation pefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced y this claim. alculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your nswers to 2 decimal places.) S&P Hedge Risk-free asset

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 1FPE: What makes for a good investment? Use the approximate yield formula or a financial calculator to...

Related questions

Question

Transcribed Image Text:oreta, an elderly investor, has a degree of risk aversion of A=3 when applied to return on wealth over a one-year horizon. She is

pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and

continuously compounded.) The S&P 500 risk premium is estimated at 8% per year, with a SD of 23%. The hedge fund risk premium is

estimated at 13% with a SD of 38%. The returns on both of these portfollos in any particular year are uncorrelated with its own returns

in other years. They are also uncorrelated with the returns bf the other portfolio in other years. The hedge fund claims the correlation

coefficient between the annual returns on the S&P 500 and the hedge fund in the same year is zero, but Greta is not fully convinced

by this claim.

Calculate Greta's capital allocation using an annual correlation of 0.3. (Do not round your intermediate calculations. Round your

answers to 2 decimal places.)

S&P

Hedge

Risk-free asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning