estion 1 Two computer firms, A and B, are planning to market network systems for office information management. Each firm can develop either a fast, high-quality system (H), or a slower, low-quality system (L). Market research indicates that the resulting profits to each firm for the alternative strategies are given by the following payoff matrix: Firm B H L H 50, 40 60, 45 Firm A L 55, 55 15, 20 1 If both firms make their decisions at the same time and follow maximin (low-risk) strategies, what will the outcome be? With reference to the definition, explain how the outcome is determined. 2 Suppose both firms try to maximise profits. What will the outcome be if Firm A can commit first?

estion 1 Two computer firms, A and B, are planning to market network systems for office information management. Each firm can develop either a fast, high-quality system (H), or a slower, low-quality system (L). Market research indicates that the resulting profits to each firm for the alternative strategies are given by the following payoff matrix: Firm B H L H 50, 40 60, 45 Firm A L 55, 55 15, 20 1 If both firms make their decisions at the same time and follow maximin (low-risk) strategies, what will the outcome be? With reference to the definition, explain how the outcome is determined. 2 Suppose both firms try to maximise profits. What will the outcome be if Firm A can commit first?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

These are revision question for my upcoming test. They are from the textbook and are not graded.

Transcribed Image Text:Question 1

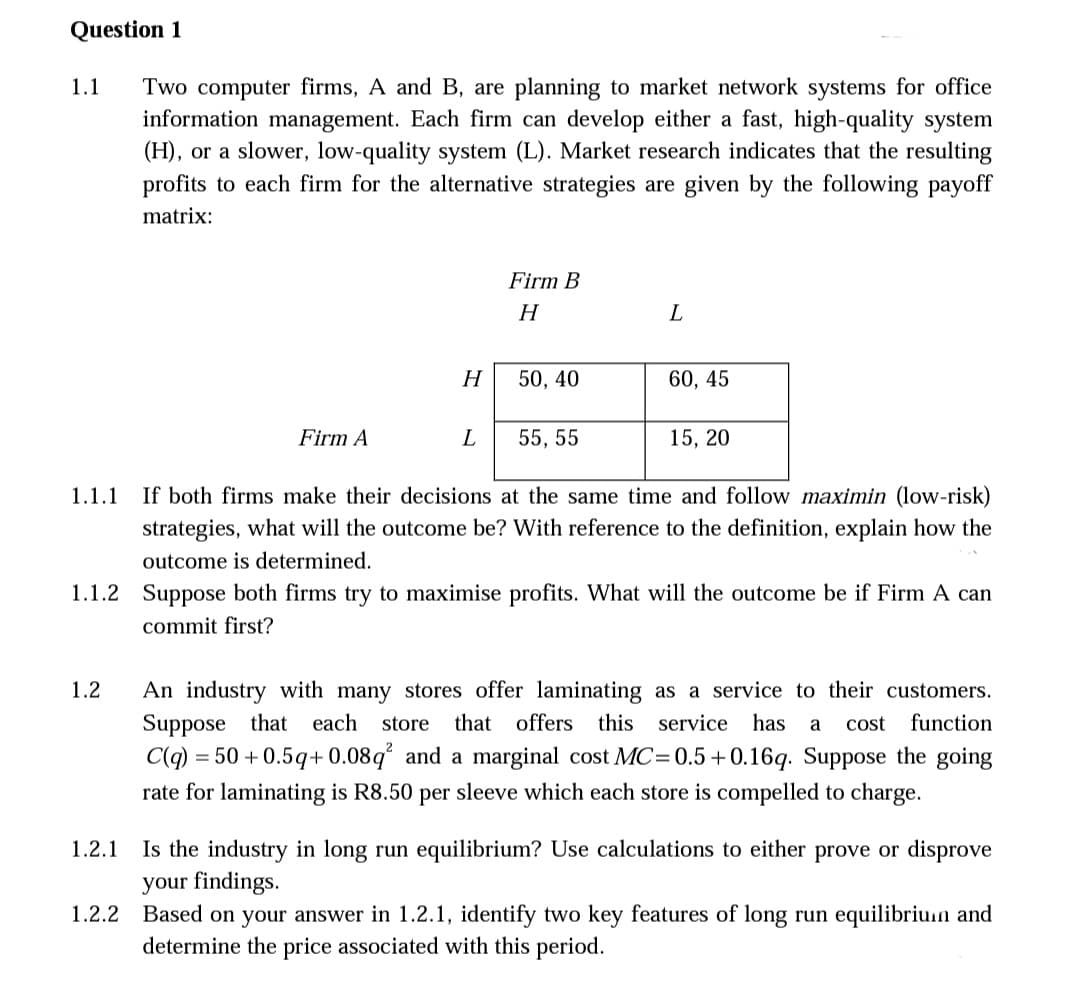

1.1 Two computer firms, A and B, are planning to market network systems for office

information management. Each firm can develop either a fast, high-quality system

(H), or a slower, low-quality system (L). Market research indicates that the resulting

profits to each firm for the alternative strategies are given by the following payoff

matrix:

Firm B

H

L

H

50, 40

60, 45

Firm A

L

55, 55

15, 20

1.1.1 If both firms make their decisions at the same time and follow maximin (low-risk)

strategies, what will the outcome be? With reference to the definition, explain how the

outcome is determined.

1.1.2 Suppose both firms try to maximise profits. What will the outcome be if Firm A can

commit first?

1.2

An industry with many stores offer laminating as a service to their customers.

Suppose that each store that offers this service has a cost function

C(q) = 50 +0.5q+0.08q² and a marginal cost MC=0.5 +0.16q. Suppose the going

rate for laminating is R8.50 per sleeve which each store is compelled to charge.

1.2.1

Is the industry in long run equilibrium? Use calculations to either prove or disprove

your findings.

1.2.2 Based on your answer in 1.2.1, identify two key features of long run equilibrium and

determine the price associated with this period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning