ets: stment in S stment in T er assets H (Rs. 000) 3,300 3,700 7,000 S(Rs. 000) 2,200 2,400 4,600

ets: stment in S stment in T er assets H (Rs. 000) 3,300 3,700 7,000 S(Rs. 000) 2,200 2,400 4,600

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

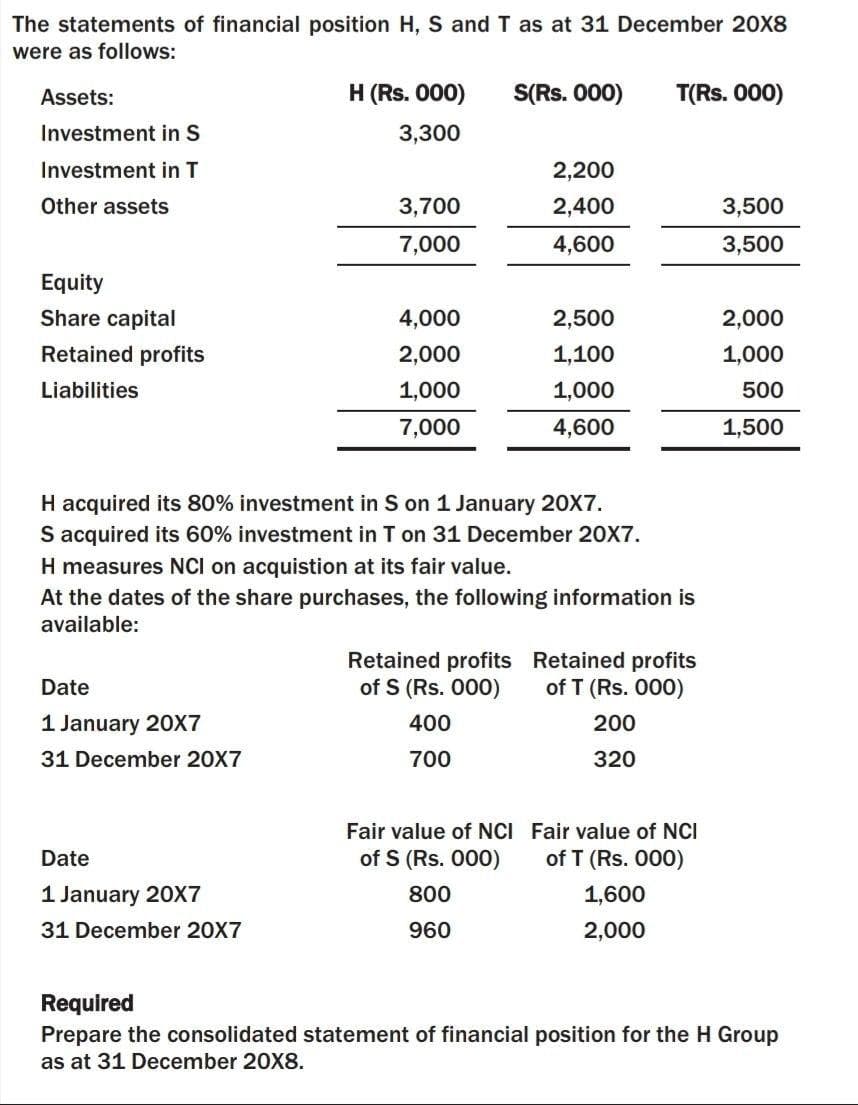

Transcribed Image Text:The statements of financial position H, S and T as at 31 December 20X8

were as follows:

Assets:

H (Rs. 000)

S(Rs. 000)

T(Rs. 000)

Investment in S

3,300

Investment in T

2,200

Other assets

3,700

2,400

3,500

7,000

4,600

3,500

Equity

Share capital

4,000

2,500

2,000

Retained profits

2,000

1,100

1,000

Liabilities

1,000

1,000

500

7,000

4,600

1,500

H acquired its 80% investment in S on 1 January 20X7.

S acquired its 60% investment in T on 31 December 20X7.

H measures NCI on acquistion at its fair value.

At the dates of the share purchases, the following information is

available:

Retained profits Retained profits

of S (Rs. 000)

Date

of T (Rs. 000)

1 January 20X7

400

200

31 December 20X7

700

320

Fair value of NCI Fair value of NCI

Date

of S (Rs. 000)

of T (Rs. 000)

1 January 20X7

800

1,600

31 December 20X7

960

2,000

Required

Prepare the consolidated statement of financial position for the H Group

as at 31 December 20X8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub