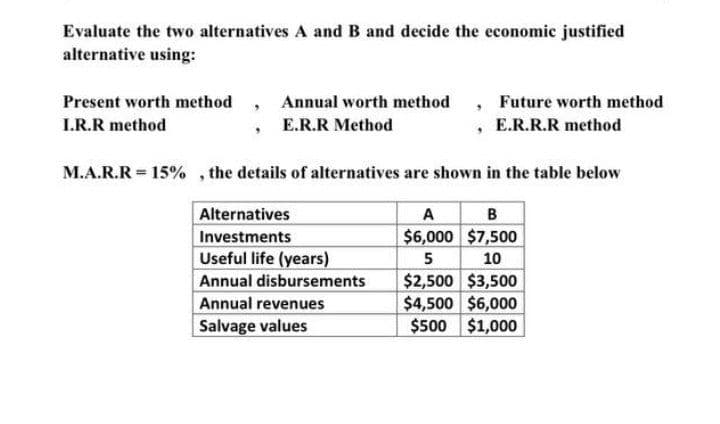

Evaluate the two alternatives A and B and decide the economic justified alternative using: Present worth method, Annual worth method, Future worth method I.R.R method E.R.R Method , E.R.R.R method M.A.R.R 15%, the details of alternatives are shown in the table below Alternatives A B Investments $6,000 $7,500 5 10 Useful life (years) Annual disbursements $2,500 $3,500 Annual revenues $4,500 $6,000 Salvage values $500 $1,000

Q: Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own…

A: As per goodwill method, the amount of goodwill is calculated by the fair market value of all the…

Q: On January 1, 2019, Tulip signed an agreement to operate as a franchise of Flower Service Inc. for…

A: In the context of the given question, we are required to compute the carrying amount of intangible…

Q: ABC Company uses job costing. Its annual estimated manufacturing overhead and machine hours (the…

A: A product's total cost is the total money paid to make it. Accounting-wise, the total cost concept…

Q: Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,817. The useful…

A: Depreciation: It implies to a decrease in the fixed asset's value because of wear and tear,…

Q: The adjusting entry to record depreciation includes O a. a debit to an expense account. b. a debit…

A: Depreciation Expenses refers to gradually decrease in the value of assets over the year due to its…

Q: An investor earns $138639 in the 2021/22 tax year. She purchases shares worth $4251 on 15 April 2021…

A: Income tax payable is tax liability which is paid to the government on the income of individual, A…

Q: Determine which of the following three alternatives is most efficient and which one is more…

A: The evaluation of investment alternatives is a part of the management’s responsibility. When a…

Q: Ill Company provides the following data for the year 2020: Cash sales - 500,000; Collection from…

A: The gross sales are calculated as sum of net sales, sales discount and allowance and sales returns.

Q: Mr. John DeMello has 2021 net income for tax purposes of $26,100. His spouse is dependent on him…

A: The answer is stated below:

Q: An adjustment to record unrecorded fees earned was posted during the current period. Which of the…

A: Explanation :- The debit to Accounts receivable for the amount and credit to the fees earned account…

Q: Pain Hub Corporation reported the following amount in the shareholders’ equity section of its…

A: Share premium accounts show the additional paid in capital in excess of par. It include the share…

Q: Searchlight, Inc. uses ROI to evaluate operations and requires the return on its operating units to…

A: Introduction:- It is used used to identify the probability of return from an investment. The higher…

Q: How should we record the journal entry that was on question 4? We are somewhat confused regarding…

A: W.N.1 Calculation of Depreciation Expense based on Input Year Depreciable Amount…

Q: At the start of the current year, Mundo Company’s stockholders’ equity account appeared as follows:…

A: The shareholder's equity is effected by issuance of shares, purchase of treasury stock, retained…

Q: As a small financial analyst, you have been selected by a client to provide assistance in the…

A: Answer:- A Future Value of an annuity due is always greater than the Future Value of an ordinary…

Q: 1. Show how the following items will appear in the capital accounts of the partners Ali and Ahmed…

A: Capital Account: - Capital Account records all capital transactions which cause the change in the…

Q: computer shop charges P15.00 in every hour of computer rental.Represent your computer rental fee(R)…

A: R = R (t) where, R= Total Computer Rental Fee payable R(t) = Rent per Hour x Total Number of Hours…

Q: Question 1 From the following trial balance of Ursula, you are asked to draw up a statement of…

A: The financial statements are prepared by the business entity to show the performance of the…

Q: name two situations in which a business can take a depreciation expense.

A: The portion of a fixed asset that's been considered destroyed in the current period is depreciation…

Q: how to creat a balance sheet using the following information? Balance sheet Given the following…

A: The balance sheet is a summary of permanent accounts prepared at the end of the accounting period.…

Q: 1. FW of Alt. A is $Blank 1 FW of Alt. B is $Blank 2 2. 3. FW of Alt. C is sBlank 3 4. FW of Alt. D…

A: Future worth which is also written as FW is one of the techniques which is taken into account by the…

Q: nt sum needed to prow year is closest to:

A: The answer has been mentioned below.

Q: The adjusting entry for accrued expenses includes O a. a debit to an expense account.

A: First of all we have to understand the concept of accrued expenses, Accrued expenses are the…

Q: What about capitalized interest in 2022?

A:

Q: Calculate the sales activity to reach a target profit of £20,000.

A: The formula for Desired Sales Volume (units) = (Total Fixed Cost + Desired Profit)/Contribution…

Q: nadette Naldo has been considering investing in the bonds of ABD Industries. The bond: were issued 5…

A: Some bonds have conversion option that they can be converted into number of shares as fixed or may…

Q: P9.1.1 Adjusting Entry Prepaid Insurance At January 31, 2022 Cy needs to update his accounts before…

A: Prepaid insurance is a cost associated with an insurance contract that has been paid in advance of…

Q: on capacity of 10,000 system units and currently only produces 8,000. The company is operating above…

A: To decide if PUPPY SAFETY should accept or reject the special order the relevant cost must be…

Q: he October 31 balances for the following inventory accounts. 1. Raw Materials $ 2. Work in…

A: Work in process refers to the concept when the goods manufactured by a company are not fully…

Q: Required: Adjusting entries

A:

Q: Proton Corporation incurred the following costs in 2022: Acquisition of R&D equipment with a useful…

A: The advertising costs and engineering costs are not included in the research and development costs.

Q: Identify any two entity forms, and briefly discuss about their legal liability.

A: The answer is stated below:

Q: Searchlight, Inc. uses ROI to evaluate operations and requires the return on its operating units to…

A: Business organizations compute the ROI so as to know how much the investor receive in comparison to…

Q: Withdrawals by an owner are found on the income statement as an expense True False

A: The income statement indicates the profitability of the company. The income statement contains the…

Q: In 2016, Natural Selection, a nationwide computer dating service, had $532 million of assets and…

A: Principal and Interest = Interest payment+Principal payment/1-tax rate+Dividends/1-tax rate=…

Q: Prepare Profit and Loss Appropriation Account and partners’ capital accounts assuming that their…

A: Roaa and Salma were partners in a firm sharing profits in the ratio of their capitals contributed on…

Q: Use the following financial information to find the entry you would make on an income statement for…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: ~Why would investors provide a business with cash? ~ Why must a business provide an income statement…

A: Answer:- Investors provide a business with cash:- A company may satisfy its daily business demands…

Q: Sales Revenue $ 58,000 Finished Goods Inventory, Beginning 9,000 Finished Goods Inventory, Ending…

A: Given that, Gross margin = $25,000 Sales revenue = $58,000 Operating income = $14,000

Q: 1. Compute over- or underapplied overhead. 2a. Which accounts will be affected by the over- or…

A:

Q: Cash Basis of Accounting and Accrual Basis of Accounting

A: Accounting is the process which involves the recording of transactions, posting them into ledgers,…

Q: *PROVIDE THE ADJUSTING ENTRIES. *PREPARE THE WORKSHEET UP TO BALANCE SHEET

A:

Q: Which of the following is true regarding adjusting entries? O a. Adjusting entries are dated as of…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: The following balances were extracted from the books of AL Masa Cleaning Services at 31st December,…

A: The net income or loss is calculated as difference between total revenue and total expenses…

Q: : a. Calculate the service department costs allocated to each production department. b. In general,…

A:

Q: The operating cash flow margin describes how much net cash the business generated from each dollar…

A: Introduction:- A cash flow statement denotes total amount cash is inflows and cash outflows your…

Q: Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,852. The useful…

A: Straight Line Method of Depreciation: In this method an equal amount is charged or written off…

Q: flows. Period (Year) Cost (Initial Net cash flow Cost (Initial Outlay) Net cash flow Outlay) $45,000…

A:

Q: Inventory excludes a) © Raw materials b) Finished goods produced c) Construction works in…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Vaughn Corporation’s comparative balance sheets are presented below. VAUGHN CORPORATION Comparative…

A: Cash Flow Statement (Indirect Method) For the year ended December 31, 2022 Cash Flow from…

Step by step

Solved in 3 steps with 4 images

- Determine which alternative, if any, should be chosen based on Annual Worth method using 15% MARR. Use Repeatability Method. Note: Show final answer to the nearest WHOLE NUMBER and show complete solution Answer the following: a. The Annual Worth of Alternative A is = $ Blank 1 b. The Annual Worth of Alternative B is = $ Blank 2 c. Choose Alternative (Type only A or B) = Blank 3Compare the alternatives below on the basis of their capitalized costs with adjustments made for inflation. Use i =12% per year and f = 3% per year. Alternative X Y First cost, $ −18,500,000 −9,000,000 AOC, $ per year −25,000 −10,000 Salvage value, $ 105,000 82,000 Life, years ∞ 10The B.T. Knight Corporation is considering two mutually exclusive pieces of machinery that perform the same task. The two alternatives available provide the following set of after-tax net cash flows: Year Equipment A Equipment B 0 ($3,100) ($3,380) 1-3 1,426 1-4 1,204 NPV at 11% 385 355 1. Determine which model should be purchased using the Replacement Chain (RC) method. 2. Calculate the equivalent annual annuity (EAA) for each model.

- Internal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $57,100 and annual net cash flows of $20,000 for each of the four years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal…The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $60,465 and annual net cash flows of $15,000 for each of the nine years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. %nternal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $49,332 and annual net cash flows of $12,000 for each of the six years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places.fill in the blank 1 b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine…

- The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $106,700 and annual net cash flows of $20,000 for each of the eight years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places.fill in the blank 1 b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of…Compare three alternatives on the basis of their capitalized costs at i = 13% per year and select the best alternative. Alternative E F G First Cost $-85,000 $-325,000 $-825,000 AOC, per Year $-65,000 $-20,000 $-6,000 Salvage Value $25,000 $75,000 $500,000 Life, Years 2 4 ∞ The capitalized cost of alternative E is $ , alternative F is $ , and alternative G is $ . The best alternative is E G F .Internal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $83,200 and annual net cash flows of $20,000 for each of the seven years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places.fill in the blank 1 b. Using the factor determined in part (a) and the present value of an annuity of $1 table above,…

- Internal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $80,028 and annual net cash flows of $19,000 for each of the five years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places.fill in the blank 1 b. Using the factor determined in part (a) and the present value of an annuity of $1 table above,…Internal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $113,550 and annual net cash flows of $30,000 for each of the six years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1, which can be used in determining the internal rate of return. If required, round your answer to three decimal places.fill in the blank 1 b. Using the factor determined in part (a) and the present value of an annuity of $1 table above,…Estimate the value of the property using the income approach based on the following facts: Net operating income annually for next 3 years is $400000 At end of three years, property is sold with an existing cap rate of 10% and a commission of 4% on sale The discount cap rate is the same as the existing cap rate and the operating income is assumed to be received at year end