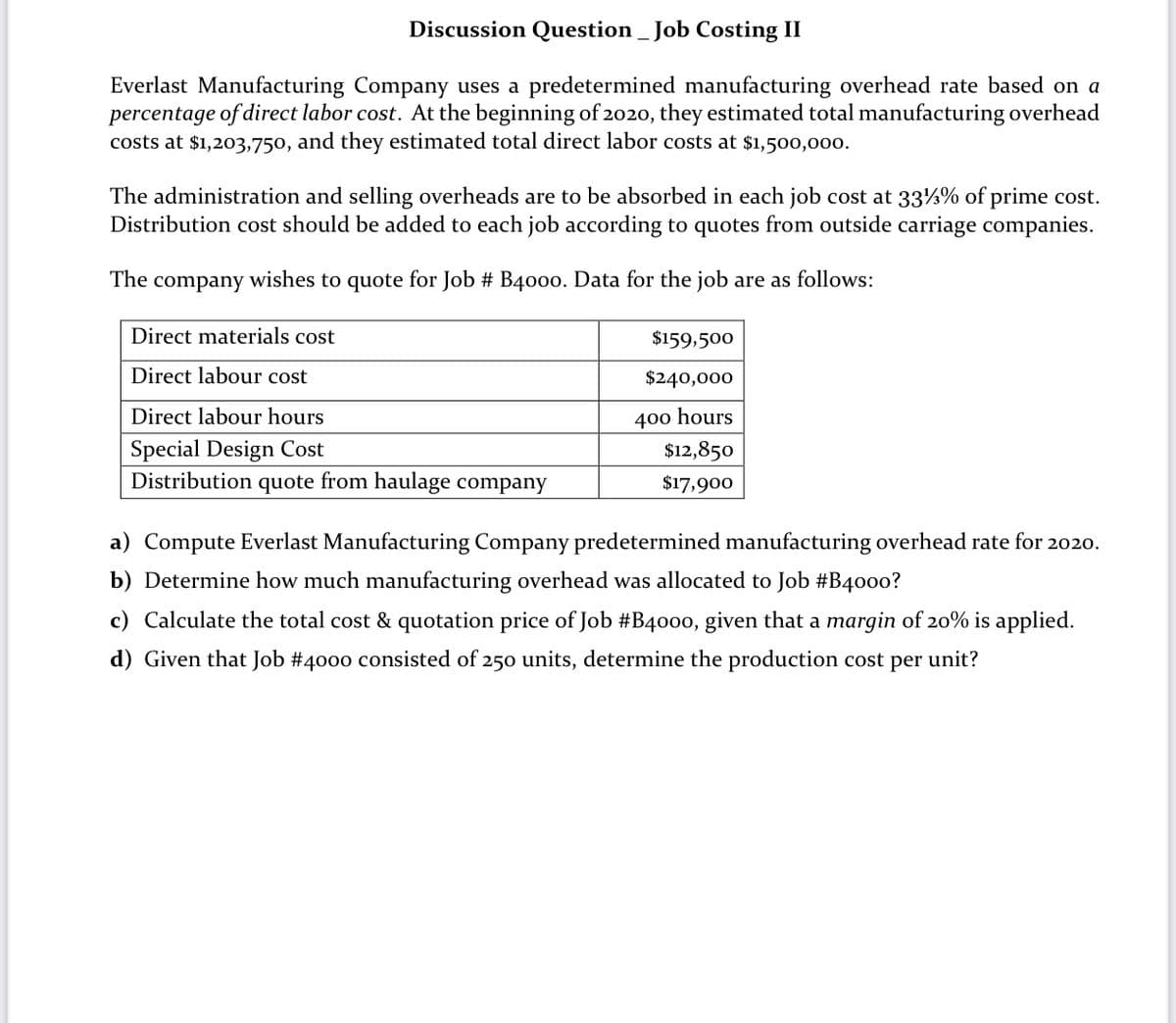

Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead costs at $1,203,750, and they estimated total direct labor costs at $1,500,0oo. The administration and selling overheads are to be absorbed in each job cost at 33%% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for Job # B400o. Data for the job are as follows: Direct materials cost $159,500 Direct labour cost $240,000 400 hours $12,850 Direct labour hours Special Design Cost Distribution quote from haulage company $17,900 a) Compute Everlast Manufacturing Company predetermined manufacturing overhead rate for 2020. b) Determine how much manufacturing overhead was allocated to Job #B4000? c) Calculate the total cost & quotation price of Job #B4000, given that a margin of 20% is applied. d) Given that Job #4000 consisted of 250 units, determine the production cost per unit?

Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead costs at $1,203,750, and they estimated total direct labor costs at $1,500,0oo. The administration and selling overheads are to be absorbed in each job cost at 33%% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for Job # B400o. Data for the job are as follows: Direct materials cost $159,500 Direct labour cost $240,000 400 hours $12,850 Direct labour hours Special Design Cost Distribution quote from haulage company $17,900 a) Compute Everlast Manufacturing Company predetermined manufacturing overhead rate for 2020. b) Determine how much manufacturing overhead was allocated to Job #B4000? c) Calculate the total cost & quotation price of Job #B4000, given that a margin of 20% is applied. d) Given that Job #4000 consisted of 250 units, determine the production cost per unit?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 4BE: Applying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000...

Related questions

Question

Need answer and working out for these questions.

Transcribed Image Text:Discussion Question _ Job Costing II

Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a

percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead

costs at $1,203,750, and they estimated total direct labor costs at $1,500,000.

The administration and selling overheads are to be absorbed in each job cost at 33½% of prime cost.

Distribution cost should be added to each job according to quotes from outside carriage companies.

The

company

wishes to quote for Job # B400o. Data for the job are as follows:

Direct materials cost

$159,500

Direct labour cost

$240,000

Direct labour hours

400 hours

Special Design Cost

$12,850

Distribution

quote

from haulage company

$17,900

a) Compute Everlast Manufacturing Company predetermined manufacturing overhead rate for 2020.

b) Determine how much manufacturing overhead was allocated to Job #B40o0?

c) Calculate the total cost & quotation price of Job #B4000, given that a margin of 20% is applied.

d) Given that Job #4000 consisted of 250 units, determine the production cost per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning