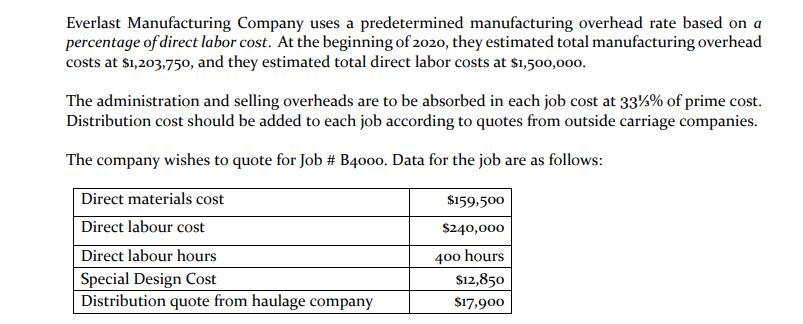

Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead costs at $1,203,750, and they estimated total direct labor costs at $1,500,000.

Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead costs at $1,203,750, and they estimated total direct labor costs at $1,500,000.

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 3PB: Event Forms expects $120,000 in overhead during the next year. It doesn't know whether it should...

Related questions

Question

a) Compute Everlast Manufacturing Company predetermined manufacturing

b) Determine how much manufacturing overhead was allocated to Job #B4000?

c) Calculate the total cost & quotation price of Job #B4000, given that a margin of 20% is applied.

Transcribed Image Text:Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a

percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead

costs at $1,203,750, and they estimated total direct labor costs at $1,500,00o.

The administration and selling overheads are to be absorbed in each job cost at 33%% of prime cost.

Distribution cost should be added to each job according to quotes from outside carriage companies.

The company wishes to quote for Job # B4000. Data for the job are as follows:

Direct materials cost

$159,500

Direct labour cost

$240,000

400 hours

$12,850

Direct labour hours

Special Design Cost

Distribution quote from haulage company

$17,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub