Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below: 2021 2020 Accounts receivable Merchandise inventory Net sales Cost of goods sold Total assets Total shareholders' equity $78,000 $ 55,000 47,000 73,000 305, 900 300, 000 152, 000 127, 000 463, 000 424,000 278,000 244,000 Net income 61, 000 47,000

Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below: 2021 2020 Accounts receivable Merchandise inventory Net sales Cost of goods sold Total assets Total shareholders' equity $78,000 $ 55,000 47,000 73,000 305, 900 300, 000 152, 000 127, 000 463, 000 424,000 278,000 244,000 Net income 61, 000 47,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 16MCQ: ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory...

Related questions

Question

Transcribed Image Text:II- Chapter 4

Saved

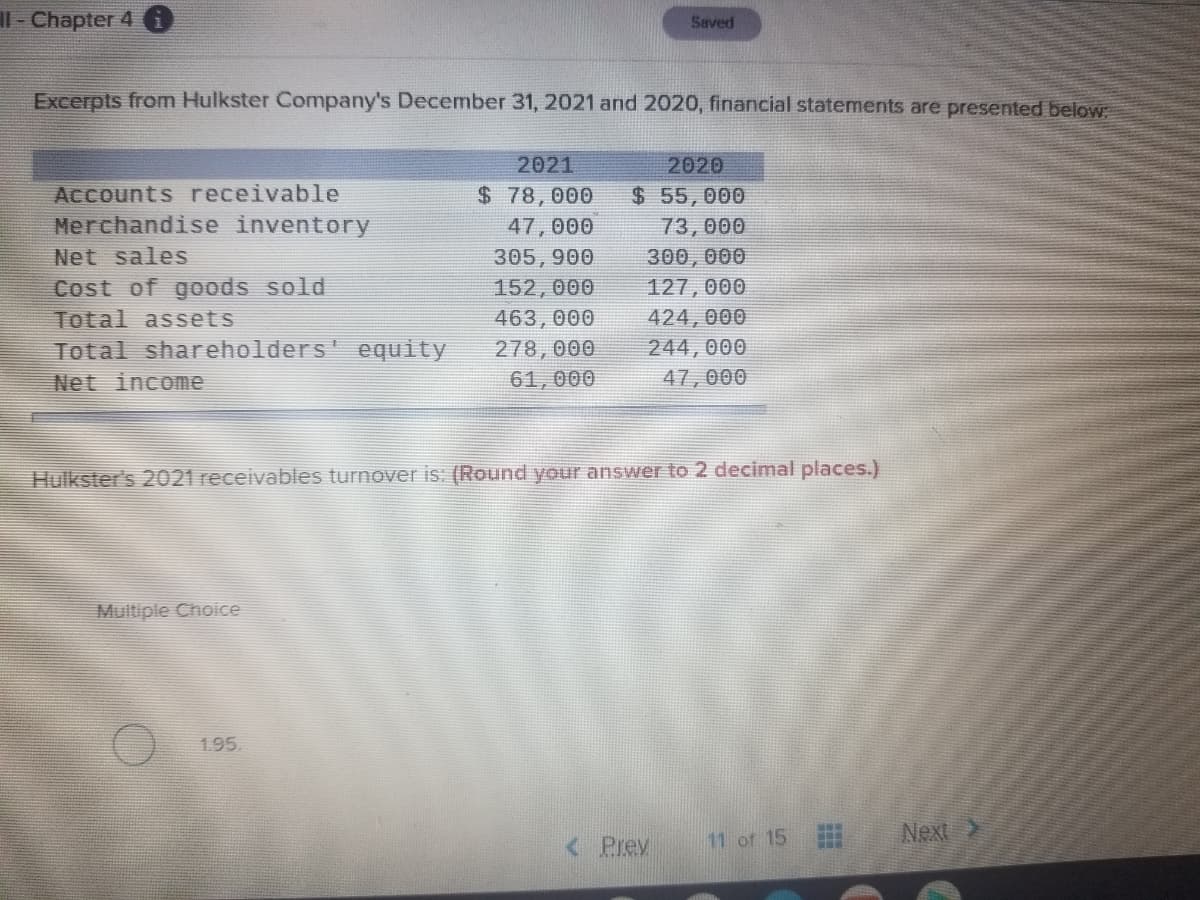

Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below:

2021

2020

ACcounts receivable

Merchandise inventory

Net sales

Cost of goods sold

$78,000

47,000

$55,000

73,000

300, 000

127, 000

305,900

152, 000

424,000

244,000

Total assets

463,000

Total shareholders' equity

278,000

61,000

Net income

47,000

Hulkster's 2021 receivables turnover is: (Round your answer to 2 decimal places.)

Multiple Choice

1.95.

11 of 15

Next >

< Prev

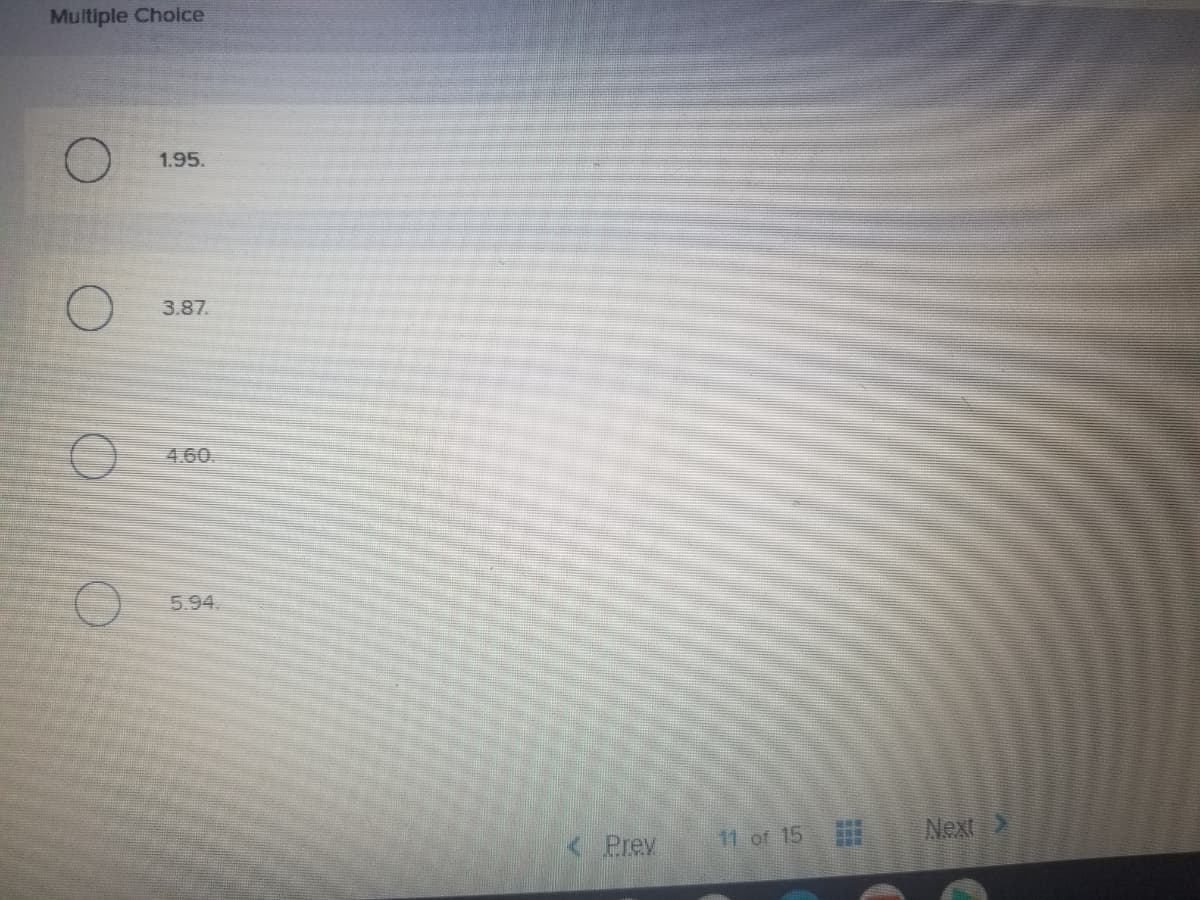

Transcribed Image Text:Multiple Choice

1.95.

3.87.

4.60.

5.94.

11 of 15

Next

< Prev

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning