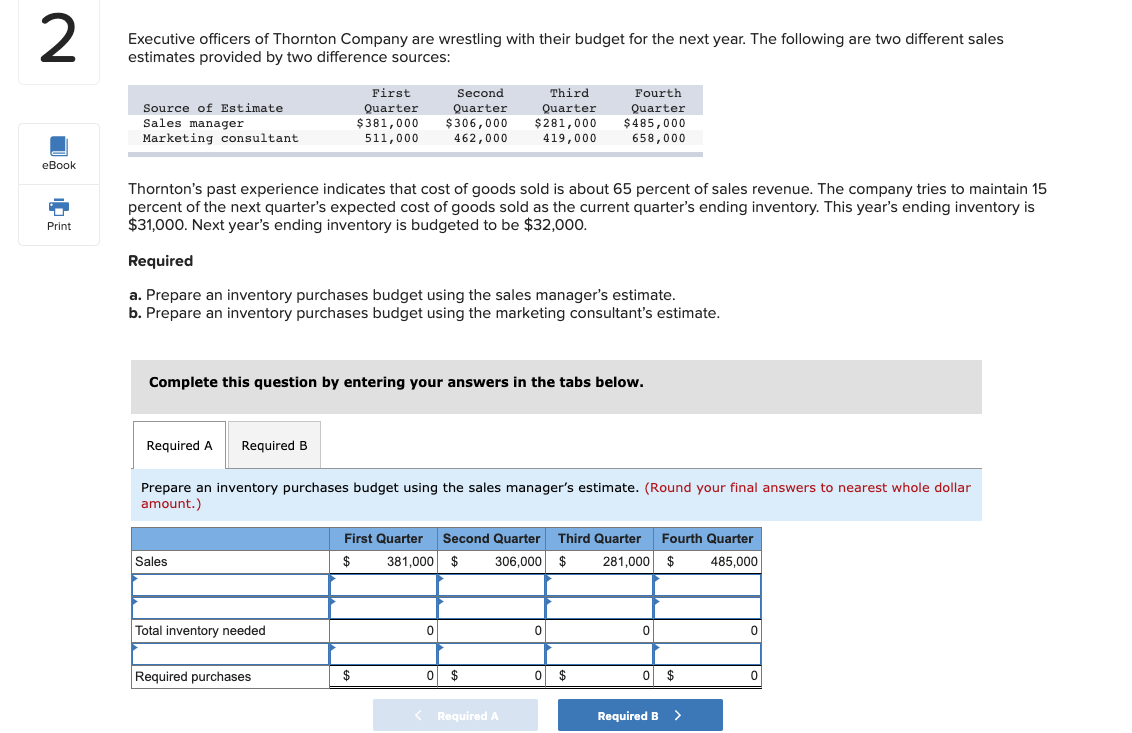

Executive officers of Thornton Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two difference sources: First Second Third Fourth Quarter $485,000 658,000 Source of Estimate Sales manager Marketing consultant Quarter $381,000 Quarter $306,000 462,000 Quarter $281,000 419,000 511,000 Thornton's past experience indicates that cost of goods sold is about 65 percent of sales revenue. The company tries to maintain 15 percent of the next quarter's expected cost of goods sold as the current quarter's ending inventory. This year's ending inventory is $31,000. Next year's ending inventory is budgeted to be $32,000. Required a. Prepare an inventory purchases budget using the sales manager's estimate. b. Prepare an inventory purchases budget using the marketing consultant's estimate. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an inventory purchases budget using the sales manager's estimate. (Round your final answers to nearest whole dollar amount.) First Quarter Second Quarter Third Quarter Fourth Quarter $ 381,000 $ 306,000 $ 281,000 $ 485,000 Sales Total inventory needed Required purchases O $ O $ %24

Executive officers of Thornton Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two difference sources: First Second Third Fourth Quarter $485,000 658,000 Source of Estimate Sales manager Marketing consultant Quarter $381,000 Quarter $306,000 462,000 Quarter $281,000 419,000 511,000 Thornton's past experience indicates that cost of goods sold is about 65 percent of sales revenue. The company tries to maintain 15 percent of the next quarter's expected cost of goods sold as the current quarter's ending inventory. This year's ending inventory is $31,000. Next year's ending inventory is budgeted to be $32,000. Required a. Prepare an inventory purchases budget using the sales manager's estimate. b. Prepare an inventory purchases budget using the marketing consultant's estimate. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an inventory purchases budget using the sales manager's estimate. (Round your final answers to nearest whole dollar amount.) First Quarter Second Quarter Third Quarter Fourth Quarter $ 381,000 $ 306,000 $ 281,000 $ 485,000 Sales Total inventory needed Required purchases O $ O $ %24

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 40P

Related questions

Question

Having an issue with this problem. A & B

Thank you

Transcribed Image Text:Executive officers of Thornton Company are wrestling with their budget for the next year. The following are two different sales

estimates provided by two difference sources:

First

Second

Third

Fourth

Quarter

$485,000

658,000

Source of Estimate

Sales manager

Marketing consultant

Quarter

$381,000

Quarter

$306,000

462,000

Quarter

$281,000

419,000

511,000

Thornton's past experience indicates that cost of goods sold is about 65 percent of sales revenue. The company tries to maintain 15

percent of the next quarter's expected cost of goods sold as the current quarter's ending inventory. This year's ending inventory is

$31,000. Next year's ending inventory is budgeted to be $32,000.

Required

a. Prepare an inventory purchases budget using the sales manager's estimate.

b. Prepare an inventory purchases budget using the marketing consultant's estimate.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare an inventory purchases budget using the sales manager's estimate. (Round your final answers to nearest whole dollar

amount.)

First Quarter Second Quarter Third Quarter Fourth Quarter

$

381,000 $

306,000 $

281,000 $

485,000

Sales

Total inventory needed

Required purchases

O $

O $

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College