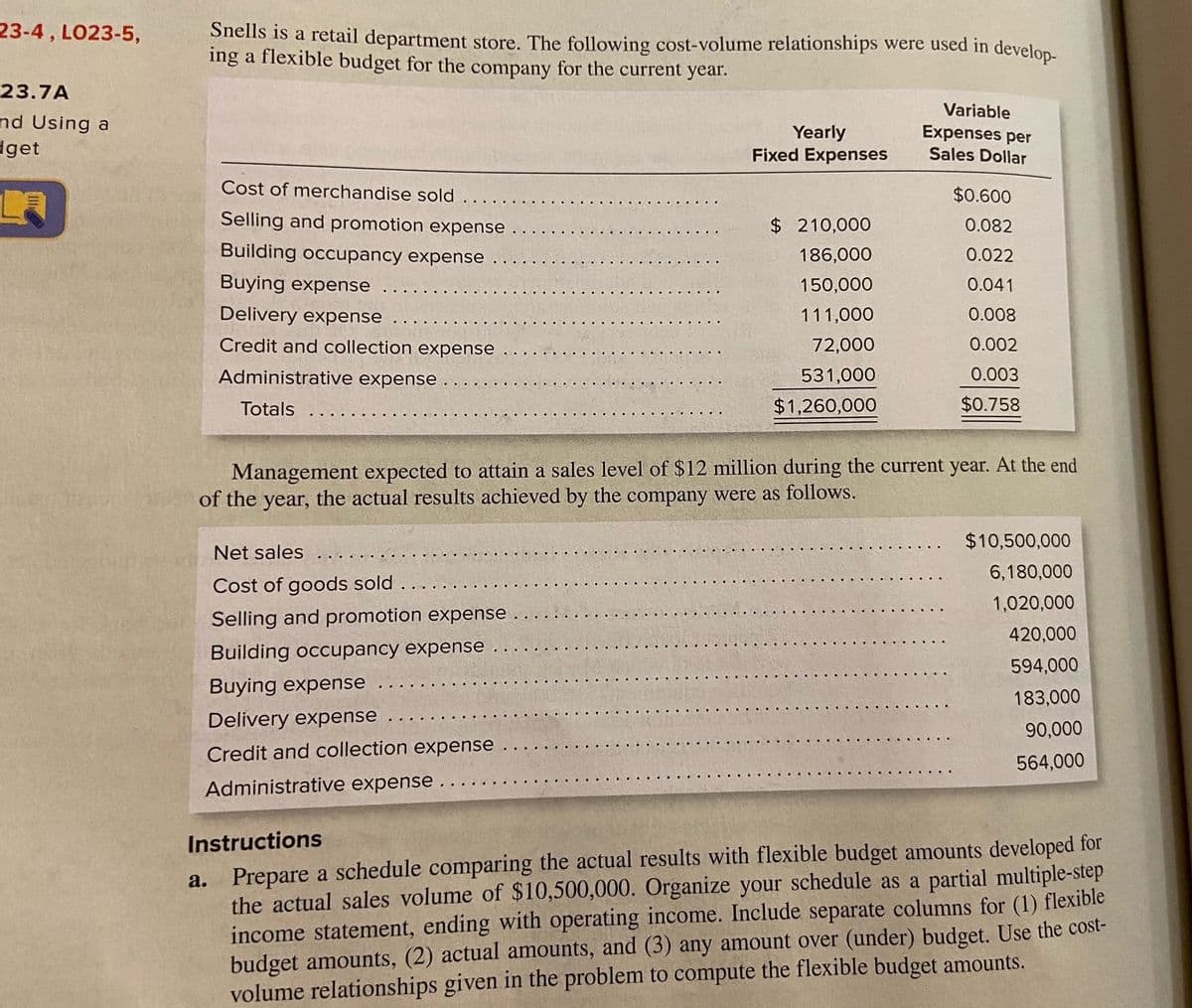

Snells is a retail department store. The following cost-volume relationships were used in develop- ing a flexible budget for the company for the current year. Yearly Fixed Expenses Variable Expenses per Sales Dollar Cost of merchandise sold $0.600 Selling and promotion expense $ 210,000 0.082 Building occupancy expense 186,000 0.022 Buying expense 150,000 0.041 Delivery expense 111,000 0.008 Credit and collection expense 72,000 0.002 Administrative expense 531,000 0.003 Totals $1,260,000 $0.758 Management expected to attain a sales level of $12 million during the current year. At the end of the year, the actual results achieved by the company were as follows. $10,500,000 Net sales 6,180,000 Cost of goods sold 1,020,000 Selling and promotion expense 420,000 Building occupancy expense 594,000 Buying expense 183,000 Delivery expense 90,000 Credit and collection expense 564,000 Administrative expense a. Prepare a schedule comparing the actual results with flexible budget amounts developed for the actual sales volume of $10,500,000. Organize your schedule as a partial multiple-step income statement, ending with operating income. Include separate columns for (1) flexible budget amounts, (2) actual amounts, and (3) any amount over (under) budget. Use the cost- volume relationships given in the problem to compute the flexible budget amounts. Instructions

Snells is a retail department store. The following cost-volume relationships were used in develop- ing a flexible budget for the company for the current year. Yearly Fixed Expenses Variable Expenses per Sales Dollar Cost of merchandise sold $0.600 Selling and promotion expense $ 210,000 0.082 Building occupancy expense 186,000 0.022 Buying expense 150,000 0.041 Delivery expense 111,000 0.008 Credit and collection expense 72,000 0.002 Administrative expense 531,000 0.003 Totals $1,260,000 $0.758 Management expected to attain a sales level of $12 million during the current year. At the end of the year, the actual results achieved by the company were as follows. $10,500,000 Net sales 6,180,000 Cost of goods sold 1,020,000 Selling and promotion expense 420,000 Building occupancy expense 594,000 Buying expense 183,000 Delivery expense 90,000 Credit and collection expense 564,000 Administrative expense a. Prepare a schedule comparing the actual results with flexible budget amounts developed for the actual sales volume of $10,500,000. Organize your schedule as a partial multiple-step income statement, ending with operating income. Include separate columns for (1) flexible budget amounts, (2) actual amounts, and (3) any amount over (under) budget. Use the cost- volume relationships given in the problem to compute the flexible budget amounts. Instructions

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter13: Budgeting And Standard Costs

Section: Chapter Questions

Problem 13.2.6P: Budgeted income statement and supporting budgets The budget director of Jupiter Helmets Inc., with...

Related questions

Question

23.7A

Transcribed Image Text:1029

b. Write a statement evaluating the company's performance in relation to the plan reflected in the

flexible budget.

ronorts in nlanning and controlling

Transcribed Image Text:23-4, LO23-5,

Snells is a retail department store. The following cost-volume relationships were used in develop-

ing a flexible budget for the company for the current year.

23.7A

nd Using a

dget

Yearly

Fixed Expenses

Variable

Expenses per

Sales Dollar

Cost of merchandise sold

$0.600

Selling and promotion expense

$210,000

0.082

Building occupancy expense

186,000

0.022

Buying expense

150,000

0.041

Delivery expense

111,000

0.008

Credit and collection expense

72,000

0.002

Administrative expense .

531,000

0.003

Totals

$1,260,000

$0.758

Management expected to attain a sales level of $12 million during the current year. At the end

of the year, the actual results achieved by the company were as follows.

$10,500,000

Net sales

6,180,000

Cost of goods sold ....

1,020,000

Selling and promotion expense

420,000

Building occupancy expense

594,000

Buying expense

183,000

Delivery expense

90,000

Credit and collection expense

564,000

Administrative expense.

a. Prepare a schedule comparing the actual results with flexible budget amounts developed for

the actual sales volume of $10,500,000. Organize your schedule as a partial multiple-step

income statement, ending with operating income. Include separate columns for (1) flexible

budget amounts, (2) actual amounts, and (3) any amount over (under) budget. Use the cost-

volume relationships given in the problem to compute the flexible budget amounts.

Instructions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning