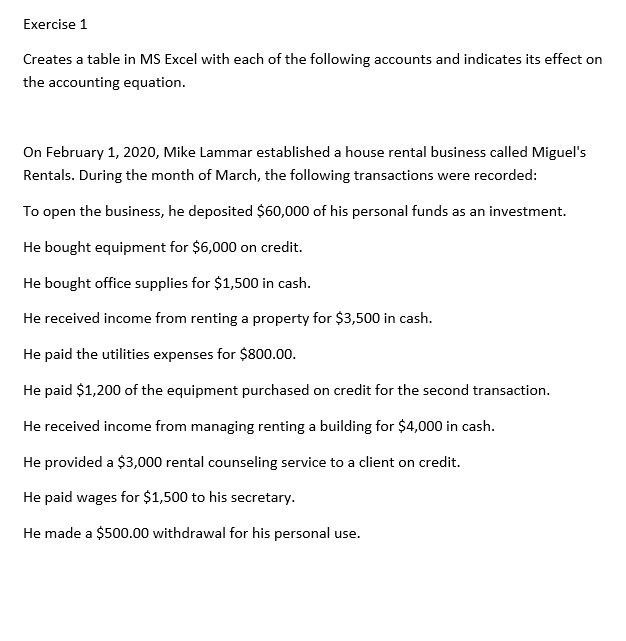

Exercise 1 Creates a table in MS Excel with each of the following accounts and indicates its effect on the accounting equation. On February 1, 2020, Mike Lammar established a house rental business called Miguel's Rentals. During the month of March, the following transactions were recorded: To open the business, he deposited $60,000 of his personal funds as an investment. He bought equipment for $6,000 on credit. He bought office supplies for $1,500 in cash. He received income from renting a property for $3,500 in cash. He paid the utilities expenses for $800.00. He paid $1,200 of the equipment purchased on credit for the second transaction. He received income from managing renting a building for $4,000 in cash. He provided a $3,000 rental counseling service to a client on credit. He paid wages for $1,500 to his secretary. He made a $500.00 withdrawal for his personal use.

Q: Problem 1. Mr. Amer started his Car Repair Business in Muscat in June 2020. During the month of…

A: The financial statements of the business including income statement and balance sheet are prepared…

Q: form the Journal entry of the given transaction: Judy Mason completed these transactions during the…

A: Journal entry: A Journal entry is used to record a business transaction in the accounting records of…

Q: Linda Williams started her own consulting firm, Linda Consulting, on May 1, 2022. The following…

A: As per Accounting Equation,Assets =Liabilities +Shareholder's equity

Q: On September 1 of the current year, Judith established Rapid Reality. Faith completed the following…

A: Since you have posted a question with multiple question we will solve the first question for you if…

Q: Elena Bellisario began a new consulting firm on January 3. The accounting equation showed the…

A: The accounting equation is the equation that describes the transaction in accounting form. The…

Q: Q1: Ahmad started his own Computer service on January 1, 2020. The following transactions occurred…

A: The accounting equation is as follows Assets=Liabilities+owner's equity

Q: 1. CtSha Enterprise started a new business on 1 of September 2020. You are required to record the…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Use the Following information for the Question Numbers 5 to 10. Mr. Salah opened the accounting…

A: Accounting equation is the one which is the foundation of the accounting system named double entry.…

Q: A- The two main sets of accounting standards followed by businesses are GAAP and IFRS. Briefly…

A: (A). The following is a brief explanation about balance sheet under generally accepted accounting…

Q: Tollow ansacti books of • Mr. Anwar decide to start a business of Computer Service Business that…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: (For items 1 and 2). Read and analyze the following transactions taken from the book of XYZ Services…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: TransactionsOn April 1 of the current year, Morgan Jones established a business tomanage rental…

A: SOLUTION- ACCOUNTING EQUATION- ACCOUNTING EQUATION IS A ACCOUNTING TOOL EXPRESSED IN THE FORM OF…

Q: Question 1 Alan runs his own e-marketing consulting business called Alan E-Marketing. On 1st January…

A: In the above journal entries, the first one is purchased of equipment, and in the second entry,…

Q: The following transactions are taken from the books of Mr. Noushad for the month of May 2020. May 1…

A: Journal is a place where journal entries are recorded in the book keeping system before ledger…

Q: Make a Financial transaction worksheet that summarizes the effects of these transactions on the…

A: Solution Concept Accounting equation is expressed as Asset = liabilities + equity Assets include…

Q: The accounting practice of George Ongkeko, CPA opened on December 1, 2019. It had the following…

A: Journal Entries are primary record prepared by an entity for the occurrence or non-occurrence of an…

Q: Creates the T accounts for the submitted transactions. During the month of May 2020, Bruno Ayala, an…

A: Journal entry of the above transaction is as follows:

Q: PROBLEM: Mr. Min Jimin established the MinJi Car Rental Services in August 1, 2021. During the first…

A: Accounting cycle is a cycle through which the process of accounting is performed and it includes…

Q: Transactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat…

A: The accounting equation describes the total of all assets are equals to total liabilities and…

Q: Transactions On April 1 of the current year, Morgan Jones established a business to manage rental…

A: A cause and effect relationship is always there in every transaction. Accounts receivable, for…

Q: 1. Indicate the effect of each transaction and the balances after each transaction: For those boxes…

A: Given: Business bank deposit = $ 45,000 Purchased office supplies = $ 2,000. Cash received from fees…

Q: 2. M. Knight owns a business called "Accounting Done Right" which has the following account balances…

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as at the…

Q: A B Loida Cardenas recently established her own business, which she called Cardenas Delivery…

A:

Q: Analyze these transactions and prepare a table to show their effect on the accounting equation.…

A: The accounting equation is the fundamental equation of the double-entry bookkeeping system.…

Q: For the past several years, Jolene Upton has operated a part-time consulting business from her home.…

A: Journal Entry - It is record of every business transaction whether it is economic or non economic…

Q: 1. Ahmadi started a new business on 1 of March 2020. You are required to record the following…

A: Machinery is described as fixed asset of the entity. It is used by the entity to manufacture goods…

Q: Transactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat…

A: Accounting equation is to be considered as the origination of double entry system where all the…

Q: Transactions On June 1 of the current year, Chad Wilson established a business to manage rental…

A: The accounting equation refers to the equation of balance sheet. It is based on the method of total…

Q: Question Hyun Bin opened his computer repair services shop on November 30, 2018. The following…

A: Adjusted trial balance: It is worksheet which shows all the accounts an organization has like…

Q: Construct an analysis of the following transaction and use the table: Assets = Liabilities…

A: Journal means the book of prime entry where all entries are recorded in different pages. Ledger…

Q: A- The two main sets of accounting standards followed by businesses are GAAP and IFRS. Briefly…

A: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Ahmad started his own Computer service on January 1, 2020. The following transactions occurred…

A: 1) Accounting Equation: Assets - liabilities = owners' Equity. Owner's Equity = $ 203000.

Q: Using the accounting equation for transaction analysis Meg McKinney opened a public relations firm…

A:

Q: Processing accounting transactions. I have to analyze, record in general journal and post the entry…

A: Analyze the given trnsactions using accounting equation.

Q: Use the Following information for the Question Numbers 5 to 10. Mr. Salah opened the accounting…

A: 5. Analyze the transaction by using an accounting equation : Transaction Assets…

Q: Q1: Ahmad started his own Computer service on January 1, 2020. The following transactions occurred…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Q: Problem 1. Mr. Asif started his Computer Repair Business in Salalah in July 2020. During the month…

A: Accounting is the detailed process of bookkeeping. Under this process, various steps are performed…

Q: Analyze these transactions and prepare a table to show their effect on the accounting equation.…

A: The accounting equation forms the basis of the double-entry system of equation. The equation is…

Q: Problem 1 Ms. Shaima, a professional accountant, started to practice her profession in Nizwa on May…

A: a) Journal Enteries

Q: Sophie Lacson started her own consulting firm, Lacson Consulting, on September 1, 2019. The…

A: Debit and credit are two aspects of a business transaction. These are used in double entry system of…

Q: Post the journal entries to T accounts (use Section II template). Prepare adjusting journal…

A: Final Accounts Final Accounts are the accounts that is prepared at the end of a financial year.…

Q: After taking into account the transactions of Choy, please answer Questions 1 -10. Choy, after…

A:

Q: Transactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat…

A: The Numerical has covered the concept of the Accounting Equation. The accounting equation, also…

Q: Exercise 3 Creates a table in MS Excel with each of the following accounts and indicates its effect…

A: Accounting equation is prepared to show the effect of a transaction on the assets, liabilities and…

Q: Q3. On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: Journal entry is defined as recording of business transactions into the books of accounts of the…

Q: TransactionsOn June 1 of the current year, Chad Wilson established a business tomanage rental…

A: The accounting equation states that assets must equal to sum of liabilities and owners' equity.

Q: After taking into account the transactions of Choy, please answer Questions 1 -10. Choy, after…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Question 1. Mrs. Blue, the owner of Blue Moon Company, formed an architectural office at the…

A: Journal entries shows the recording of transaction during an accounting year.

Q: Transactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat…

A: The accounting equation records the transactions in equation for such as assets equal to sum of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 1620, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 2631, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.Comprehensive problem 1 Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement. 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 1-15; 9,180. 16. Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 1-16, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 16-20, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 17-23, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Paid dividends, 10,500. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account 34 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.

- The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.SERIES A PROBLEMS THE ACCOUNTING EQUATION Dr. John Salvaggi is a chiropractor. As of December 31, he owned the following property that related to his professional practice. REQUIRED 1. From the preceding information, compute the accounting elements and enter them in the accounting equation shown as follows. 2. During January, the assets increase by 8,540, and the liabilities increase by 3,360. Compute the resulting accounting equation. 3. During February, the assets decrease by 3,460, and the liabilities increase by 2,000. Compute the resulting accounting equation.J. Carrie established Carries Photo Tours during June of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month of June: a. Carrie deposited 30,000 cash in a bank account in the name of the business. b. Bought office equipment for cash, 1,850, Ck. No. 1001 c. Bought computer software from Moreys Computer Center, 640, paying 350 in cash and placing the balance on account, Ck. No. 1002. d. Paid current months rent, 950, Ck. No. 1003. e. Sold services for cash, 1,575. f. Bought a neon sign from The Sign Company, 1,335, paying 435 in cash and placing the balance on account, Ck. No. 1004. g. Received bill from The Gossiper for advertising, 445. h. Bought supplies on account from City Supply, 460. i. Received and paid the electric bill, 380, Ck. No. 1005. j. Paid on account to The Gossiper, 245, Ck. No. 1006. k. Sold services for cash, 3,474. l. Paid wages to an employee, 930, Ck. No. 1007. m. Carrie invested his personal computer with a fair market value of 1,000 in the business. n. Carrie withdrew cash for personal use, 800, Ck. No. 1008. o. Received and paid the bill for city business license, 75, Ck. No. 1009. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated June 30, 20--.

- Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.Transactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April: a. Opened a business bank account with a deposit of 24,000 in exchange for common stock. b. Paid rent on office and equipment for the month, 3,600. c. Paid automobile expenses for month, 1,350, and miscellaneous expenses, 600. d. Purchased supplies on account, 1,200. e. Earned sales commissions, receiving cash, 19,800. f. Paid creditor on account, 750. g. Paid office salaries, 2,500. h. Paid dividends, 3,500. i. Determined that the cost of supplies on hand was 300; therefore, the cost of supplies used was 900. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: 2. Prepare an income statement for April, a statement of stockholders equity for April, and a balance sheet as of April 30.B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.