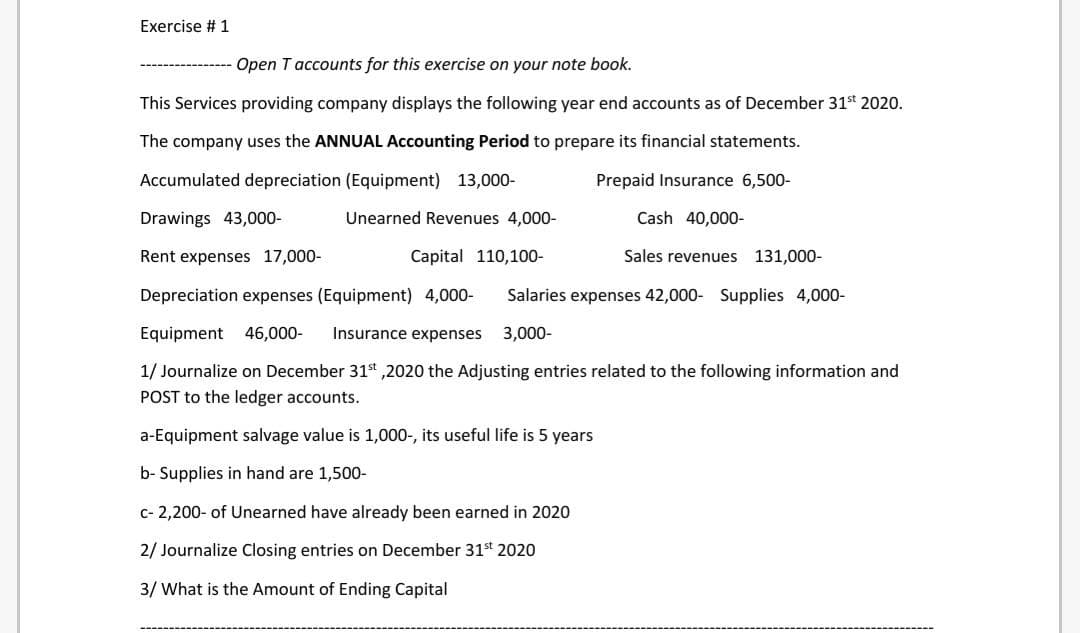

Exercise # 1 Open Taccounts for this exercise on your note book. This Services providing company displays the following year end accounts as of December 31* 2020. The company uses the ANNUAL Accounting Period to prepare its financial statements. Accumulated depreciation (Equipment) 13,000- Prepaid Insurance 6,500- Drawings 43,000- Unearned Revenues 4,000- Cash 40,000- Rent expenses 17,000- Capital 110,100- Sales revenues 131,000- Depreciation expenses (Equipment) 4,000- Salaries expenses 42,000- Supplies 4,000-

Q: ournalizing Transactions Monilast Chemicals engaged in the following transactions during December…

A: In this question, we have to record transactions in the journal which helps us in financial…

Q: ACTIVITY NO. 2 NAME: YR.&SEC. COURSE: DATE The following accounts were taken from the General Ledger…

A: Trial balance is a list of accounts which records each ledger account balance on debit and credit…

Q: fiscal year end is November 30. Accounts Payable-$3,500, Accounts Receivable-$2,300, Cash-$5000,…

A: Balance sheet is considered to be important part of financial statement which shows the entities…

Q: Every entry should have narration please Problem 1 November 19, 2020, BG Ltd purchased a mini…

A: Journal Entry for note. BG Ltd purchased mini excavator for $60000. BG Ltd paid cash of $6000 and…

Q: furniture borrower Воx Statemen creditors buildings 50000 150000 125000 75000 100000 first term…

A: Accounting equation is the equation which is used to prepare the balance sheets. It is; Assets =…

Q: usty Krab Inc. started business on January 1, 2022. Record the required journal entry (F-I) or…

A: Basic Accounting Concept Journal Entries

Q: Use the following question to answer next 10 Questions. Comprehensive Problem Dell Company is…

A: Here student asked for Multi sub part question we will solve first three sub part question for you.…

Q: How would you journalize the closing entries for the month ended April 31, 2024? (*You credit…

A: Journal Entry: Keeping or creating records of any transactions, whether economic or non-economic, is…

Q: Prepare the ORIGINAL ENTRY and REVERSING ENTRIES at January 2, 20x3. 1. The note amounting to…

A: The journal entries and the reversing entries are to be made for the given transactions.

Q: general journal adjusting entry on December 31, 2021

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: Preparing the Worksheet, Adjusting and Closing entries, and Financial Statements.…

A: Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings…

Q: PROBLEM 4 Dial Corp.'s accounts payable at December 31, 2020, totaled P800,000 before any necessary…

A: 4. The purchase of goods is normally considered when the seller transfers the risks and rewards…

Q: Gas and Oil Expense Interest Expense Total 75,000 10,000 6,961,350 6,961,350 ing information were…

A: Journal Entries: It is the process to record the business transaction by way of debit and credit…

Q: 3.12

A: 3.12: a. Income statement and retained earnings statement is prepared as follows: Ending…

Q: Blackberry Mountain Inc began business on January 1, 2020. The following transactions occurred…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Please document all journal entries for each month, January through March. - $65,000 Insurance…

A: Journal entries are first step in accounting to record business event. It always consist two parts…

Q: Blackberry Mountain Inc began business on January 1, 2020. The following transactions occurred…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Blackberry Mountain Inc began business on January 1, 2020. The following transactions occurred…

A: As you have posted multiple independent questions, we are answering the first question. Kindly…

Q: please help

A: Calculate the net accounts receivable at the end of the year.

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: Carry out the adjustment journal entries on 31 December 20X1 (accounting year 01.01-31.12) of the…

A:

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: 1. Fee received in advance:

Q: help

A: 1. Prepare the journal entries for each date.

Q: Use the following list of transactions and the balance sheet for 2019 of ABC Ltd. to prepare: a)…

A: The income statement determines the net income of the business by subtracting the total expenses…

Q: ANSWER THE WORKSHEET USING THE JOURNAL entries apr 2022 Transactions PARTICULARS DR. CR. 4…

A: Worksheet is prepared in order to assist preparation of financial statements. This is a 10 column…

Q: The adjusted trial balance for Cullumber Bowling Alley at December 31, 2020, contains the following…

A:

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: A journal is a book of original entry in which all the financial transactions of the business are…

Q: Service Revenue Kibitz Fitness received $24,000 from customers on August 1, 2022. These payments…

A: Unearned Service Revenues: Unearned service revenues are the payment that is received in advance,…

Q: IVANHOE COMPANY Worksheet (partial) For the Month Ended April 30, 2020 Adjusted Trial Balance Income…

A: In the Double Entry System one important thing is that the Total of the Debit should be equal to the…

Q: JAY CESAR SYSTEM DEVELOPER TRIAL BALANCE DECEMBER 31, 2019 DEBIT CREDIT CASH NOTES RECEIVABLE…

A: Working Notes: 1. Office Supplies Expense = [P63,000 - P21,000] = P42,000 2. Unearned consulting…

Q: Prepare the adjusting entries on December 31, 2020 and the adjusted trial balance.

A: The first question is answered for you. Please resubmit specifying the question number you want…

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: 1. Record adjustment journal entry for rent as shown below:

Q: 3. Spring Water Corporation has the following selected accounts at March 31, 2020 after posting…

A: Introduction

Q: Notes Payable Prepare the necessary journal entries for the following transactions: (a)On…

A: Journal entry to record borrowings of 6 months at 8% notes:

Q: Blackberry Mountain Inc began business on January 1, 2020. The following transactions occurred…

A: Step 1 Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for…

Q: An insurance premium of $6,300 was paid on March 1, 2020, and was charged to Prepaid Insurance. The…

A: The question is based on the concept of Financial Accounting.

Q: Required information [The following information applies to the questions displayed below] The…

A: Posting transactions to : Cash Accounts receivable Allowance for Uncollectible Accounts

Q: Instructions: Make the Journal Entry and the Adjusting Entry Hayley Williams operated FarMore…

A: Journal entry is the entry which is recorded in the journal book. These entries are the first entry…

Q: On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the…

A: Calculate the depreciation expenses for one month as follows: Depreciation = ((cost of asset -…

Q: Problem 1. Rebecca Fleming and Carrie Platt borrowed S12,000 on a 7-month, 9% note from Gopher State…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Exercise 1 1. The Creative Electronics Company shows the following selected adjusted account…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Exercise 8. Lola Company's accounting year ends on December 31, 2016. On December 1, Lola signs a…

A: Adjusting journal entry: At year-end when the company finalizes its accounts, any unrecognized…

Q: Activity No.2 Prepare a Report Form of SFP as of December 31, 2020. The following pieces of…

A: Statement of financial position is the financial statement in business, which shows all assets and…

Q: Journalize the transactions for the company. 2. Considering the given transactions only, what are…

A: The current liabilities include the amount to be paid within one year. For example, creditors,…

Q: A company has a fiscal year-end of Dec. 31: (1) On Oct. 1, $12,000 was paid for a one-year fire…

A: Journal: Recording of a business transactions in a chronological order.

plz solve

Step by step

Solved in 2 steps

- Cornerstone Exercise 1-18 Balance Sheet An analysis of the transactions of Cavernous Homes Inc. yields the following totals at December 31, 2019: cash, $3,200; accounts receivable, $4,500; notes payable, $5,000; supplies, $8,100; common stock, $7,000; and retained earnings, 9,800. Required: Prepare a balance sheet for Cavernous Homes Inc. at December 31 , 2019.Exercise 1-38 Identifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing and footwear 10 retail customers. Dunns accountant indicates that the firms operating cycle averages 6 months. At December 31, 2019, Dunn has the following assets and liabilities: Prepaid rent in the amount of 58,500. Dunns rent is $500 per month. A $9,700 account payable due in 45 days. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until September 2020. The items placed in storage should be sold by November 2020. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The remainder are not expected to be sold until 2022. Cash in the amount of $1,050. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019. with the remainder relating to the first 3 months of 2020). An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of 51,250. Required: Prepare the current asset and current liability portions of Dunns December 31, 20191 balance-sheet. Compute Dunns working capital and current ratio at December 31, 2019. CONCEPTUAL CONNECTION As in investor or creditor. what do these ratios tell you about Dunns liquidity?Brief Exercise 3-36 Preparing and Analyzing Closing Entries At December 31, 2019, the ledger of Aulani Company includes the following accounts, all having normal balances: Sales Revenue, cost of Goods sold, $31,000; Retained $20,000; Interest Expense, $3,200; Dividends, $5,000, Wages Expense $5,000, and Interest Payable, $2,100. Required: Prepare the closing entries for Aulani at December 31, 2019. How does the closing process affect Aulanis retained earnings?

- Brief Exercise 3-33 Preparing an Income Statement The adjusted trial balance of Pelton Company at December 31, 2019, includes the following accounts: Wages Expense, $22,400; Service Revenue. Rent Expense, $3,200; Dividends, $4,000; Retained Earnings, $12,200; and Prepaid Rent, $1,000. Required: Prepare a single-step income Statement for Pelton for 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- Journal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.Adjusting Entries Exercise 3-52 Allentown Services Inc. is preparing adjusting entries for the year ending December 31, 2019. The following data are available: Interest is owed at December 31, 2019, on a 6-month, 8% note. Allentown borrowed $120,ooo from NBD on September 1, 2019. Allentown provides daily building maintenance services to Mack Trucks for a quarterly fee of $2,700 payable on the fifteenth of the month following the end of each quarter. No entries have been made for the services provided to Mack Trucks during the quarter ended December 31, and the related bill will not be sent until January 15, 2020. At the beginning of 2019, the cost of office supplies on hand was $1,220. During 2019, office supplies with a total cost of $6,480 were purchased from Office Depot and debited to office supplies inventory. On December 31, 2019, Allentown determined the cost of office supplies on hand to be $970. On September 23, 2019, Allentown received a $7,650 payment from Bethlehem Steel for 9 months of maintenance services beginning on October 1, 2019. The entire amount was credited to unearned service revenue when received. Required: Prepare the appropriate adjusting entries at December 31, 2019. CONCEPTUAL CONNECTION What would be the effect on the balance sheet and the income statement if the accountant failed to make the above adjusting entries?Brief Exercise 3-32 Adjusting Entries-Deferrals Tyndal Company had the following items that required adjustment at December 31, 2019. Purchased equipment for $40,000 on January 1, 2019. Tyndal estimates annual depreciation to be $3,100. Paid $2,400 for a 2-year insurance policy on July 1, 2019. The amount was debited to Pre-paid Insurance when paid. Collected $1,200 rent for the period December 1, 2019 to March 30, 2020. The amount was credited to Unearned Service Revenue when received. Required: Prepare the adjusting entries needed at December 31. CONCEPTUAL CONNECTION What is the effect on the financial statements if these adjusting entries were not made?

- Problem 1-60A Income Statement and Balance Sheet The following information for Rogers Enterprises is available at December 31, 2019 and includes all of Rogers financial statement amounts except retained earnings: Required: Prepare a single-step income statement and a c1assified balance sheet for the year ending December 31, 2019, for Rogers.(Appendix 3.1) Cash-Basis Accounting Puntarelli Contracting keep its accounting records on a cash basis during the year. At year end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2018, Puntarelli reported the following balance sheet items. It is now the end of 2019. The companys checkbook shows a balance of 4,700, which includes cash receipts from customers of 51,300 and cash payments of 49,300. An examination of the cash payments shows that: (1) 30,600 was paid to suppliers, (2) 12,700 was paid for other operating costs (including 7,200 paid on January 1 for 2 years annual rent), and (3) 6,000 was withdrawn by T. Puntarelli. On December 51, 2019, (1) customers owed Puntarelli Contracting 55,900, (2) Puntarelli owed suppliers and employees 7,000 and 900, respectively, and (3) the ending inventory was 6,300. Puntarelli is depreciating the equipment using straight line depreciation over a 10-year life (no residual value). Required: 1. Using accrual based accounting, prepare a 2019 income statement (show supporting calculations). 2. Using accrual-based accounting, prepare a December 31, 2019, balance sheet (show supporting calculations).Problem 3-64B Identification and Preparation of Entries Morgan Dance Inc. provides ballet, tap, and jazz dancing instruction to promising young dancers. Morgan began operations in January 2020 and is preparing its monthly financial statements. The following items describe Morgans transactions in January 2020: Morgan requires that dance instruction be paid in advance-either monthly or quarterly. On January 1, Morgan received $4,125 for dance instruction to be provided during 2020. On January 31, Morgan noted that $825 of dance instruction revenue is still unearned. On January 20, Morgans hourly employees were paid $1,415 for work performed in January. Morgans insurance policy requires semiannual premium payments. Morgan paid the $3,000 insurance policy which covered the first half of 2020 in December 2019. When there are no scheduled dance classes, Morgan rents its dance studio for birthday parties for $100 per two-hour party. Four birthday parties were held during January. Morgan will not bill the parents until February. Morgan purchased $350 of office supplies on January 10. On January 31, Morgan determined that Office supplies of $770 were unused. Morgan received a January utility bill for S770. The bill will not be paid until it is due in February. Required: Identify whether each transaction is an adjusting entry or a regular journal entry. If the entry is an adjusting entry, identify it as an accrued revenue, accrued expense, deferred revenue, or deferred expense. Prepare the entries necessary to record the transactions above and on the previous page.