Gas and Oil Expense Interest Expense Total 75,000 10,000 6,961,350 6,961,350 ing information were given to you for the preparation of the adjusting entries as of December 5,500 worth of supplies are still unused at the end of the year. surance represents the amount of a one-year premium expiring on April 1, 2020 he note was received from a customer on November 16, 2019 for 60 days at 20% interest. advanced payment for service to be rendered amounting to P120,500 was included in the inco he allowance for bad debts/allowance for impairment (required allowance) is 10% of Accounts . Gallardo entered into a contract of lease on January 1, 2019 for 2 years. Mr. Gallardo vanced payment amounting to P240,000 from a lessee. - Gallardo issued a 16% P100, 000 note to Metro bank dated April 15, 2019. e life of the equipment and furniture is 5 years and the estimated residual values are 10,000 J TI bildi CUPC CIO

Gas and Oil Expense Interest Expense Total 75,000 10,000 6,961,350 6,961,350 ing information were given to you for the preparation of the adjusting entries as of December 5,500 worth of supplies are still unused at the end of the year. surance represents the amount of a one-year premium expiring on April 1, 2020 he note was received from a customer on November 16, 2019 for 60 days at 20% interest. advanced payment for service to be rendered amounting to P120,500 was included in the inco he allowance for bad debts/allowance for impairment (required allowance) is 10% of Accounts . Gallardo entered into a contract of lease on January 1, 2019 for 2 years. Mr. Gallardo vanced payment amounting to P240,000 from a lessee. - Gallardo issued a 16% P100, 000 note to Metro bank dated April 15, 2019. e life of the equipment and furniture is 5 years and the estimated residual values are 10,000 J TI bildi CUPC CIO

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

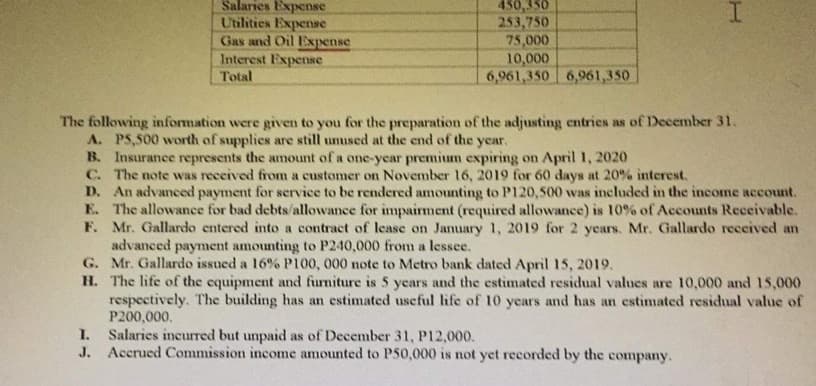

Transcribed Image Text:Salaries Expense

Utilities Expense

Gas and Oil Expense

Interest Expense

Total

450,350

253,750

75,000

10,000

6,961,350 6,961,350

T

The following information were given to you for the preparation of the adjusting entries as of December 31.

A. P5,500 worth of supplies are still unused at the end of the year.

B. Insurance represents the amount of a one-year premium expiring on April 1, 2020

C. The note was received from a customer on November 16, 2019 for 60 days at 20% interest.

D. An advanced payment for service to be rendered amounting to P120,500 was included in the income account.

E. The allowance for bad debts/allowance for impairment (required allowance) is 10% of Accounts Receivable.

F. Mr. Gallardo entered into a contract of lease on January 1, 2019 for 2 years. Mr. Gallardo received an

advanced payment amounting to P240,000 from a lessee.

G. Mr. Gallardo issued a 16% P100, 000 note to Metro bank dated April 15, 2019.

H. The life of the equipment and furniture is 5 years and the estimated residual values are 10,000 and 15,000

respectively. The building has an estimated useful life of 10 years and has an estimated residual value of

P200,000.

I. Salaries incurred but unpaid as of December 31, P12,000.

J.

Accrued Commission income amounted to P50,000 is not yet recorded by the company.

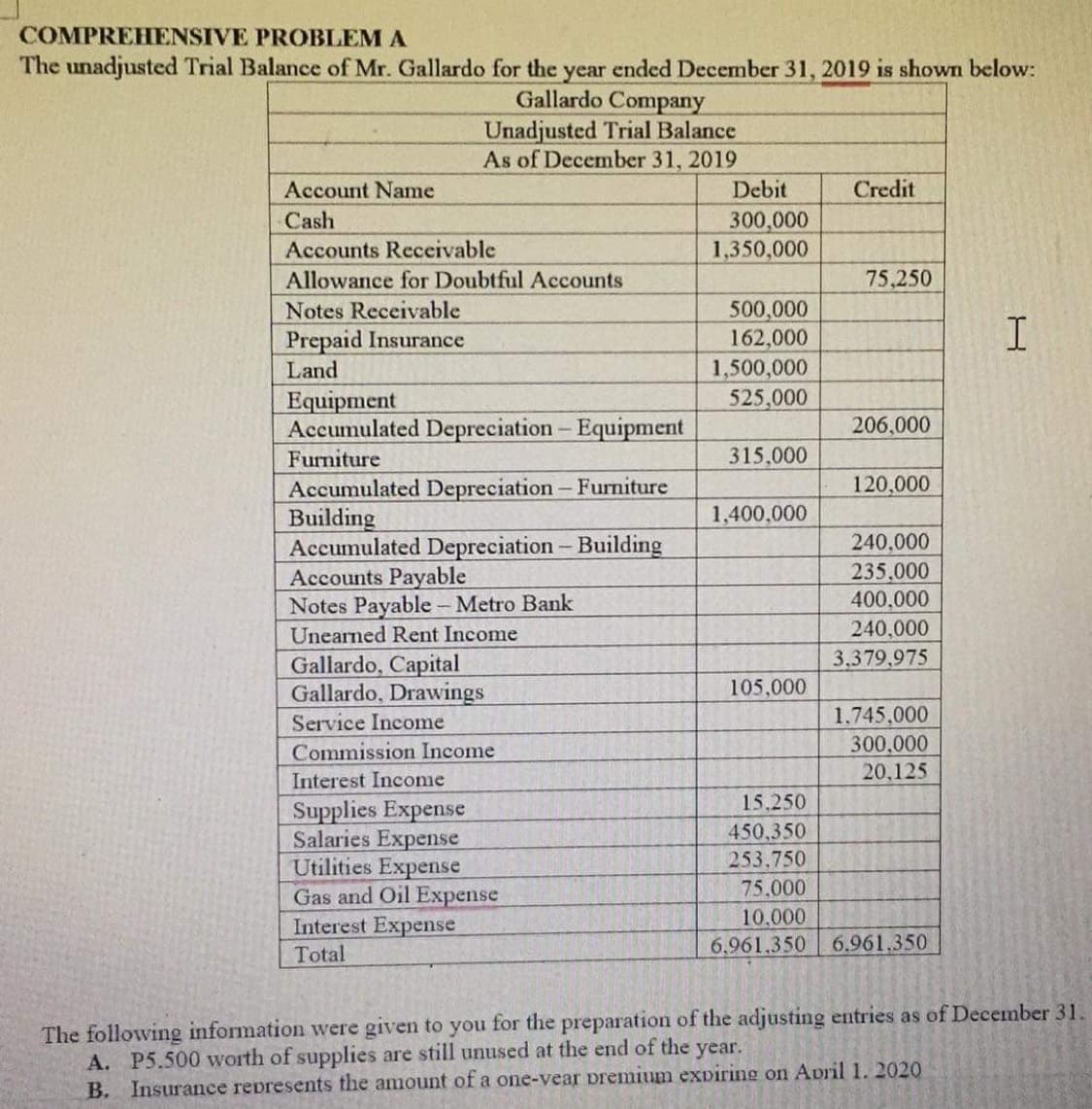

Transcribed Image Text:COMPREHENSIVE PROBLEM A

The unadjusted Trial Balance of Mr. Gallardo for the year ended December 31, 2019 is shown below:

Gallardo Company

Unadjusted Trial Balance

As of December 31, 2019

Account Name

Cash

Accounts Receivable

Allowance for Doubtful Accounts

Notes Receivable

Prepaid Insurance

Land

Equipment

Accumulated Depreciation - Equipment

Furniture

Accumulated Depreciation - Furniture

Building

Accumulated Depreciation - Building

Accounts Payable

Notes Payable - Metro Bank

Unearned Rent Income

Gallardo, Capital

Gallardo, Drawings

Service Income

Commission Income

Interest Income

Supplies Expense

Salaries Expense

Utilities Expense

Gas and Oil Expense

Interest Expense

Total

Debit

300,000

1,350,000

500,000

162,000

1,500,000

525,000

315,000

1,400,000

105,000

Credit

75,250

206,000

120,000

240,000

235,000

400,000

240,000

3,379,975

1,745,000

300,000

20,125

15,250

450,350

253.750

75,000

10.000

6.961.350 6.961.350

T

The following information were given to you for the preparation of the adjusting entries as of December 31.

A. P5.500 worth of supplies are still unused at the end of the

year.

B. Insurance represents the amount of a one-year premium expiring on April 1. 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,