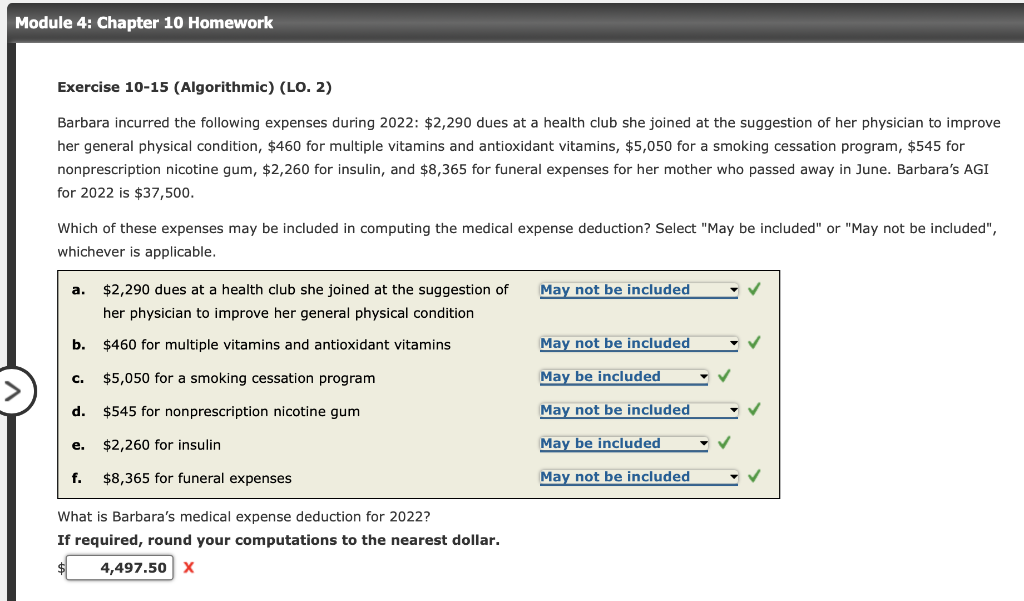

Exercise 10-15 (Algorithmic) (LO. 2) Barbara incurred the following expenses during 2022: $2,290 dues at a health club she joined at the suggestion of her physician to improve her general physical condition, $460 for multiple vitamins and antioxidant vitamins, $5,050 for a smoking cessation program, $545 for nonprescription nicotine gum, $2,260 for insulin, and $8,365 for funeral expenses for her mother who passed away in June. Barbara's AGI for 2022 is $37,500. Which of these expenses may be included in computing the medical expense deduction? Select "May be included" or "May not be included", whichever is applicable. a. $2,290 dues at a health club she joined at the suggestion of her physician to improve her general physical condition $460 for multiple vitamins and antioxidant vitamins $5,050 for a smoking cessation program $545 for nonprescription nicotine gum $2,260 for insulin f. $8,365 for funeral expenses b. C. d. e. What is Barbara's medical expense deduction for 2022? If required, round your computations to the nearest dollar. 4,497.50 X May not be included May not be included May be included May not be included May be included May not be included

Exercise 10-15 (Algorithmic) (LO. 2) Barbara incurred the following expenses during 2022: $2,290 dues at a health club she joined at the suggestion of her physician to improve her general physical condition, $460 for multiple vitamins and antioxidant vitamins, $5,050 for a smoking cessation program, $545 for nonprescription nicotine gum, $2,260 for insulin, and $8,365 for funeral expenses for her mother who passed away in June. Barbara's AGI for 2022 is $37,500. Which of these expenses may be included in computing the medical expense deduction? Select "May be included" or "May not be included", whichever is applicable. a. $2,290 dues at a health club she joined at the suggestion of her physician to improve her general physical condition $460 for multiple vitamins and antioxidant vitamins $5,050 for a smoking cessation program $545 for nonprescription nicotine gum $2,260 for insulin f. $8,365 for funeral expenses b. C. d. e. What is Barbara's medical expense deduction for 2022? If required, round your computations to the nearest dollar. 4,497.50 X May not be included May not be included May be included May not be included May be included May not be included

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Module 4: Chapter 10 Homework

Exercise 10-15 (Algorithmic) (LO. 2)

Barbara incurred the following expenses during 2022: $2,290 dues at a health club she joined at the suggestion of her physician to improve

her general physical condition, $460 for multiple vitamins and antioxidant vitamins, $5,050 for a smoking cessation program, $545 for

nonprescription nicotine gum, $2,260 for insulin, and $8,365 for funeral expenses for her mother who passed away in June. Barbara's AGI

for 2022 is $37,500.

Which of these expenses may be included in computing the medical expense deduction? Select "May be included" or "May not be included",

whichever is applicable.

a. $2,290 dues at a health club she joined at the suggestion of

her physician to improve her general physical condition

b. $460 for multiple vitamins and antioxidant vitamins

$5,050 for a smoking cessation program

$545 for nonprescription nicotine gum

$2,260 for insulin

f. $8,365 for funeral expenses

C.

d.

e.

What is Barbara's medical expense deduction for 2022?

If required, round your computations to the nearest dollar.

4,497.50 X

May not be included

May not be included

May be included

May not be included

May be included

May not be included

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education