Exercise 12-13 Z Your answer is partially correct. Try again. The 2019 accounting records of Cheyenne Corp. reveal these transactions and events. Payment of interest Cash sales $ 10,100 Collection of accounts receivable 49,900 Payment of salaries and wages $189,900 56,200 Receipt of dividend revenue 18,400 Depreciation expense Payment of income taxes 15,100 Proceeds from sale of vehicles 15,400 12,200 Net income 38,100 Purchase of equipment for cash 21,200 Payment of accounts payable Loss on sale of vehicles 2,300 for merchandise Payment for land 115,800 Payment of dividends 74,300 Payment of operating expenses 13,100 28,000 Prepare the cash flows from operating activities section using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cheyenne Corp. Statement of Cash Flows-Direct Method 2019 Cash Flows from Operating Activities Cash receipts from Cash Flows from Operating Activities Cash receipts from Customers 49900 Customers 189900 239800 Less cash payments: For Salaries and Wages 56200 To Suppliers for Merchandise 115800 For Income Taxes 15100 For Operating Expenses 28000 For Interest 10100 225200 Net Cash Provided by Operating Activities + 14600

Exercise 12-13 Z Your answer is partially correct. Try again. The 2019 accounting records of Cheyenne Corp. reveal these transactions and events. Payment of interest Cash sales $ 10,100 Collection of accounts receivable 49,900 Payment of salaries and wages $189,900 56,200 Receipt of dividend revenue 18,400 Depreciation expense Payment of income taxes 15,100 Proceeds from sale of vehicles 15,400 12,200 Net income 38,100 Purchase of equipment for cash 21,200 Payment of accounts payable Loss on sale of vehicles 2,300 for merchandise Payment for land 115,800 Payment of dividends 74,300 Payment of operating expenses 13,100 28,000 Prepare the cash flows from operating activities section using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cheyenne Corp. Statement of Cash Flows-Direct Method 2019 Cash Flows from Operating Activities Cash receipts from Cash Flows from Operating Activities Cash receipts from Customers 49900 Customers 189900 239800 Less cash payments: For Salaries and Wages 56200 To Suppliers for Merchandise 115800 For Income Taxes 15100 For Operating Expenses 28000 For Interest 10100 225200 Net Cash Provided by Operating Activities + 14600

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 21E: (Appendix 21.1) Visual Inspection The following changes in account balances were taken from Walson...

Related questions

Question

Choices are: Net income,

I am unsure where I am going wrong here.

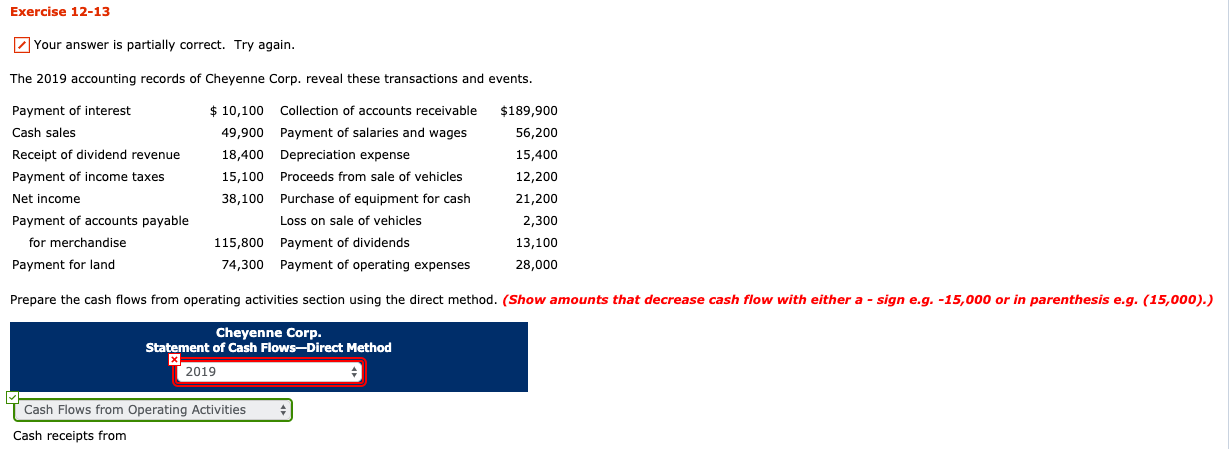

Transcribed Image Text:Exercise 12-13

Z Your answer is partially correct. Try again.

The 2019 accounting records of Cheyenne Corp. reveal these transactions and events.

Payment of interest

Cash sales

$ 10,100 Collection of accounts receivable

49,900 Payment of salaries and wages

$189,900

56,200

Receipt of dividend revenue

18,400 Depreciation expense

Payment of income taxes

15,100 Proceeds from sale of vehicles

15,400

12,200

Net income

38,100 Purchase of equipment for cash

21,200

Payment of accounts payable

Loss on sale of vehicles

2,300

for merchandise

Payment for land

115,800 Payment of dividends

74,300 Payment of operating expenses

13,100

28,000

Prepare the cash flows from operating activities section using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Cheyenne Corp.

Statement of Cash Flows-Direct Method

2019

Cash Flows from Operating Activities

Cash receipts from

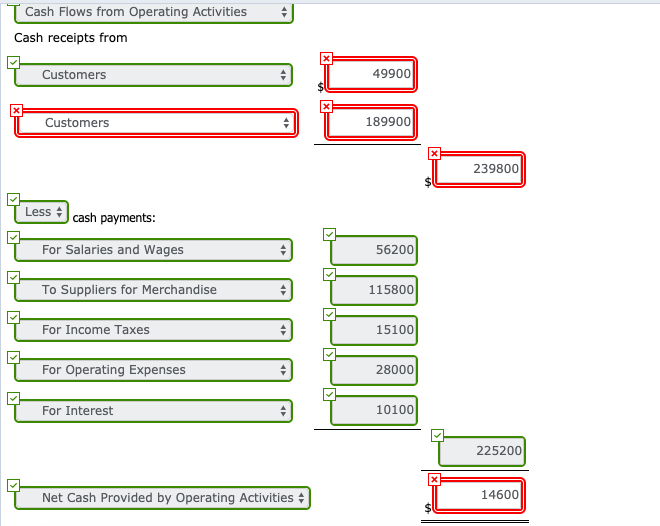

Transcribed Image Text:Cash Flows from Operating Activities

Cash receipts from

Customers

49900

Customers

189900

239800

Less

cash payments:

For Salaries and Wages

56200

To Suppliers for Merchandise

115800

For Income Taxes

15100

For Operating Expenses

28000

For Interest

10100

225200

Net Cash Provided by Operating Activities +

14600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning