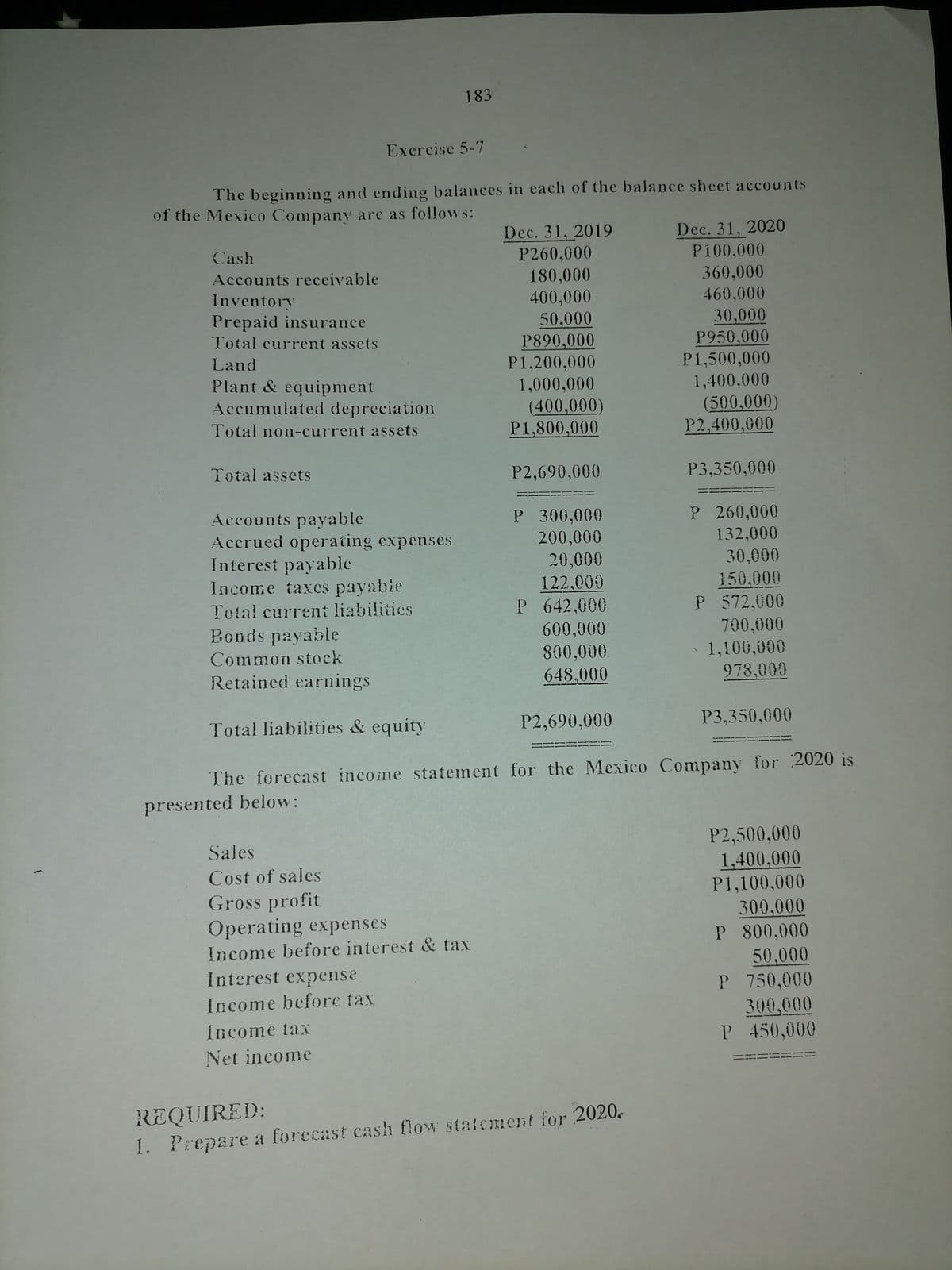

Exercise 5- The beginning and ending balances in each of the balance sheet accounts of the Mexico Company are as follows: Dec. 31, 2019 P260,000 180,000 Dec. 31, 2020 P100,000 Cash 360,000 Accounts receivable 460,000 400,000 50,000 P890,000 P1,200,000 1,000,000 Inventory Prepaid insurance 30,000 P950,000 P1,500,000 1,400,000 Total current assets Land Plant & equipment Accumulated depreciation (400,000) P1,800,000 (500,000) P2,400,000 Total non-current assets Total assets P2,690,000 P3,350,000 P 260,000 132,000 30,000 150.000 P 572,000 700,000 P 300,000 Accounts payable Accrued operating expenses Interest payable Income taxes payabie 200,000 20,000 122,000 P 642,000 600,000 800,000 648.000 Total curret liabilities Bonds payable 1,100,000 Common stock 978,000 Retained earnings P2,690,000 P3,350,000 Total liabilities & equity The forecast income statement for the Mexico Company for 2020 i presented below: P2,500,000 1,400,000 P1,100,000 300,000 Sales Cost of sales Gross profit Operating expenses P 800,000 50,000 P 750,000 300,000 Income before interest & tax Interest expense Income before tax Income tax P 450,000 Net income REQUIRED: 1. Prepare a forecast cash flow stateRIent for 2020.

Exercise 5- The beginning and ending balances in each of the balance sheet accounts of the Mexico Company are as follows: Dec. 31, 2019 P260,000 180,000 Dec. 31, 2020 P100,000 Cash 360,000 Accounts receivable 460,000 400,000 50,000 P890,000 P1,200,000 1,000,000 Inventory Prepaid insurance 30,000 P950,000 P1,500,000 1,400,000 Total current assets Land Plant & equipment Accumulated depreciation (400,000) P1,800,000 (500,000) P2,400,000 Total non-current assets Total assets P2,690,000 P3,350,000 P 260,000 132,000 30,000 150.000 P 572,000 700,000 P 300,000 Accounts payable Accrued operating expenses Interest payable Income taxes payabie 200,000 20,000 122,000 P 642,000 600,000 800,000 648.000 Total curret liabilities Bonds payable 1,100,000 Common stock 978,000 Retained earnings P2,690,000 P3,350,000 Total liabilities & equity The forecast income statement for the Mexico Company for 2020 i presented below: P2,500,000 1,400,000 P1,100,000 300,000 Sales Cost of sales Gross profit Operating expenses P 800,000 50,000 P 750,000 300,000 Income before interest & tax Interest expense Income before tax Income tax P 450,000 Net income REQUIRED: 1. Prepare a forecast cash flow stateRIent for 2020.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 16.3APE: Changes in current operating assets and liabilities-indirect method Alpenrose Corporations...

Related questions

Question

Transcribed Image Text:183

Excrcise 5-7

The beginning and ending balances in each of the balance sheet accounts

of the Mexico Company are as follows:

Dec. 31, 2019

P260,000

180,000

400,000

50,000

P890,000

P1,200,000

1,000,000

(400,000)

P1,800,000

Dec. 31, 2020

P100,000

360,000

460,000

30,000

P950,000

P1,500,000

1,400,000

(500,000)

P2,400,000

Cash

Accounts receivable

Inventory

Prepaid insurance

Total current assets

Land

Plant & equipment

Accumulated depreciation

Total non-current assets

Total assets

P2,690,000

P3,350,000

Accounts payable

Accrued operating expenses

Interest payable

Income taxes payable

P 300,000

200,000

P 260,000

132,000

30,000

20,000

122,000

P 642,000

150.000

P 572,000

700,000

Total current liabilities

Bonds payable

600,000

800,000

648,000

Common stock

1,100,000

Retained earnings

978,000

Total liabilities & equity

P2,690,000

P3,350,000

The forecast income statement for the Mexico Company for 2020 is

presented below:

P2,500,000

1,400,000

P1,100,000

300,000

P 800,000

50,000

P 750,000

300,000

P 450,000

Sales

Cost of sales

Gross profit

Operating expenses

Income before interest & tax

Interest expense

Income before tax

Income tax

Net income

REQUIRED:

1. Prepare a forecast cash flow statement for 2020,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning