Exercise 5–14 Calculate the current and acid-test ratios in each of the following cases: Acid-test ratio Case X Case Y Case Z (LO 5) Cash $ 800 $ 910 $1,100 Temporary investments Receivables Inventory Prepaid expenses 500 800 4,000 990 2,000 1,000 1,200 $4,000 600 900 Total current assets. $3,500 $7,300 Current liabilities $2,200 $1,100 $3,650 .... ...

Exercise 5–14 Calculate the current and acid-test ratios in each of the following cases: Acid-test ratio Case X Case Y Case Z (LO 5) Cash $ 800 $ 910 $1,100 Temporary investments Receivables Inventory Prepaid expenses 500 800 4,000 990 2,000 1,000 1,200 $4,000 600 900 Total current assets. $3,500 $7,300 Current liabilities $2,200 $1,100 $3,650 .... ...

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterMJ: Mornin's Joe

Section: Chapter Questions

Problem 3IFRS

Related questions

Question

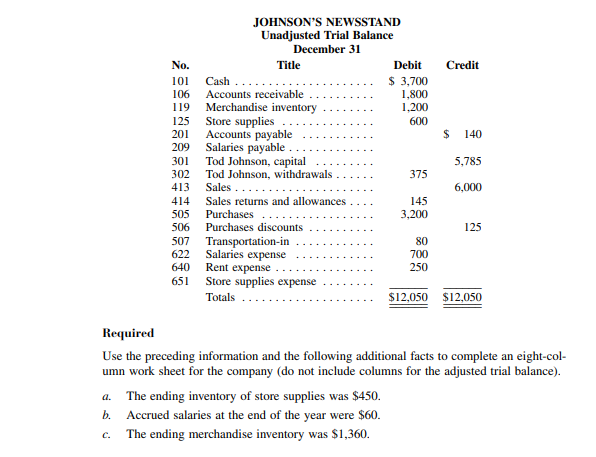

Transcribed Image Text:JOHNSON'S NEWSSTAND

Unadjusted Trial Balance

December 31

No.

Title

Debit

Credit

101

$ 3,700

Cash

Accounts receivable

Merchandise inventory

Store supplies

Accounts payable

Salaries payable

Tod Johnson, capital

Tod Johnson, withdrawals

106

1,800

1,200

119

125

600

201

24

140

209

301

5,785

302

375

413

Sales

6,000

414

Sales returns and allowances

145

3,200

505

Purchases

506

Purchases discounts

125

507 Transportation-in

Salaries expense

Rent expense

651 Store supplies expense

Totals

80

622

700

640

250

$12,050 $12,050

Required

Use the preceding information and the following additional facts to complete an eight-col-

umn work sheet for the company (do not include columns for the adjusted trial balance).

a. The ending inventory of store supplies was $450.

b. Accrued salaries at the end of the year were $60.

c. The ending merchandise inventory was $1,360.

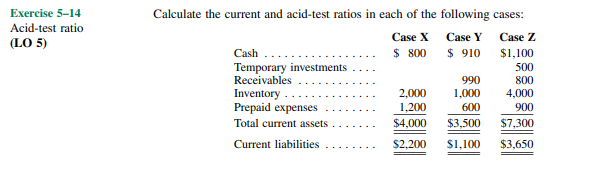

Transcribed Image Text:Exercise 5-14

Calculate the current and acid-test ratios in each of the following cases:

Acid-test ratio

Case X

Case Y

Case Z

(LO 5)

Cash

$ 800

$ 910

$1,100

Temporary investments

Receivables

Inventory

Prepaid expenses

500

800

4,000

990

2,000

1,000

1,200

600

900

Total current assets

$4,000

$3,500

$7,300

Current liabilities

$2,200

$1,100

$3,650

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning