Jay Oullette, CEO of Bumper to Bumper Inc., anticipates that his company's year-end balance sheet will show current assets of $12,666 and current liabilities of $7,560. Oullette has asked your advice concerning a possible early payment of $3,790 of accounts payable before year-end, even though payment isn't due until later. Required: Calculate the firm’s working capital and current ratio under each situation. Assume that Bumper to Bumper had negotiated a short-term bank loan of $6,000 that can be drawn down either before or after the end of the year. Calculate working capital and the current ratio at year-end under each situation, assuming that early payment of accounts payable is not made. When would you recommend that the loan be taken?

Jay Oullette, CEO of Bumper to Bumper Inc., anticipates that his company's year-end balance sheet will show current assets of $12,666 and current liabilities of $7,560. Oullette has asked your advice concerning a possible early payment of $3,790 of accounts payable before year-end, even though payment isn't due until later. Required: Calculate the firm’s working capital and current ratio under each situation. Assume that Bumper to Bumper had negotiated a short-term bank loan of $6,000 that can be drawn down either before or after the end of the year. Calculate working capital and the current ratio at year-end under each situation, assuming that early payment of accounts payable is not made. When would you recommend that the loan be taken?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 7P: Effective Cost of Short-Term Credit Yonge Corporation must arrange financing for its working capital...

Related questions

Question

Practice Pack

Exercise 3-15 (Algo) Effect of transactions on working capital and current ratio LO 6

Jay Oullette, CEO of Bumper to Bumper Inc., anticipates that his company's year-end balance sheet will show current assets of $12,666 and current liabilities of $7,560. Oullette has asked your advice concerning a possible early payment of $3,790 of accounts payable before year-end, even though payment isn't due until later.

Required:

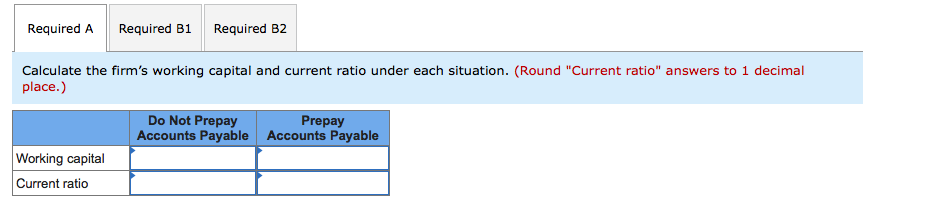

- Calculate the firm’s working capital and current ratio under each situation.

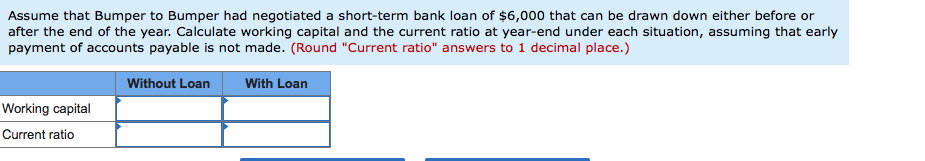

- Assume that Bumper to Bumper had negotiated a short-term bank loan of $6,000 that can be drawn down either before or after the end of the year. Calculate working capital and the current ratio at year-end under each situation, assuming that early payment of accounts payable is not made. When would you recommend that the loan be taken?

Transcribed Image Text:Required A

Required B1

Required B2

Calculate the firm's working capital and current ratio under each situation. (Round "Current ratio" answers to 1 decimal

place.)

Do Not Prepay

Accounts Payable Accounts Payable

Prepay

Working capital

Current ratio

Transcribed Image Text:Assume that Bumper to Bumper had negotiated a short-term bank loan of $6,000 that can be drawn down either before or

after the end of the year. Calculate working capital and the current ratio at year-end under each situation, assuming that early

payment of accounts payable is not made. (Round "Current ratio" answers to 1 decimal place.)

Without Loan

With Loan

Working capital

Current ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning