Exercise 6-16 Working with a Segmented Income Statement; Break-Even Analysis (LO6-4, LO6-5) [The following information applies to the questions displayed below] Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: office Total Company $ 862,500 100.08 54.0 Chicago $ 172,500 51,750 120,750 89,700 $ 31,050 Minneapolis $ 690,000 414,000 276,000 103, 500 $ 172,500 Sales 100 30 100 Variable expenses Contribution margin Traceable fixed expenses 465,750 60 46.08 396,750 193,200 708 40 22.4 521 154 office segnent nargin Comon fixed expenses not traceable to offices 203, 550 23.6 18 258 138,000 $65,550 16.00 Net operating income 7.61 Exercise 6-16 Part 3 . Assume that sales in Chicago increase by $57,500 next year and that sales in Minneapolis remain unchanged. Assume no change in xed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (l.e. 0.1234 should be entered as 12.3).)

Exercise 6-16 Working with a Segmented Income Statement; Break-Even Analysis (LO6-4, LO6-5) [The following information applies to the questions displayed below] Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: office Total Company $ 862,500 100.08 54.0 Chicago $ 172,500 51,750 120,750 89,700 $ 31,050 Minneapolis $ 690,000 414,000 276,000 103, 500 $ 172,500 Sales 100 30 100 Variable expenses Contribution margin Traceable fixed expenses 465,750 60 46.08 396,750 193,200 708 40 22.4 521 154 office segnent nargin Comon fixed expenses not traceable to offices 203, 550 23.6 18 258 138,000 $65,550 16.00 Net operating income 7.61 Exercise 6-16 Part 3 . Assume that sales in Chicago increase by $57,500 next year and that sales in Minneapolis remain unchanged. Assume no change in xed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (l.e. 0.1234 should be entered as 12.3).)

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter20: Variable Costing For Management Analysis

Section: Chapter Questions

Problem 20.22EX: Variable costing income statement and contribution margin analysis for a service company The actual...

Related questions

Question

Please help me

![Exercise 6-16 Working with a Segmented Income Statement; Break-Even Analysis (LO6-4, LO6-5)

[The following information applies to the questions displayed below.]

Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has

two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable

costs. A contribution format segmented income statement for the company's most recent year is given:

office

Total Company

$ 862,500

465,750

396,750

193,200

Chicago

$ 172,500

51,750

120,750

89,700

$ 31,050

Minneapolis

$ 690,000

414,000

276,000

103,500

$ 172,500

Sales

100.08

100

Variable expenses

Contribution margin

Traceable fixed expenses

100

608

40%

54.0N

30

46.08

70

22.48

521

15%

office segment nargin

Common fixed expenses not traceable to offices

Net operating income

203,550

23.6

18

251

138,000

$ 65,550

16.0

7.68

Exercise 6-16 Part 3

3. Assume that sales in Chicago increase by $57,500 next year and that sales in Minneapolis remain unchanged. Assume no change in

fixed costs.

a. Prepare a new segmented income statement for the company (Round your percentage answers to 1 decimal place (i.e. 0.1234

should be entered as 12.3).)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F5d601f64-088b-4fac-bdc0-28942335e730%2F0d569ecd-91c5-4413-a8c3-5c382e6f3ace%2Fx8r7buh_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Exercise 6-16 Working with a Segmented Income Statement; Break-Even Analysis (LO6-4, LO6-5)

[The following information applies to the questions displayed below.]

Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has

two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable

costs. A contribution format segmented income statement for the company's most recent year is given:

office

Total Company

$ 862,500

465,750

396,750

193,200

Chicago

$ 172,500

51,750

120,750

89,700

$ 31,050

Minneapolis

$ 690,000

414,000

276,000

103,500

$ 172,500

Sales

100.08

100

Variable expenses

Contribution margin

Traceable fixed expenses

100

608

40%

54.0N

30

46.08

70

22.48

521

15%

office segment nargin

Common fixed expenses not traceable to offices

Net operating income

203,550

23.6

18

251

138,000

$ 65,550

16.0

7.68

Exercise 6-16 Part 3

3. Assume that sales in Chicago increase by $57,500 next year and that sales in Minneapolis remain unchanged. Assume no change in

fixed costs.

a. Prepare a new segmented income statement for the company (Round your percentage answers to 1 decimal place (i.e. 0.1234

should be entered as 12.3).)

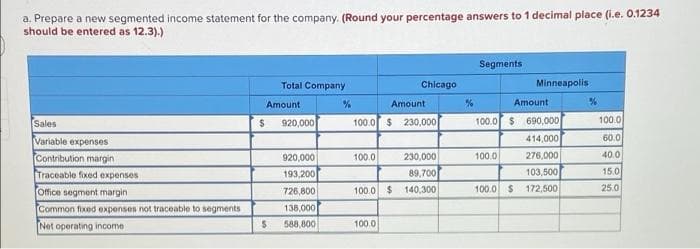

Transcribed Image Text:a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (i.e. 0.1234

should be entered as 12.3).)

Segments

Total Company

Chicago

Minneapolis

Amount

Amount

Amount

Sales

920,000

100.0 $

230,000

100.0 $ 690,000

100.0

Variable expenses

414,000

60.0

230,000

89,700

Contribution margin

920,000

100.0

100.0

276,000

40.0

Traceable fixed expenses

193,200

103,500

15.0

Office segment margin

726,800

100.0 $ 140,300

100.0 $

172,500

25.0

Common fixed expenses not traceable to segments

138,000

Net operating income

588,800

100.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning