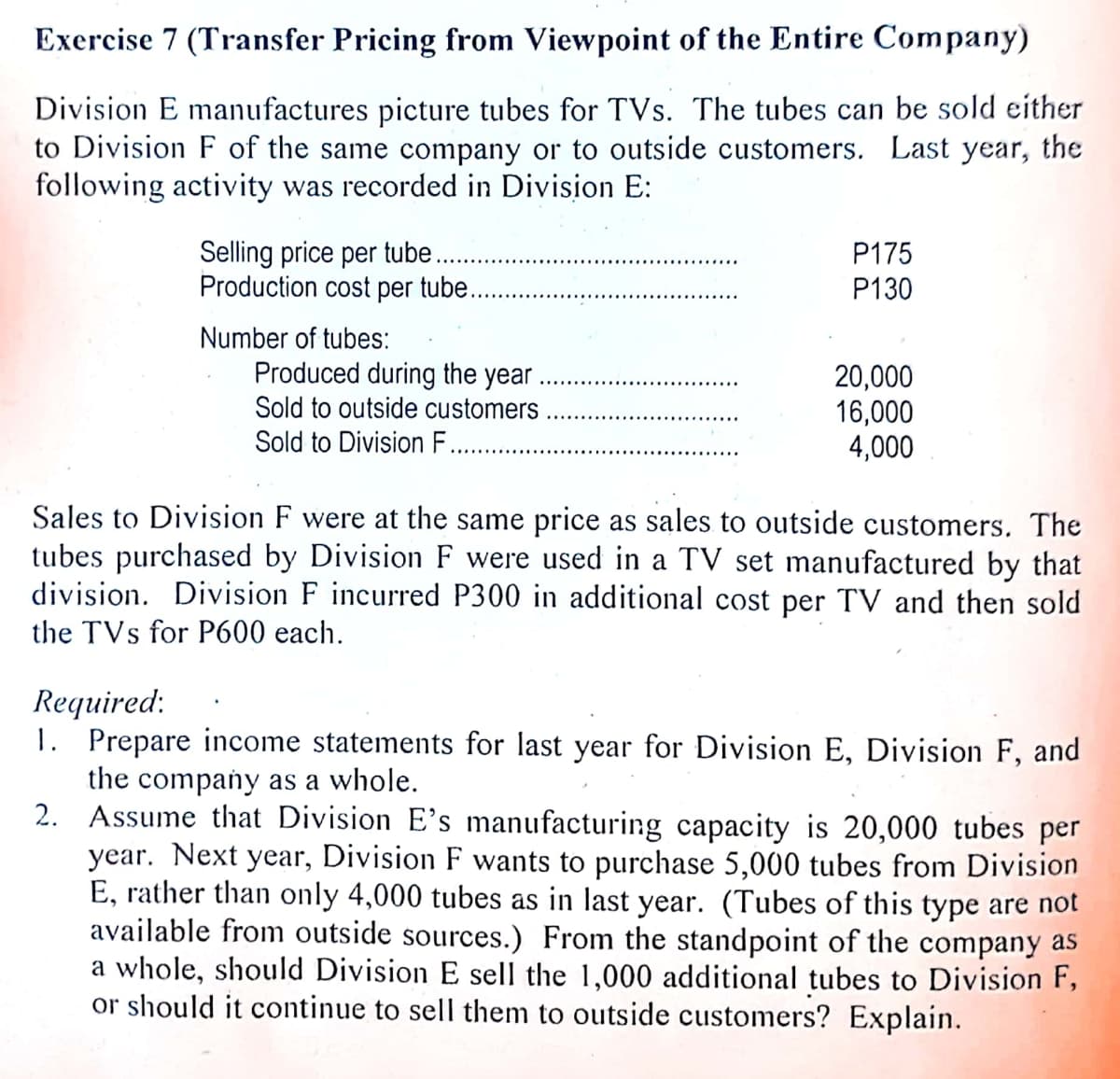

Exercise 7 (Transfer Pricing from Viewpoint of the Entire Company) Division E manufactures picture tubes for TVs. The tubes can be sold either to Division F of the same company or to outside customers. Last year, the following activity was recorded in Division E: Selling price per tube.. Production cost per tube.. P175 P130 Number of tubes: Produced during the year 20,000 16,000 4,000 Sold to outside customers Sold to Division . . Sales to Division F were at the same price as sales to outside customers. The tubes purchased by Division F were used in a TV set manufactured by that division. Division F incurred P300 in additional cost per TV and then sold the TVs for P600 each. Required: 1. Prepare income statements for last year for Division E, Division F, and the company as a whole. 2. Assume that Division E's manufacturing capacity is 20,000 tubes per year. Next year, Division F wants to purchase 5,000 tubes from Division E, rather than only 4,000 tubes as in last year. (Tubes of this type are not available from outside sources.) From the standpoint of the company as a whole, should Division E sell the 1,000 additional tubes to Division F, or should it continue to sell them to outside customers? Explain.

Exercise 7 (Transfer Pricing from Viewpoint of the Entire Company) Division E manufactures picture tubes for TVs. The tubes can be sold either to Division F of the same company or to outside customers. Last year, the following activity was recorded in Division E: Selling price per tube.. Production cost per tube.. P175 P130 Number of tubes: Produced during the year 20,000 16,000 4,000 Sold to outside customers Sold to Division . . Sales to Division F were at the same price as sales to outside customers. The tubes purchased by Division F were used in a TV set manufactured by that division. Division F incurred P300 in additional cost per TV and then sold the TVs for P600 each. Required: 1. Prepare income statements for last year for Division E, Division F, and the company as a whole. 2. Assume that Division E's manufacturing capacity is 20,000 tubes per year. Next year, Division F wants to purchase 5,000 tubes from Division E, rather than only 4,000 tubes as in last year. (Tubes of this type are not available from outside sources.) From the standpoint of the company as a whole, should Division E sell the 1,000 additional tubes to Division F, or should it continue to sell them to outside customers? Explain.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter11: Performance Evaluation And Decentralization

Section: Chapter Questions

Problem 9MCQ

Related questions

Question

Transcribed Image Text:Exercise 7 (Transfer Pricing from Viewpoint of the Entire Company)

Division E manufactures picture tubes for TVs. The tubes can be sold either

to Division F of the same company or to outside customers. Last year, the

following activity was recorded in Division E:

Selling price per tube..

Production cost per tube...

P175

P130

Number of tubes:

Produced during the year

20,000

16,000

4,000

Sold to outside customers

Sold to Division F.

Sales to Division F were at the same price as sales to outside customers. The

tubes purchased by Division F were used in a TV set manufactured by that

division. Division F incurred P300 in additional cost per TV and then sold

the TVs for P600 each.

Required:

1. Prepare income statements for last year for Division E, Division F, and

the company as a whole.

2. Assume that Division E's manufacturing capacity is 20,000 tubes per

year. Next year, Division F wants to purchase 5,000 tubes from Division

E, rather than only 4,000 tubes as in last year. (Tubes of this type are not

available from outside sources.) From the standpoint of the company as

a whole, should Division E sell the 1,000 additional tubes to Division F,

or should it continue to sell them to outside customers? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning