Exercise Topic 6 (PROBLEM 8–21) Natural Care Corp., a distributor of natural cosmetics, is ready to begin its third quarter, in vhich peak sales occur. The company has requested a 90-day loan fromits bank to help meet ash requirements during the quaiter. Because Natural Care has experienced difficulty in aying off its loans in the past, the bank’s loan officer has asked the company to prepare a ash budget for the quarter. In response to this request, the following data have been ssembled: On July 1, the beginning of the third quarter, the company will have a cash balance of S43,000. July $290,000 August $355,600 September $431,000 Total cash receipts fromcustomers : Budgeted merchandise purchases and budgeted expenses for the third quarter are given pelow: J Merchandise purchases Salaries and wages Advertising Rent payments Depreciation July $160,000 $70,000 $80,000 $30,000 $40,000 August $160,000 $70,000 $90,000 $30,000 $40,000 September $155,000 $65,000 $100,000 $30,000 $40,000 1. Equipment costing $25,000 will be purchased for cash during July. In preparing the cash budget, assume that sufficient amount of loan will be made in July and repaid in September. Interest on the loan will total $2,000. The company needs a minimumcash balance of $30,000 to start each month. Required: .. Prepare a cash budget for July, August, and September and in total, for the third quarter.

Exercise Topic 6 (PROBLEM 8–21) Natural Care Corp., a distributor of natural cosmetics, is ready to begin its third quarter, in vhich peak sales occur. The company has requested a 90-day loan fromits bank to help meet ash requirements during the quaiter. Because Natural Care has experienced difficulty in aying off its loans in the past, the bank’s loan officer has asked the company to prepare a ash budget for the quarter. In response to this request, the following data have been ssembled: On July 1, the beginning of the third quarter, the company will have a cash balance of S43,000. July $290,000 August $355,600 September $431,000 Total cash receipts fromcustomers : Budgeted merchandise purchases and budgeted expenses for the third quarter are given pelow: J Merchandise purchases Salaries and wages Advertising Rent payments Depreciation July $160,000 $70,000 $80,000 $30,000 $40,000 August $160,000 $70,000 $90,000 $30,000 $40,000 September $155,000 $65,000 $100,000 $30,000 $40,000 1. Equipment costing $25,000 will be purchased for cash during July. In preparing the cash budget, assume that sufficient amount of loan will be made in July and repaid in September. Interest on the loan will total $2,000. The company needs a minimumcash balance of $30,000 to start each month. Required: .. Prepare a cash budget for July, August, and September and in total, for the third quarter.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.6DC

Related questions

Question

i need the answer quickly

Transcribed Image Text:please solve all as they connected please

help me

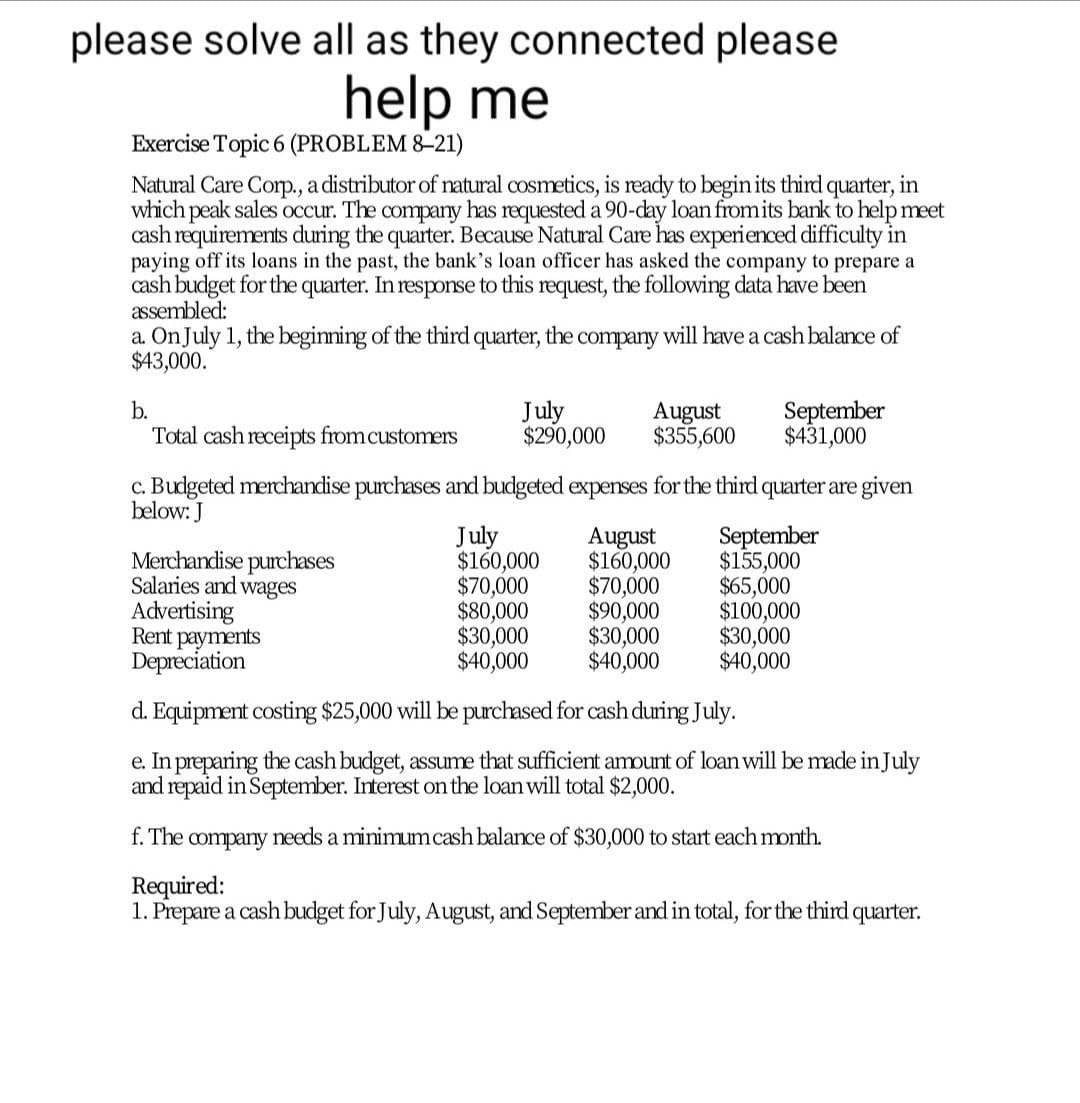

Exercise Topic 6 (PROBLEM 8–21)

Natural Care Corp., a distributor of natural cosmetics, is ready to begin its third quarter, in

which peak sales occur. The company has requested a 90-day loan fromits bank to help meet

cash requirements during the quarter. Because Natural Care has experienced difficulty in

paying off its loans in the past, the bank's loan officer has asked the company to prepare a

cash budget for the quarter. In response to this request, the following data have been

assembled:

a. OnJuly 1, the beginning of the third quarter, the company will have a cash balance of

$43,000.

July

$290,000

September

$431,000

b.

August

$355,600

Total cash receipts from customers

c. Budgeted merchandise purchases and budgeted expenses for the third quarter are given

below: J

Merchandise purchases

Salaries and wages

Advertising

Rent payments

Depreciation

July

$160,000

$70,000

$80,000

$30,000

$40,000

August

$160,000

$70,000

$90,000

$30,000

$40,000

September

$155,000

$65,000

$100,000

$30,000

$40,000

d. Equipment costing $25,000 will be purchased for cash during July.

e. In preparing the cash budget, assume that sufficient amount of loan will be made in July

and repaid in September. Interest on the loan will total $2,000.

f. The company needs a minimumcash balance of $30,000 to start each month.

Required:

1. Prepare a cash budget for July, August, and September and in total, for the third quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning