Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter24: The Aggregate Demand/aggregate Supply Model

Section: Chapter Questions

Problem 25RQ: Briefly explain the reason for the near-vertical shape of the SRAS curve on its far right.

Related questions

Question

Explain the fiscal and monetary policy used in the attached document using IS model and the AD model

Transcribed Image Text:05:18 Tue 7 Dec

a 33%

88 0

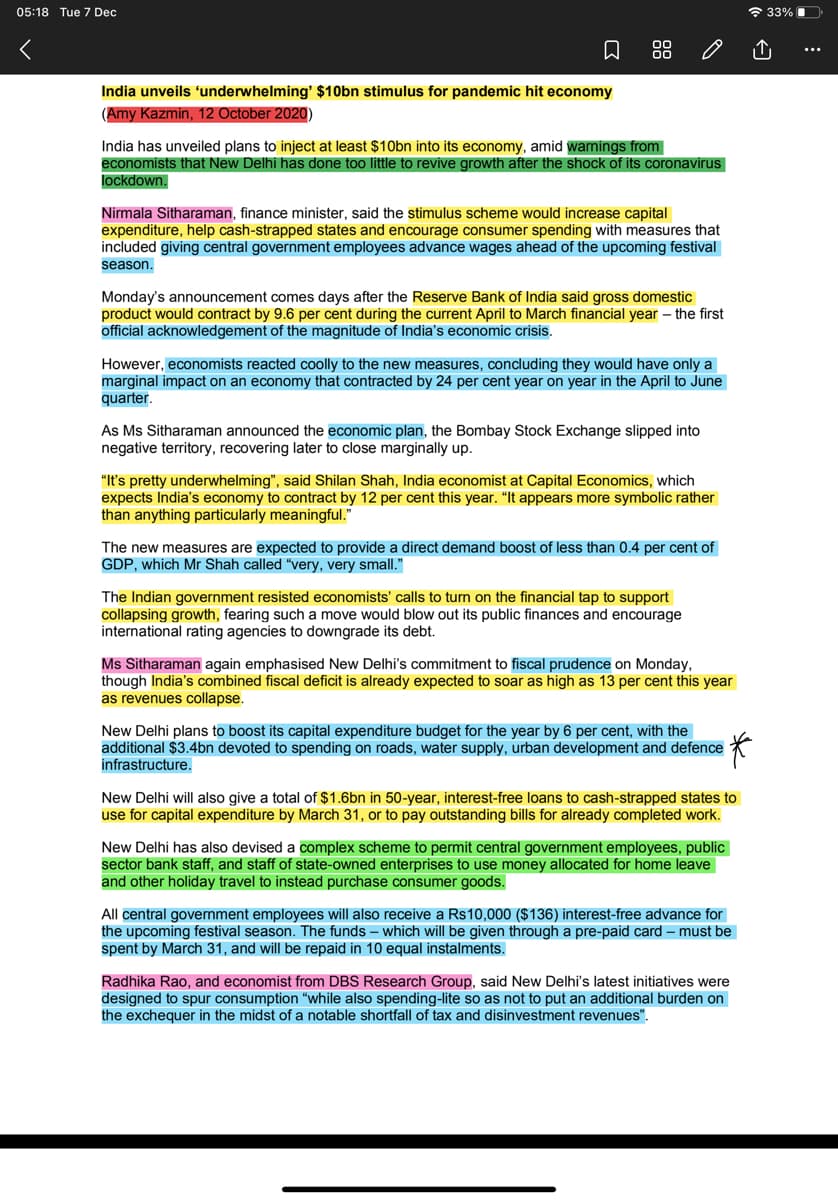

India unveils 'underwhelming' $10bn stimulus for pandemic hit economy

(Amy Kazmin, 12 October 2020)

India has unveiled plans to inject at least $10bn into its economy, amid warnings from

economists that New Delhi has done too little to revive growth after the shock of its coronavirus

lockdown.

Nirmala Sitharaman, finance minister, said the stimulus scheme would increase capital

expenditure, help cash-strapped states and encourage consumer spending with measures that

included giving central government employees advance wages ahead of the upcoming festival

season.

Monday's announcement comes days after the Reserve Bank of India said gross domestic

product would contract by 9.6 per cent during the current April to March financial year – the first

official acknowledgement of the magnitude of India's economic crisis.

However, economists reacted coolly to the new measures, concluding they would have only a

marginal impact on an economy that contracted by 24 per cent year on year in the April to June

quarter.

As Ms Sitharaman announced the economic plan, the Bombay Stock Exchange slipped into

negative territory, recovering later to close marginally up.

"It's pretty underwhelming", said Shilan Shah, India economist at Capital Economics, which

expects India's economy to contract by 12 per cent this year. "It appears more symbolic rather

than anything particularly meaningful."

The new measures are expected to provide a direct demand boost of less than 0.4 per cent of

GDP, which Mr Shah called "very, very small."

The Indian government resisted economists' calls to turn on the financial tap to support

collapsing growth, fearing such a move would blow out its public finances and encourage

international rating agencies to downgrade its debt.

Ms Sitharaman again emphasised New Delhi's commitment to fiscal prudence on Monday,

though India's combined fiscal deficit is already expected to soar as high as 13 per cent this year

as revenues collapse.

New Delhi plans to boost its capital expenditure budget for the year by 6 per cent, with the

additional $3.4bn devoted to spending on roads, water supply, urban development and defence

infrastructure.

New Delhi will also give a total of $1.6bn in 50-year, interest-free loans to cash-strapped states to

use for capital expenditure by March 31, or to pay outstanding bills for already completed work.

New Delhi has also devised a complex scheme to permit central government employees, public

sector bank staff, and staff of state-owned enterprises to use money allocated for home leave

and other holiday travel to instead purchase consumer goods.

All central govermment employees will also receive a Rs10,000 ($136) interest-free advance for

the upcoming festival season. The funds – which will be given through a pre-paid card – must be

spent by March 31, and will be repaid in 10 equal instalments.

Radhika Rao, and economist from DBS Research Group, said New Delhi's latest initiatives were

designed to spur consumption "while also spending-lite so as not to put an additional burden on

the exchequer in the midst of a notable shortfall of tax and disinvestment revenues".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax