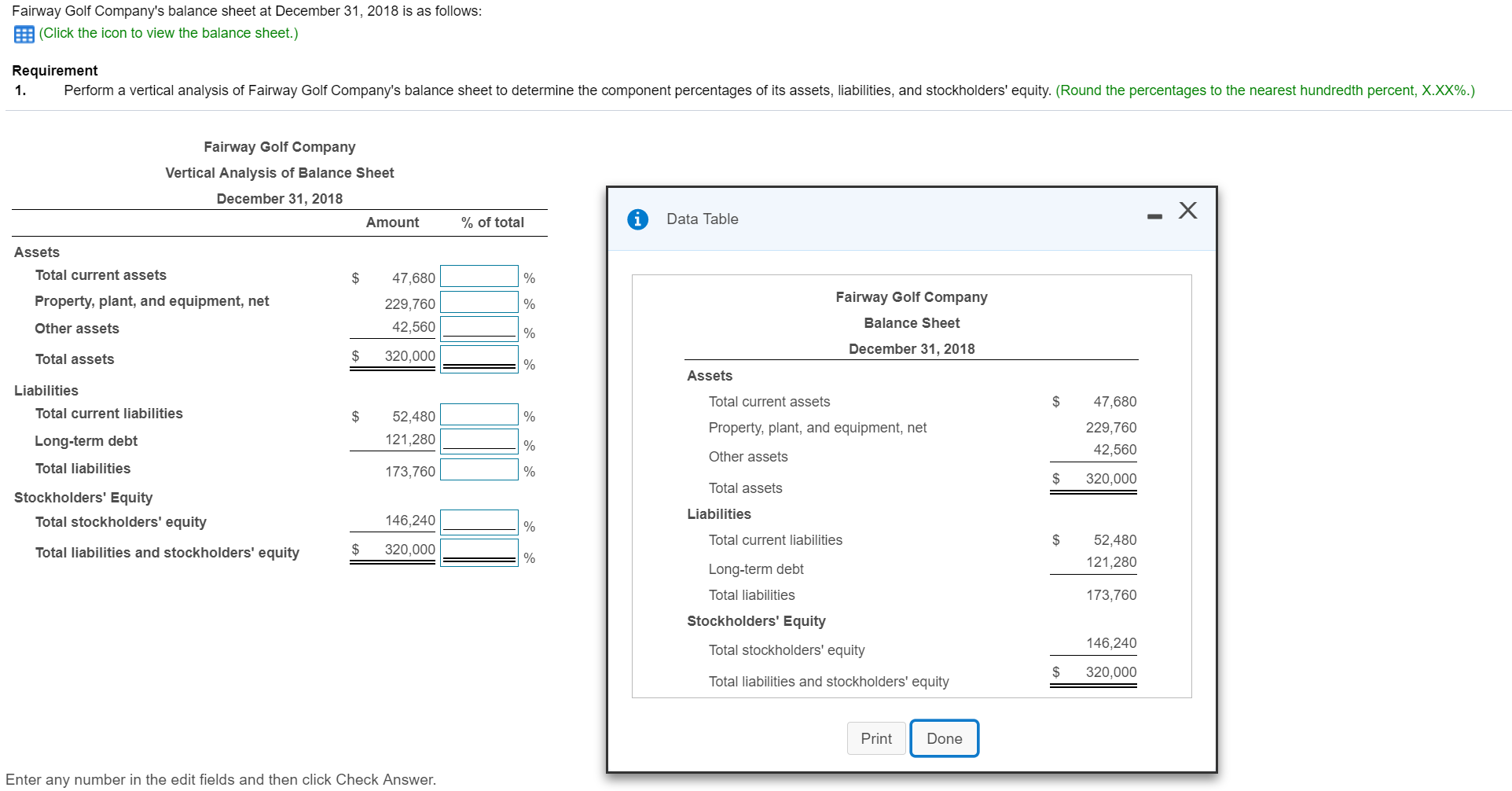

Fairway Golf Company's balance sheet at December 31, 2018 is as follows EEB (Click the icon to view the balance sheet.) Requirement 1. Perform a vertical analysis of Fairway Golf Company's balance sheet to determine the component percentages of its assets, liabilities, and stockholders' equity Round the percentages to the nearest hundredth percent, XXX%. Fairway Golf Company Vertical Analysis of Balance Sheet December 31, 2018 Amount % of total Data Table Assets otal current assets Property, plant, and equipment, net Other assets Total assets $47,680 229,760 42,560 $ 320,000 Fairway Golf Company Balance Sheet December 31, 2018 Assets Liabilities Total current liabilities Long-term debt Total liabilities $ 52,480 121,280 173,760 Total current assets Property, plant, and equipment, net Other assets Total assets $ 47,680 229,760 42,560 $ 320,000 Stockholders' Equity Liabilities Total stockholders' equity 146,240 $ 52,480 121,280 Total current liabilities Long-term debt Total liabilities Total liabilities and stockholders' equity $ 320,000 173,760 Stockholders' Equity 146,240 Total stockholders' equity $ 320,000 Total liabilities and stockholders' equity Print Done Enter any number in the edit fields and then click Check Answer.

Fairway Golf Company's balance sheet at December 31, 2018 is as follows EEB (Click the icon to view the balance sheet.) Requirement 1. Perform a vertical analysis of Fairway Golf Company's balance sheet to determine the component percentages of its assets, liabilities, and stockholders' equity Round the percentages to the nearest hundredth percent, XXX%. Fairway Golf Company Vertical Analysis of Balance Sheet December 31, 2018 Amount % of total Data Table Assets otal current assets Property, plant, and equipment, net Other assets Total assets $47,680 229,760 42,560 $ 320,000 Fairway Golf Company Balance Sheet December 31, 2018 Assets Liabilities Total current liabilities Long-term debt Total liabilities $ 52,480 121,280 173,760 Total current assets Property, plant, and equipment, net Other assets Total assets $ 47,680 229,760 42,560 $ 320,000 Stockholders' Equity Liabilities Total stockholders' equity 146,240 $ 52,480 121,280 Total current liabilities Long-term debt Total liabilities Total liabilities and stockholders' equity $ 320,000 173,760 Stockholders' Equity 146,240 Total stockholders' equity $ 320,000 Total liabilities and stockholders' equity Print Done Enter any number in the edit fields and then click Check Answer.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

Answer all questions and make sure they're correct. Ch.12-4

Transcribed Image Text:Fairway Golf Company's balance sheet at December 31, 2018 is as follows

EEB (Click the icon to view the balance sheet.)

Requirement

1.

Perform a vertical analysis of Fairway Golf Company's balance sheet to determine the component percentages of its assets, liabilities, and stockholders' equity

Round the percentages to the nearest hundredth percent, XXX%.

Fairway Golf Company

Vertical Analysis of Balance Sheet

December 31, 2018

Amount

% of total

Data Table

Assets

otal current assets

Property, plant, and equipment, net

Other assets

Total assets

$47,680

229,760

42,560

$ 320,000

Fairway Golf Company

Balance Sheet

December 31, 2018

Assets

Liabilities

Total current liabilities

Long-term debt

Total liabilities

$ 52,480

121,280

173,760

Total current assets

Property, plant, and equipment, net

Other assets

Total assets

$ 47,680

229,760

42,560

$ 320,000

Stockholders' Equity

Liabilities

Total stockholders' equity

146,240

$ 52,480

121,280

Total current liabilities

Long-term debt

Total liabilities

Total liabilities and stockholders' equity

$ 320,000

173,760

Stockholders' Equity

146,240

Total stockholders' equity

$ 320,000

Total liabilities and stockholders' equity

Print

Done

Enter any number in the edit fields and then click Check Answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1

VIEWTrending now

This is a popular solution!

Step by step

Solved in 1 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning