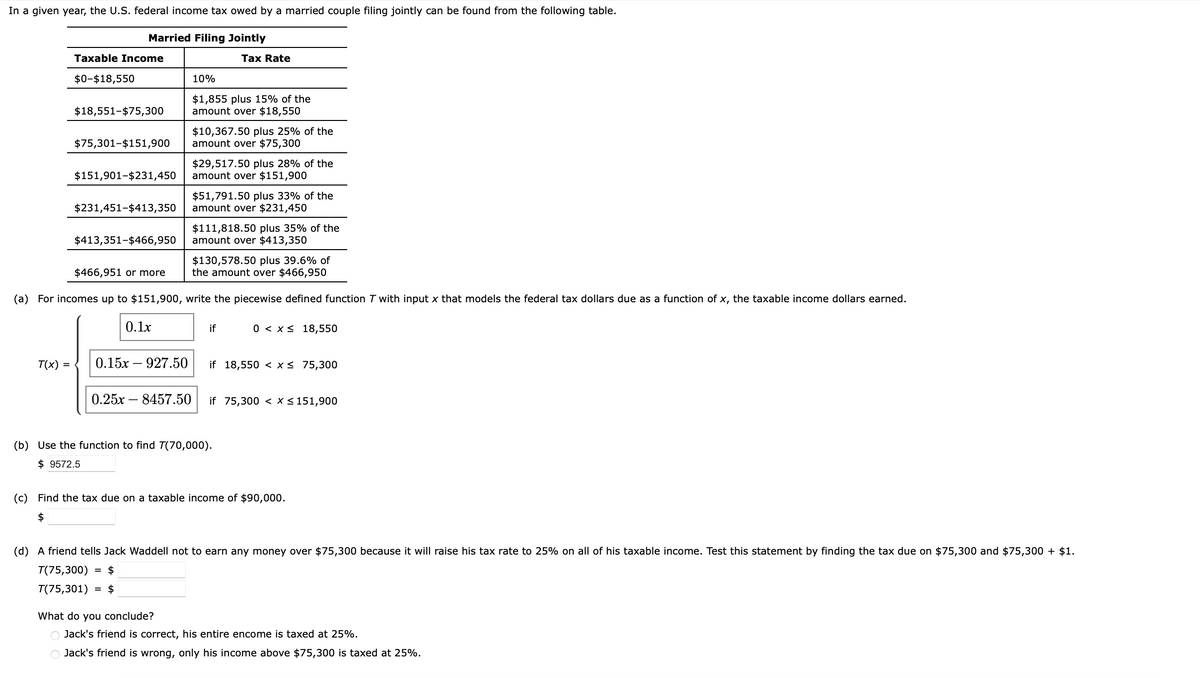

In a given year, the U.S. federal income tax owed by a married couple filing jointly can be found from the following table. Married Filing Jointly Taxable Income $0-$18,550 T(x) = $18,551-$75,300 $75,301-$151,900 $413,351-$466,950 $466,951 or more (a) For incomes up to $151,900, 0.1x Tax Rate 10% $1,855 plus 15% of the amount over $18,550 $10,367.50 plus 25% of the amount over $75,300 $151,901-$231,450 $231,451-$413,350 amount over $231,450 $29,517.50 plus 28% of the amount over $151,900 $51,791.50 plus 33% of the $111,818.50 plus 35% of the amount over $413,350 $130,578.50 plus 39.6% of the amount over $466,950 write the piecewise defined function T with input x that models the federal tax dollars due as a function of x, the taxable income dollars earned. if 0 < x≤ 18,550 0.15x-927.50 if 18,550 < x≤ 75,300 0.25x-8457.50 if 75,300 < x≤151,900 (b) Use the function to find 7(70,000). $9572.5 (c) Find the tax due on a taxable income of $90,000. (d) A friend tells Jack Waddell not to earn any money over $75,300 because it will raise his tax rate to 25% on all of his taxable income. Test this statement by finding the tax due on $75,300 and $75,300 + $1. T(75,300) = $ T(75,301) = $ What do you conclude? Jack's friend is correct, his entire encome is taxed at 25%. Jack's friend is wrong, only his income above $75,300 is taxed at 25%.

In a given year, the U.S. federal income tax owed by a married couple filing jointly can be found from the following table. Married Filing Jointly Taxable Income $0-$18,550 T(x) = $18,551-$75,300 $75,301-$151,900 $413,351-$466,950 $466,951 or more (a) For incomes up to $151,900, 0.1x Tax Rate 10% $1,855 plus 15% of the amount over $18,550 $10,367.50 plus 25% of the amount over $75,300 $151,901-$231,450 $231,451-$413,350 amount over $231,450 $29,517.50 plus 28% of the amount over $151,900 $51,791.50 plus 33% of the $111,818.50 plus 35% of the amount over $413,350 $130,578.50 plus 39.6% of the amount over $466,950 write the piecewise defined function T with input x that models the federal tax dollars due as a function of x, the taxable income dollars earned. if 0 < x≤ 18,550 0.15x-927.50 if 18,550 < x≤ 75,300 0.25x-8457.50 if 75,300 < x≤151,900 (b) Use the function to find 7(70,000). $9572.5 (c) Find the tax due on a taxable income of $90,000. (d) A friend tells Jack Waddell not to earn any money over $75,300 because it will raise his tax rate to 25% on all of his taxable income. Test this statement by finding the tax due on $75,300 and $75,300 + $1. T(75,300) = $ T(75,301) = $ What do you conclude? Jack's friend is correct, his entire encome is taxed at 25%. Jack's friend is wrong, only his income above $75,300 is taxed at 25%.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 26CE

Related questions

Question

Please do Parts B, C, D.

thank you.

Transcribed Image Text:In a given year, the U.S. federal income tax owed by a married couple filing jointly can be found from the following table.

Married Filing Jointly

Taxable Income

$0-$18,550

$18,551-$75,300

$151,901-$231,450

$75,301-$151,900 amount over $75,300

$413,351-$466,950

0.1x

10%

$1,855 plus 15% of the

amount over $18,550

T(x) = 0.15x927.50

Tax Rate

$10,367.50 plus 25% of the

$231,451-$413,350 amount over $231,450

0.25x8457.50

$29,517.50 plus 28% of the

amount over $151,900

$51,791.50 plus 33% of the

$130,578.50 plus 39.6% of

$466,951 or more

the amount over $466,950

(a) For incomes up to $151,900, write the piecewise defined function T with input x that models the federal tax dollars due as a function of x, the taxable income dollars earned.

$111,818.50 plus 35% of the

amount over $413,350

if

0 x 18,550

if 18,550 < x≤ 75,300

(b) Use the function to find T(70,000).

$9572.5

if 75,300 < x < 151,900

(c) Find the tax due on a taxable income of $90,000.

$

(d) A friend tells Jack Waddell not to earn any money over $75,300 because it will raise his tax rate to 25% on all of his taxable income. Test this statement by finding the tax due on $75,300 and $75,300 + $1.

T(75,300) = $

T(75,301) $

What do you conclude?

Jack's friend is correct, his entire encome is taxed at 25%.

O Jack's friend is wrong, only his income above $75,300 is taxed at 25%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT