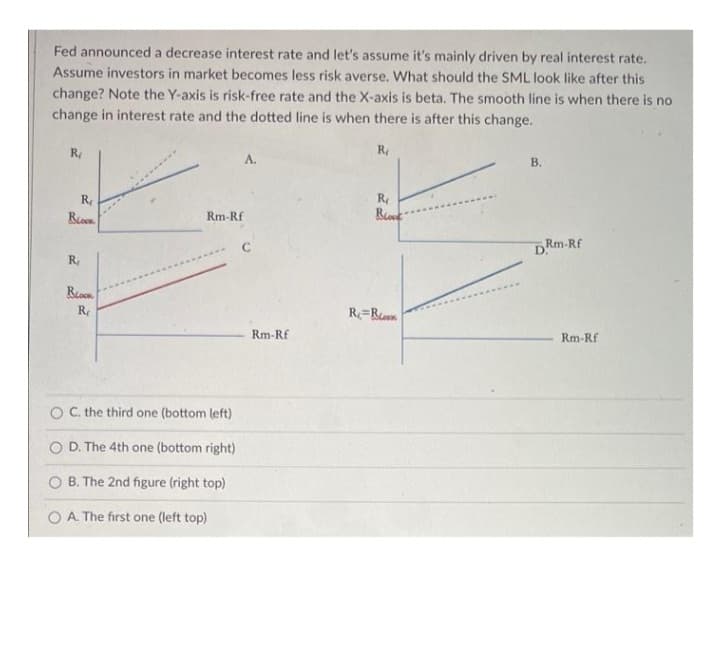

Fed announced a decrease interest rate and let's assume it's mainly driven by real interest rate. Assume investors in market becomes less risk averse. What should the SML look like after this change? Note the Y-axis is risk-free rate and the X-axis is beta. The smooth line is when there is no change in interest rate and the dotted line is when there is after this change. R R A. В. R R Rom Rm-Rf DRm-Rf R Ren Re R=R Rm-Rf Rm-Rf O C. the third one (bottom left) O D. The 4th one (bottom right) O B. The 2nd figure (right top) O A. The first one (left top)

Fed announced a decrease interest rate and let's assume it's mainly driven by real interest rate. Assume investors in market becomes less risk averse. What should the SML look like after this change? Note the Y-axis is risk-free rate and the X-axis is beta. The smooth line is when there is no change in interest rate and the dotted line is when there is after this change. R R A. В. R R Rom Rm-Rf DRm-Rf R Ren Re R=R Rm-Rf Rm-Rf O C. the third one (bottom left) O D. The 4th one (bottom right) O B. The 2nd figure (right top) O A. The first one (left top)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 4MC: You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the...

Related questions

Question

M3

Transcribed Image Text:Fed announced a decrease interest rate and let's assume it's mainly driven by real interest rate.

Assume investors in market becomes less risk averse. What should the SML look like after this

change? Note the Y-axis is risk-free rate and the X-axis is beta. The smooth line is when there is no

change in interest rate and the dotted line is when there is after this change.

R

R

A.

В.

R,

Re

Roen

Rok

Rm-Rf

DRm-Rf

R

R

R=R

Rm-Rf

Rm-Rf

O C. the third one (bottom left)

O D. The 4th one (bottom right)

O B. The 2nd figure (right top)

O A. The first one (left top)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning